US Cellular 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

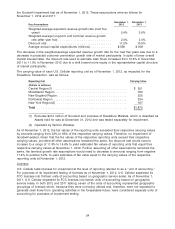

U.S. Cellular repurchased Common Shares for $20.0 million, $62.3 million and $52.8 million in 2012,

2011 and 2010, respectively. See Note 14—Common Shareholders’ Equity in the Notes to Consolidated

Financial Statements for additional information related to these transactions.

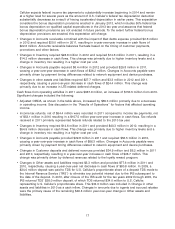

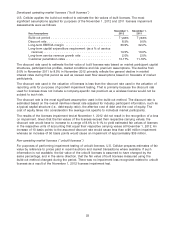

Free Cash Flow

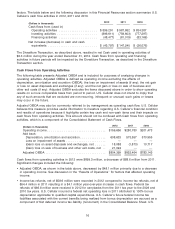

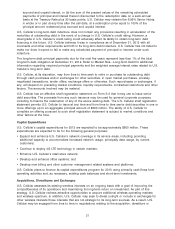

The following table presents Free cash flow. Free cash flow is defined as Cash flows from operating

activities less Cash used for additions to property, plant and equipment. Free cash flow is a non-GAAP

financial measure. U.S. Cellular believes that Free cash flow as reported by U.S. Cellular may be useful

to investors and other users of its financial information in evaluating the amount of cash generated by

business operations, after Cash used for additions to property, plant and equipment.

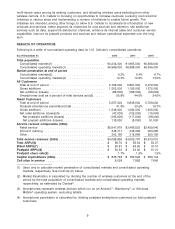

2012 2011 2010

(Dollars in thousands)

Cash flows from operating activities ................. $899,291 $ 987,862 $ 834,387

Cash used for additions to property, plant and equipment . (826,400) (771,798) (569,323)

Free cash flow ................................. $ 72,891 $ 216,064 $ 265,064

See Cash flows from Operating Activities and Cash flows from Investing Activities for details on the

changes to the components of Free cash flow.

LIQUIDITY AND CAPITAL RESOURCES

U.S. Cellular believes that existing cash and investment balances, funds available under its revolving

credit facilities and expected cash flows from operating and investing activities provide substantial

liquidity and financial flexibility for U.S. Cellular to meet its normal financing needs (including working

capital, construction and development expenditures and share repurchases under approved programs)

for the foreseeable future. In addition, U.S. Cellular may access public and private capital markets to help

meet its financing needs.

U.S. Cellular’s profitability historically has been lower in the fourth quarter as a result of significant

promotional spending during the holiday season. Changes in these or other economic factors could

have a material adverse effect on demand for U.S. Cellular’s products and services and on U.S. Cellular’s

financial condition and results of operations.

U.S. Cellular cannot provide assurances that circumstances that could have a material adverse effect on

its liquidity or capital resources will not occur. Economic conditions, changes in financial markets or

other factors could restrict U.S. Cellular’s liquidity and availability of financing on terms and prices

acceptable to U.S. Cellular, which could require U.S. Cellular to reduce its construction, development,

acquisition or share repurchase programs. Such reductions could have a material adverse effect on U.S.

Cellular’s business, financial condition or results of operations.

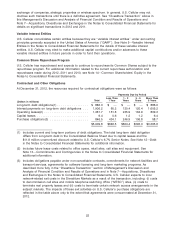

Cash and Cash Equivalents

At December 31, 2012, U.S. Cellular had $378.4 million in Cash and cash equivalents, which included

cash and short-term, highly liquid investments with original maturities of three months or less. The

primary objective of U.S. Cellular’s Cash and cash equivalents investment activities is to preserve

principal. At December 31, 2012, the majority of U.S. Cellular’s Cash and cash equivalents was held in

money market funds that invest exclusively in U.S. Treasury securities or in repurchase agreements fully

collateralized by such obligations. U.S. Cellular monitors the financial viability of the money market funds

and direct investments in which it invests and believes that the credit risk associated with these

investments is low.

Short-term and Long-term Investments

At December 31, 2012, U.S. Cellular had $100.7 million in Short-term investments and $50.3 million in

Long-term investments. Short-term and Long-term investments consist primarily of U.S. Treasury

securities which are designated as held-to-maturity investments and recorded at amortized cost in the

19