US Cellular 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.that time and U.S. Cellular will receive 60% of its baseline support until the Phase II Mobility Fund is

operational.

Multiple appeals and petitions for reconsideration have been filed with respect to the FCC Reform Order,

but it has not been stayed.

At this time, U.S. Cellular cannot predict the net effect of the FCC’s changes to the USF high cost

support program in the Reform Order or whether reductions in support will be fully offset with additional

support from the CAF or the Mobility Fund. Accordingly, U.S. Cellular cannot predict whether such

changes will have a material adverse effect on U.S. Cellular’s business, financial condition or results of

operations.

On September 27, 2012, the FCC conducted a single round, sealed bid, reverse auction to award up to

$300 million in one-time Mobility Fund Phase I support to successful bidders that commit to provide 3G,

or better, wireless service in areas designated as unserved by the FCC. This auction was designated by

the FCC as Auction 901. As announced on October 3, 2012, U.S. Cellular and several of its wholly-

owned subsidiaries participated in Auction 901. U.S. Cellular and its subsidiaries were winning bidders in

eligible areas within 10 states and will receive up to $40.1 million in support from the Mobility Fund. As

part of the auction rules, winning bidders must complete network build-out projects to provide 3G or 4G

service to these areas within two or three years, respectively, and must also make their networks

available to other providers for roaming. Winning bidders will receive support funding primarily upon

achievement of coverage milestones defined in the auction rules.

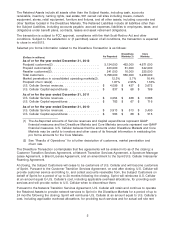

Cash Flows and Investments

See ‘‘Financial Resources’’ and ‘‘Liquidity and Capital Resources’’ below for information related to cash

flows and investments.

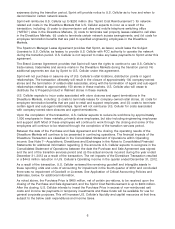

DIVESTITURE TRANSACTION

On November 6, 2012, U.S. Cellular entered into a Purchase and Sale Agreement with subsidiaries of

Sprint Nextel Corporation (‘‘Sprint’’). The Purchase and Sale Agreement also contemplates certain other

agreements, collectively referred to as the ‘‘Divestiture Transaction.’’

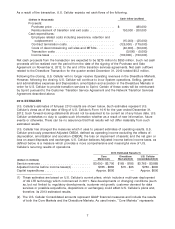

As more fully described below, the Purchase and Sale Agreement provides that U.S. Cellular will transfer

to Sprint certain rights and assets (collectively, the ‘‘Subject Assets’’), and Sprint will assume certain

liabilities (‘‘Subject Liabilities’’), related to U.S. Cellular’s Chicago, central Illinois, St. Louis and certain

Indiana/Michigan/Ohio markets (the ‘‘Divestiture Markets’’), in consideration for $480 million in cash at

closing (‘‘Purchase Price’’), subject to pro-rations of certain assets and liabilities. U.S. Cellular will retain

all other assets (‘‘Retained Assets’’) and liabilities (‘‘Retained Liabilities’’) related to the Divestiture

Markets. U.S. Cellular is not transferring and will continue to operate and provide services in Peoria,

Rockford and certain other areas in Illinois, and in Columbia, Joplin, Jefferson City and certain other

areas in Missouri.

Management, the U.S. Cellular Board of Directors and the TDS Board of Directors considered various

alternatives and approved this transaction as part of a decision to divest low-margin markets and focus

U.S. Cellular’s efforts and capital on its higher-margin markets. The transaction will better position U.S.

Cellular to invest its resources in markets where it is more likely to succeed. U.S. Cellular’s strategic

priority is to drive growth and profitability in its stronger markets.

The Subject Assets include customers (the ‘‘Subject Customers’’) and most of U.S. Cellular’s PCS

licenses in the Divestiture Markets. U.S. Cellular will retain its direct and indirect ownership interests in

other spectrum in the Divestiture Markets. The transaction does not affect spectrum licenses held by U.S.

Cellular or by variable interest entities consolidated by U.S. Cellular, that are not currently used in the

operations of the Divestiture Markets. The Subject Liabilities that will be assumed by Sprint include only

(i) liabilities as of the closing relating to the Subject Customers and (ii) liabilities arising after the closing

relating to the Subject Assets.

4