US Cellular 2012 Annual Report Download - page 35

Download and view the complete annual report

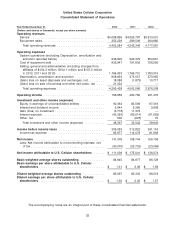

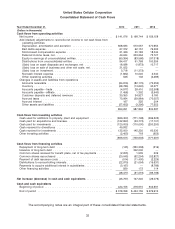

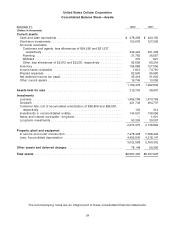

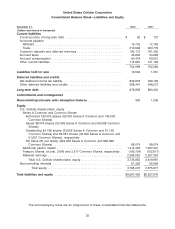

Please find page 35 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The amounts of income tax assets and liabilities, the related income tax provision and the amount of

unrecognized tax benefits are critical accounting estimates because such amounts are significant to U.S.

Cellular’s financial condition and results of operations.

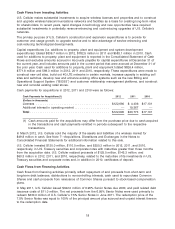

The preparation of the consolidated financial statements requires U.S. Cellular to calculate a provision for

income taxes. This process involves estimating the actual current income tax liability together with

assessing temporary differences resulting from the different treatment of items for tax purposes. These

temporary differences result in deferred income tax assets and liabilities, which are included in U.S.

Cellular’s Consolidated Balance Sheet. U.S. Cellular must then assess the likelihood that deferred

income tax assets will be realized based on future taxable income and, to the extent management

believes that realization is not likely, establish a valuation allowance. Management’s judgment is required

in determining the provision for income taxes, deferred income tax assets and liabilities and any

valuation allowance that is established for deferred income tax assets.

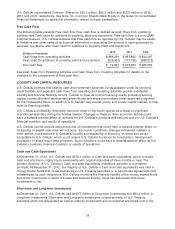

U.S. Cellular recognizes the tax benefit from an uncertain tax position only if it is more likely than not that

the tax position will be sustained on examination by the taxing authorities, based on the technical merits

of the position. The tax benefits recognized in the financial statements from such a position are

measured based on the largest benefit that has a greater than 50% likelihood of being realized upon

ultimate resolution.

See Note 4—Income Taxes in the Notes to Consolidated Financial Statements for details regarding U.S.

Cellular’s income tax provision, deferred income taxes and liabilities, valuation allowances and

unrecognized tax benefits, including information regarding estimates that impact income taxes.

Loyalty Reward Program

See the Revenue Recognition section of Note 1—Summary of Significant Accounting Policies and Recent

Accounting Pronouncements in the Notes to Consolidated Financial Statements for a description of this

program and the related accounting.

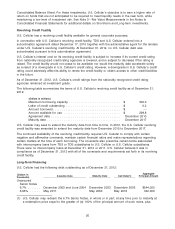

U.S. Cellular follows the deferred revenue method of accounting for its loyalty reward program. Under

this method, revenue allocated to loyalty reward points is fully deferred as U.S. Cellular does not yet

have sufficient historical data in which to estimate any portion of loyalty reward points that will not be

redeemed. Revenue is recognized at the time of customer redemption or when such points have been

depleted via a maintenance charge. U.S. Cellular periodically reviews and will revise the redemption and

depletion rates as appropriate based on history and related future expectations.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

See Note 17—Related Parties and Note 18—Certain Relationships and Related Transactions in the Notes

to Consolidated Financial Statements.

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

SAFE HARBOR CAUTIONARY STATEMENT

This Management’s Discussion and Analysis of Financial Condition and Results of Operations and other

sections of this Annual Report contain statements that are not based on historical facts, including the

words ‘‘believes,’’ ‘‘anticipates,’’ ‘‘intends,’’ ‘‘expects’’ and similar words. These statements constitute

‘‘forward-looking statements’’ within the meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors that

may cause actual results, events or developments to be significantly different from any future results,

events or developments expressed or implied by such forward-looking statements. Such factors include,

but are not limited to, the following risks:

•Intense competition in the markets in which U.S. Cellular operates could adversely affect U.S. Cellular’s

revenues or increase its costs to compete.

27