US Cellular 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Retained Assets include all assets other than the Subject Assets, including cash, accounts

receivable, inventory, naming rights, real estate, 561 owned cell sites including towers, network

equipment, stores, retail equipment, furniture and fixtures, and all other assets, including corporate and

other facilities located in the Divestiture Markets. The Retained Liabilities include all liabilities other than

the Subject Liabilities, including accounts payable, accrued expenses, liabilities to employees, taxes, and

obligations under benefit plans, contracts, leases and asset retirement obligations.

The transaction is subject to FCC approval, compliance with the Hart-Scott-Rodino Act and other

conditions. Subject to the satisfaction or (if permitted) waiver of all conditions, the transaction is expected

to close in mid-2013.

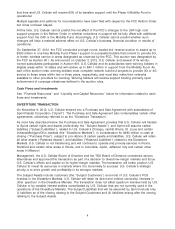

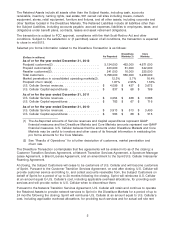

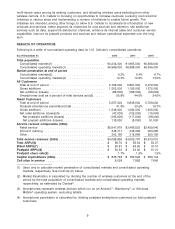

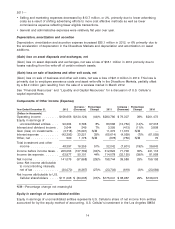

Selected pro forma information related to the Divestiture Transaction is as follows:

Divestiture Core

As Reported Markets(1) Markets

(Dollars in millions)

As of or for the year ended December 31, 2012

Postpaid customers(2) ......................... 5,134,000 463,000 4,671,000

Prepaid customers(2) .......................... 423,000 81,000 342,000

Reseller customers(2) .......................... 241,000 16,000 225,000

Total customers .............................. 5,798,000 560,000 5,238,000

Market penetration in consolidated operating markets(2) . 12.3% 3.7% 16.4%

Postpaid churn rate(2) ......................... 1.67% 2.95% 1.53%

U.S. Cellular Service revenues .................... $ 4,099 $ 427 $ 3,672

U.S. Cellular Capital expenditures ................. $ 837 $ 68 $ 769

As of or for the year ended December 31, 2011

U.S. Cellular Service revenues .................... $ 4,054 $ 468 $ 3,586

U.S. Cellular Capital expenditures ................. $ 783 $ 67 $ 716

As of or for the year ended December 31, 2010

U.S. Cellular Service revenues .................... $ 3,913 $ 513 $ 3,400

U.S. Cellular Capital expenditures ................. $ 583 $ 68 $ 515

(1) The As-Reported amounts of Service revenues and Capital expenditures represent GAAP

financial measures and the Divestiture Markets and Core Markets amounts represent non-GAAP

financial measures. U.S. Cellular believes that the amounts under Divestiture Markets and Core

Markets may be useful to investors and other users of its financial information in evaluating the

pro forma amounts for the Core Markets.

(2) See ‘‘Results of Operations’’ for a further description of customers, market penetration and

churn rate.

The Divestiture Transaction contemplates that five agreements will be entered into as of the closing: a

Customer Transition Services Agreement, a Network Transition Services Agreement, a Spectrum Manager

Lease Agreement, a Brand License Agreement, and an amendment to the Sprint/U.S. Cellular Intercarrier

Roaming Agreement.

At closing, the Subject Customers will cease to be customers of U.S. Cellular and will become customers

of Sprint. Pursuant to the Customer Transition Services Agreement, on and after closing, U.S. Cellular will

provide customer service and billing to, and collect accounts receivable from, the Subject Customers on

behalf of Sprint for a period of up to 24 months following the closing. Sprint will reimburse U.S. Cellular

at an amount equal to U.S. Cellular’s cost, including applicable overhead allocations, for providing such

services and will provide notice to U.S. Cellular when to discontinue them.

Pursuant to the Network Transition Services Agreement, U.S. Cellular will retain and continue to operate

the Retained Assets to provide network services to Sprint in the Divestiture Markets for a period of up to

24 months following the closing. Sprint will reimburse U.S. Cellular at an amount equal to U.S. Cellular’s

cost, including applicable overhead allocations, for providing such services and for actual cell site rent

5