US Cellular 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

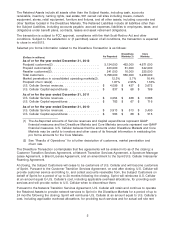

U.S. Cellular’s total consolidated markets excluding the Divestiture Markets. The Core Markets and

Divestiture Markets amounts represent non-GAAP financial measures. U.S. Cellular believes that the

Core Markets and Divestiture Markets amounts may be useful to investors and other users of its

financial information in evaluating the pro forma results for the Core Markets.

(3) These estimates assume the Divestiture Transaction closes July 1, 2013. Actual effects could vary

significantly from these estimates as a result of a change in the expected timing of the Divestiture

Transaction. See Note 7—Acquisitions, Divestitures and Exchanges in the Notes to the Consolidated

Financial Statements for additional information on the Divestiture Transaction.

(4) Adjusted income before income taxes is a non-GAAP financial measure defined as income before:

Income taxes, Depreciation, amortization and accretion, net Gain or loss on sale of business and

other exit costs, and Interest expense. Adjusted income before income taxes is not a measure of

financial performance under GAAP and should not be considered as an alternative to Income before

income taxes as an indicator of the Company’s operating performance or as an alternative to cash

flows from operating activities, determined in accordance with GAAP, as an indicator of cash flows or

as a measure of liquidity. U.S. Cellular believes Adjusted income before income taxes is a

meaningful measure of U.S. Cellular’s operating results before significant recurring non-cash

charges, discrete gains and losses and financing charges (Interest expense). The following tables

provide a reconciliation of Income before income taxes to Adjusted income before income taxes for

2013 Estimated Results and 2012, 2011 and 2010 actual results:

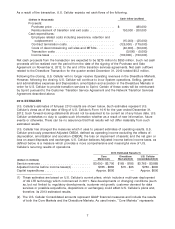

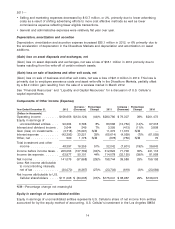

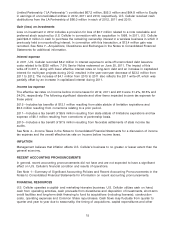

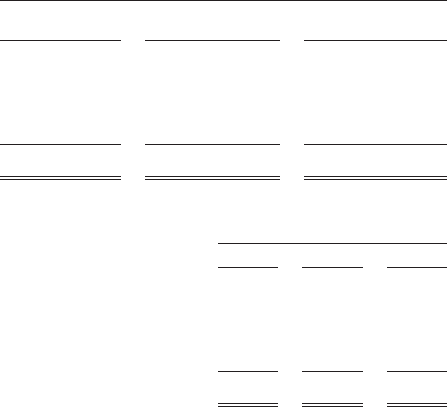

2013 Estimated Results

Core Divestiture U.S. Cellular

Markets(2) Markets(2)(3) Consolidated(2)(3)

(Dollars in millions)

Income before income taxes(5) .......... $165 - $265 ($180) - ($160) ($15) - $105

Depreciation, amortization and accretion

expense(6) ....................... Approx. $545 Approx. $195 Approx. $740

Interest expense ..................... Approx. $55 — Approx. $55

Adjusted income before income taxes ..... $765 - $865 $15 - $35 $780 - $900

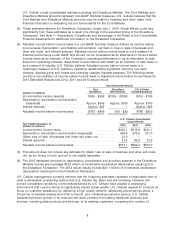

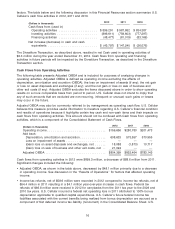

U.S. Cellular Consolidated

Actual Results

Year Ended December 31, 2012 2011 2010

(Dollars in millions)

Income before income taxes ............................. $205.1 $312.8 $241.1

Depreciation, amortization and accretion expense(6) ............ 608.6 573.6 571.0

(Gain) loss on sale of business and other exit costs, net ......... 21.0 — —

Interest expense ...................................... 42.4 65.6 61.6

Adjusted income before income taxes ....................... $877.1 $952.0 $873.7

(5) This amount does not include any estimate for (Gain) loss on sale of business and other exit costs,

net, as the timing of such amount is not readily estimable.

(6) The 2013 estimated amounts for depreciation, amortization and accretion expense in the Divestiture

Markets include approximately $120 million of incremental accelerated depreciation resulting from

the Divestiture Transaction. The 2012 actual results include $20.1 million of incremental accelerated

depreciation resulting from the Divestiture Transaction.

U.S. Cellular management currently believes that the foregoing estimates represent a reasonable view of

what is achievable considering actions that U.S. Cellular has taken and will be taking. However, the

current competitive conditions in the markets served by U.S. Cellular have created a challenging

environment that could continue to significantly impact actual results. U.S. Cellular expects to continue its

focus on customer satisfaction by delivering a high quality network, attractively priced service plans, a

broad line of wireless devices and other products, and outstanding customer service. U.S. Cellular

believes that future growth in its revenues will result primarily from selling additional products and

services, including data products and services, to its existing customers, increasing the number of

8