US Cellular 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

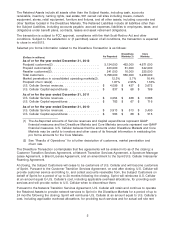

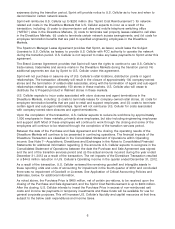

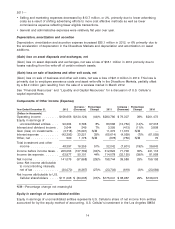

As a result of the transaction, U.S. Cellular expects net cash flows of the following:

Cash inflow (outflow)

(Dollars in thousands)

Proceeds:

Purchase price .................................. $ 480,000

Reimbursement of transition and exit costs .............. 150,000 - 200,000

Cash expenditures:

Employee related costs including severance, retention and

outplacement ................................. (15,000) - (25,000)

Contract termination costs .......................... (125,000) - (175,000)

Costs of decommissioning cell sites and MTSOs .......... (40,000) - (50,000)

Transaction costs ................................ (3,000) - (5,000)

Income taxes ................................... (130,000) - (150,000)

Net cash proceeds from the transaction are expected to be $275 million to $350 million. Such net cash

proceeds will be realized over the period from the date of the signing of the Purchase and Sale

Agreement on November 6, 2012, to the end of the transition services agreements. Net cash outflows

related to the Divestiture Transaction for the quarter ended December 31, 2012 totaled $0.3 million.

Following the closing, U.S. Cellular will no longer receive Operating revenues in the Divestiture Markets.

However, following the closing, U.S. Cellular will continue to incur System operations, Selling, general

and administrative expenses and Depreciation, amortization and accretion in the Divestiture Markets in

order for U.S. Cellular to provide transition services to Sprint. Certain of these costs will be reimbursed

by Sprint pursuant to the Customer Transition Service Agreement and the Network Transition Services

Agreement described above.

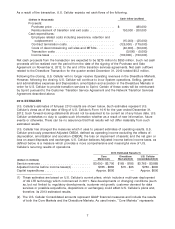

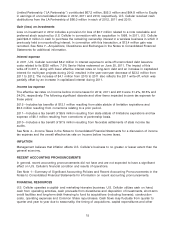

2013 ESTIMATES

U.S. Cellular’s estimates of full-year 2013 results are shown below. Such estimates represent U.S.

Cellular’s views as of the date of filing of U.S. Cellular’s Form 10-K for the year ended December 31,

2012. Such forward-looking statements should not be assumed to be current as of any future date. U.S.

Cellular undertakes no duty to update such information whether as a result of new information, future

events or otherwise. There can be no assurance that final results will not differ materially from such

estimated results.

U.S. Cellular has changed the measures which it uses to present estimates of operating results. U.S.

Cellular previously presented Adjusted OIBDA, defined as operating income excluding the effects of:

depreciation, amortization and accretion (OIBDA); the loss on impairment of assets; and the net gain or

loss on asset disposals and exchanges. U.S. Cellular believes Adjusted income before income taxes, as

defined below, is a measure which provides a more comprehensive and meaningful view of U.S.

Cellular’s recurring results of operations.

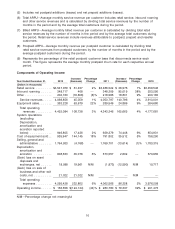

2013 Estimated Results(1)

Core Divestiture U.S. Cellular

Markets(2) Markets(2)(3) Consolidated(2)(3)

(Dollars in millions)

Service revenues ........................... $3,600 - $3,700 $165 - $185 $3,765 - $3,885

Adjusted income before income taxes(4) .......... $765 - $865 $15 - $35 $780 - $900

Capital expenditures ......................... Approx. $600 — Approx. $600

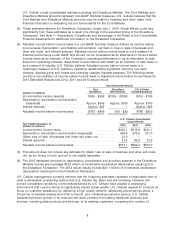

(1) These estimates are based on U.S. Cellular’s current plans, which include a multi-year deployment

of 4G LTE technology which commenced in 2011. New developments or changing conditions (such

as, but not limited to, regulatory developments, customer net growth, customer demand for data

services or possible acquisitions, dispositions or exchanges) could affect U.S. Cellular’s plans and,

therefore, its 2013 estimated results.

(2) The U.S. Cellular Consolidated amounts represent GAAP financial measures and include the results

of both the Core Markets and the Divestiture Markets. As used herein, ‘‘Core Markets’’ represents

7