US Cellular 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Notes to the Consolidated Financial Statements (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

reducing revenues at the time of the wireless device sale to the agent rather than at the time the agent

activates a new customer or retains a current customer. Similarly, U.S. Cellular offers certain wireless

device sales rebates and incentives to its retail customers and records the revenue net of the

corresponding rebate or incentive. The total potential rebates and incentives are reduced by U.S.

Cellular’s estimate of rebates that will not be redeemed by customers based on historical experience of

such redemptions.

Prior to July 1, 2012, U.S. Cellular charged a service activation fee to customers. Activation fees charged

at agent locations with the sale of service only, where U.S. Cellular did not sell a wireless device to the

customer, were deferred and recognized over the average customer life. On July 1, 2012, U.S. Cellular

discontinued the service activation fee and began charging a device activation fee. Device activation fees

charged at agent locations, where U.S. Cellular does not also sell a wireless device to the customer, are

deferred and recognized over the average device life. Device activation fees charged as a result of

handset sales at Company-owned retail stores are recognized at the time the handset is delivered to the

customer. GAAP requires that activation fees charged with the sale of equipment and service be

allocated to the equipment and service based upon the relative selling prices of each item. This generally

results in the recognition of the activation fee as additional wireless device revenue at the time of sale.

ETC revenues recognized in the reporting period represent the amounts which U.S. Cellular is entitled to

receive for such period, as determined and approved in connection with U.S. Cellular’s designation as an

ETC in various states.

Amounts Collected from Customers and Remitted to Governmental Authorities

U.S. Cellular records amounts collected from customers and remitted to governmental authorities net

within a tax liability account if the tax is assessed upon the customer and U.S. Cellular merely acts as an

agent in collecting the tax on behalf of the imposing governmental authority. If the tax is assessed upon

U.S. Cellular, then amounts collected from customers as recovery of the tax are recorded in Service

revenues and amounts remitted to governmental authorities are recorded in Selling, general and

administrative expenses in the Consolidated Statement of Operations. The amounts recorded gross in

revenues that are billed to customers and remitted to governmental authorities totaled $135.7 million,

$125.2 million and $137.6 million for 2012, 2011 and 2010, respectively.

Advertising Costs

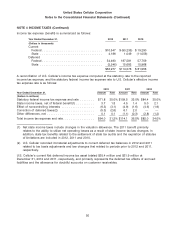

U.S. Cellular expenses advertising costs as incurred. Advertising costs totaled $227.0 million,

$257.8 million and $265.2 million in 2012, 2011 and 2010, respectively.

Income Taxes

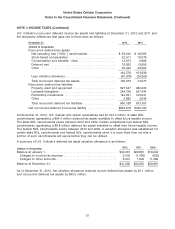

U.S. Cellular is included in a consolidated federal income tax return with other members of the TDS

consolidated group. TDS and U.S. Cellular are parties to a Tax Allocation Agreement which provides that

U.S. Cellular and its subsidiaries be included with the TDS affiliated group in a consolidated federal

income tax return and in state income or franchise tax returns in certain situations. For financial

statement purposes, U.S. Cellular and its subsidiaries calculate their income, income taxes and credits as

if they comprised a separate affiliated group. Under the Tax Allocation Agreement, U.S. Cellular remits its

applicable income tax payments to TDS. U.S. Cellular had a tax payable balance with TDS of $1.1 million

and a tax receivable balance of $73.7 million as of December 31, 2012 and 2011, respectively.

Deferred taxes are computed using the liability method, whereby deferred tax assets are recognized for

future deductible temporary differences and operating loss carryforwards, and deferred tax liabilities are

recognized for future taxable temporary differences. Both deferred tax assets and liabilities are measured

46