US Cellular 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to the Consolidated Financial Statements (Continued)

NOTE 4 INCOME TAXES (Continued)

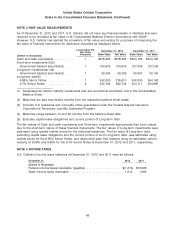

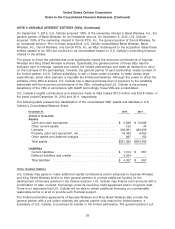

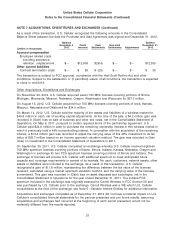

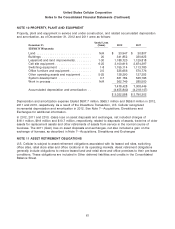

U.S. Cellular’s noncurrent deferred income tax assets and liabilities at December 31, 2012 and 2011 and

the temporary differences that gave rise to them were as follows:

December 31, 2012 2011

(Dollars in thousands)

Noncurrent deferred tax assets

Net operating loss (‘‘NOL’’) carryforwards ............... $ 63,240 $ 48,565

Stock-based compensation .......................... 22,411 19,079

Compensation and benefits—other .................... 13,673 2,985

Deferred rent .................................... 15,822 12,656

Other ......................................... 25,432 20,554

140,578 103,839

Less valuation allowance ........................... (40,208) (29,262)

Total noncurrent deferred tax assets ................... 100,370 74,577

Noncurrent deferred tax liabilities

Property, plant and equipment ....................... 527,547 482,433

Licenses/intangibles ............................... 294,738 267,344

Partnership investments ............................ 124,221 120,941

Other ......................................... 3,682 3,049

Total noncurrent deferred tax liabilities .................. 950,188 873,767

Net noncurrent deferred income tax liability ............... $849,818 $799,190

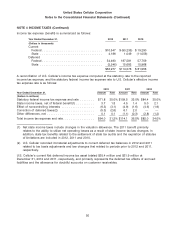

At December 31, 2012, U.S. Cellular and certain subsidiaries had $1,152.0 million of state NOL

carryforwards (generating a $54.4 million deferred tax asset) available to offset future taxable income.

The state NOL carryforwards expire between 2013 and 2032. Certain subsidiaries had federal NOL

carryforwards (generating a $8.8 million deferred tax asset) available to offset their future taxable income.

The federal NOL carryforwards expire between 2013 and 2032. A valuation allowance was established for

certain state NOL carryforwards and federal NOL carryforwards since it is more likely than not that a

portion of such carryforwards will expire before they can be utilized.

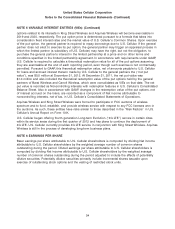

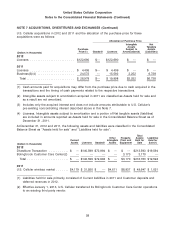

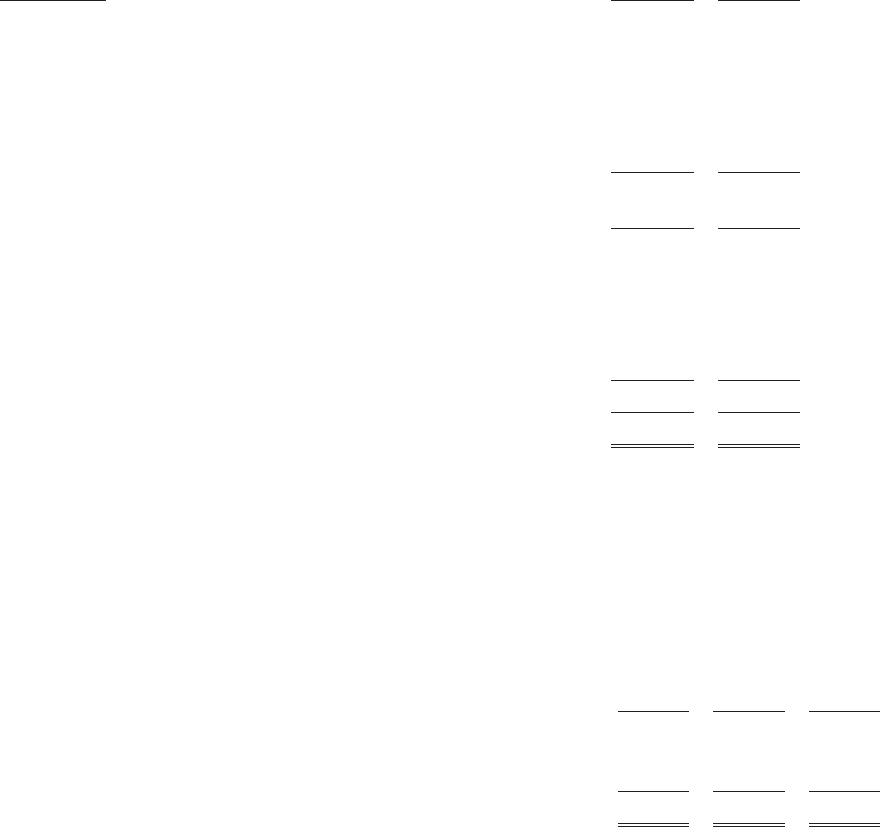

A summary of U.S. Cellular’s deferred tax asset valuation allowance is as follows:

2012 2011 2010

(Dollars in thousands)

Balance at January 1, ...................................... $30,261 $29,891 $19,234

Charged to income tax expense ............................. 3,033 (1,450) (832)

Charged to other accounts ................................. 8,001 1,820 11,489

Balance at December 31, ................................... $41,295 $30,261 $29,891

As of December 31, 2012, the valuation allowance reduced current deferred tax assets by $1.1 million

and noncurrent deferred tax assets by $40.2 million.

51