US Cellular 2012 Annual Report Download - page 23

Download and view the complete annual report

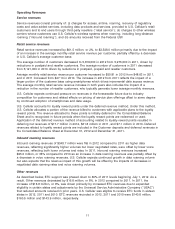

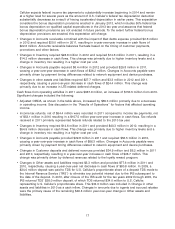

Please find page 23 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Limited Partnership (‘‘LA Partnership’’) contributed $67.2 million, $55.3 million and $64.8 million to Equity

in earnings of unconsolidated entities in 2012, 2011 and 2010, respectively. U.S. Cellular received cash

distributions from the LA Partnership of $66.0 million in each of 2012, 2011 and 2010.

Gain (loss) on investments

Loss on investment in 2012 includes a provision for loss of $3.7 million related to a note receivable and

preferred stock acquired by U.S. Cellular in connection with an acquisition in 1998. In 2011, U.S. Cellular

paid $24.6 million in cash to purchase the remaining ownership interest in a wireless business in which it

previously held a noncontrolling interest. In connection with this transaction, a $13.4 million gain was

recorded. See Note 7—Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial

Statements for additional information.

Interest expense

In 2011, U.S. Cellular recorded $8.2 million in interest expense to write-off unamortized debt issuance

costs related to its $330 million, 7.5% Senior Notes redeemed on June 20, 2011. The impact of this

write-off in 2011, along with lower effective interest rates on long-term debt and an increase in capitalized

interest for multi-year projects during 2012, resulted in the year-over-year decrease of $23.2 million from

2011 to 2012. The increase of $4.1 million from 2010 to 2011 also reflects the 2011 write-off, which was

partially offset by an increase in capitalized interest during 2011.

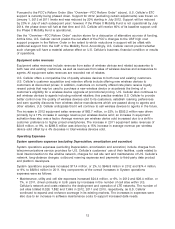

Income tax expense

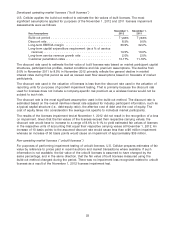

The effective tax rates on Income before income taxes for 2012, 2011 and 2010 were 31.2%, 36.5% and

34.0%, respectively. The following significant discrete and other items impacted income tax expense for

these years:

2012—Includes tax benefits of $12.1 million resulting from state statute of limitation expirations and

$5.3 million resulting from corrections relating to a prior period.

2011—Includes a tax benefit of $9.9 million resulting from state statute of limitations expirations and tax

expense of $6.1 million resulting from corrections of partnership basis.

2010—Includes a tax benefit of $7.9 million resulting from favorable settlements of state income tax

audits.

See Note 4—Income Taxes in the Notes to Consolidated Financial Statements for a discussion of income

tax expense and the overall effective tax rate on Income before income taxes.

INFLATION

Management believes that inflation affects U.S. Cellular’s business to no greater or lesser extent than the

general economy.

RECENT ACCOUNTING PRONOUNCEMENTS

In general, recent accounting pronouncements did not have and are not expected to have a significant

effect on U.S. Cellular’s financial condition and results of operations.

See Note 1—Summary of Significant Accounting Policies and Recent Accounting Pronouncements in the

Notes to Consolidated Financial Statements for information on recent accounting pronouncements.

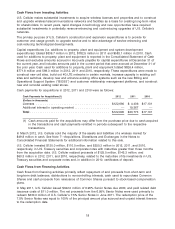

FINANCIAL RESOURCES

U.S. Cellular operates a capital- and marketing-intensive business. U.S. Cellular utilizes cash on hand,

cash from operating activities, cash proceeds from divestitures and disposition of investments, short-term

credit facilities and long-term debt financing to fund its acquisitions (including licenses), construction

costs, operating expenses and Common Share repurchases. Cash flows may fluctuate from quarter to

quarter and year to year due to seasonality, the timing of acquisitions, capital expenditures and other

15