US Cellular 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash Flows from Investing Activities

U.S. Cellular makes substantial investments to acquire wireless licenses and properties and to construct

and upgrade wireless telecommunications networks and facilities as a basis for creating long-term value

for shareholders. In recent years, rapid changes in technology and new opportunities have required

substantial investments in potentially revenue-enhancing and cost-reducing upgrades of U.S. Cellular’s

networks.

The primary purpose of U.S. Cellular’s construction and expansion expenditures is to provide for

customer and usage growth, to upgrade service and to take advantage of service-enhancing and

cost-reducing technological developments.

Capital expenditures (i.e. additions to property, plant and equipment and system development

expenditures) totaled $836.7 million in 2012, $782.5 million in 2011 and $583.1 million in 2010. Cash

used for additions to property, plant and equipment is reported in the Consolidated Statement of Cash

Flows and excludes amounts accrued in Accounts payable for capital expenditures at December 31 of

the current year, and includes amounts paid in the current period that were accrued at December 31 of

the prior year. Cash used for additions to property, plant and equipment totaled $826.4 million,

$771.8 million and 569.3 million in 2012, 2011 and 2010, respectively. These expenditures were made to

construct new cell sites, build out 4G LTE networks in certain markets, increase capacity in existing cell

sites and switches, develop new and enhance existing office systems such as the new Billing and

Operational Support System (‘‘B/OSS’’) and customer relationship management platforms, and construct

new and remodel existing retail stores.

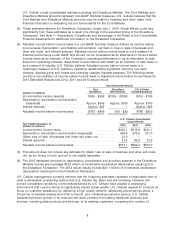

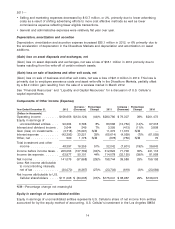

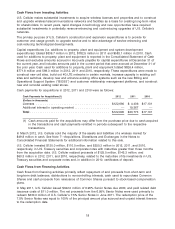

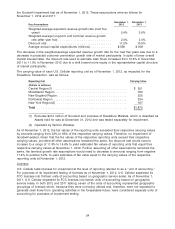

Cash payments for acquisitions in 2012, 2011 and 2010 were as follows:

Cash Payments for Acquisitions(1) 2012 2011 2010

(Dollars in thousands)

Licenses ........................................ $122,690 $ 4,406 $17,101

Additional interest in operating market ................... — 19,367 —

Total ........................................... $122,690 $23,773 $17,101

(1) Cash amounts paid for the acquisitions may differ from the purchase price due to cash acquired

in the transactions and cash payments remitted in periods subsequent to the respective

transactions.

In March 2012, U.S. Cellular sold the majority of the assets and liabilities of a wireless market for

$49.8 million in cash. See Note 7—Acquisitions, Divestitures and Exchanges in the Notes to

Consolidated Financial Statements for additional information related to this sale.

U.S. Cellular invested $120.0 million, $110.0 million, and $250.3 million in 2012, 2011, and 2010,

respectively, in U.S. Treasury securities and corporate notes with maturities greater than three months

from the acquisition date. U.S. Cellular realized proceeds of $125.0 million, $145.3 million, and

$60.3 million in 2012, 2011, and 2010, respectively, related to the maturities of its investments in U.S.

Treasury securities and corporate notes and, in addition in 2010, certificates of deposit.

Cash Flows from Financing Activities

Cash flows from financing activities primarily reflect repayment of and proceeds from short-term and

long-term debt balances, distributions to noncontrolling interests, cash used to repurchase Common

Shares and cash proceeds from reissuance of Common Shares pursuant to stock-based compensation

plans.

In May 2011, U.S. Cellular issued $342.0 million of 6.95% Senior Notes due 2060, and paid related debt

issuance costs of $11.0 million. The net proceeds from the 6.95% Senior Notes were used primarily to

redeem $330.0 million of U.S. Cellular’s 7.5% Senior Notes in June 2011. The redemption price of the

7.5% Senior Notes was equal to 100% of the principal amount plus accrued and unpaid interest thereon

to the redemption date.

18