US Cellular 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Notes to the Consolidated Financial Statements (Continued)

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

Operating Leases

U.S. Cellular is a party to various lease agreements for office space, retail stores, cell sites and

equipment that are accounted for as operating leases. Certain leases have renewal options and/or fixed

rental increases. Renewal options that are reasonably assured of exercise are included in determining

the lease term. U.S. Cellular accounts for certain operating leases that contain rent abatements, lease

incentives and/or fixed rental increases by recognizing lease revenue and expense on a straight-line

basis over the lease term.

Recent Accounting Pronouncements

On July 27, 2012, the FASB issued Accounting Standards Update 2012-02, Intangibles—Goodwill and

Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment (‘‘ASU 2012-02’’).

ASU 2012-02 is intended to reduce the cost and complexity of the annual indefinite-lived intangible

assets impairment testing by providing entities an option to perform a ‘‘qualitative’’ assessment to

determine whether further impairment testing is necessary. As such, there is the possibility that

quantitative assessments would not need to be performed if it is more likely than not that no impairment

exists. U.S. Cellular is required to adopt the provisions of ASU 2012-02 as of January 1, 2013. Early

adoption is permitted. The adoption of ASU 2012-02 is not expected to have a significant impact on U.S.

Cellular’s financial position or results of operations.

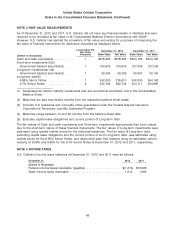

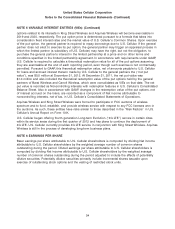

NOTE 2 NONCONTROLLING INTERESTS

U.S. Cellular’s consolidated financial statements include certain noncontrolling interests that meet the

GAAP definition of mandatorily redeemable financial instruments. These mandatorily redeemable

noncontrolling interests represent interests held by third parties in consolidated partnerships and limited

liability companies (‘‘LLCs’’), where the terms of the underlying partnership or LLC agreement provide for

a defined termination date at which time the assets of the subsidiary are to be sold, the liabilities are to

be extinguished and the remaining net proceeds are to be distributed to the noncontrolling interest

holders and U.S. Cellular in accordance with the respective partnership and LLC agreements. The

termination dates of these mandatorily redeemable noncontrolling interests range from 2085 to 2107.

The settlement value or estimate of cash that would be due and payable to settle these noncontrolling

interests assuming an orderly liquidation of the finite-lived consolidated partnerships and LLCs on

December 31, 2012, net of estimated liquidation costs, is $159.2 million. This amount excludes

redemption amounts recorded in Noncontrolling interests with redemption features in the Consolidated

Balance Sheet. The estimate of settlement value was based on certain factors and assumptions which

are subjective in nature. Changes in those factors and assumptions could result in a materially larger or

smaller settlement amount. U.S. Cellular currently has no plans or intentions relating to the liquidation of

any of the related partnerships or LLCs prior to their scheduled termination dates. The corresponding

carrying value of the mandatorily redeemable noncontrolling interests in finite-lived consolidated

partnerships and LLCs at December 31, 2012 was $57.5 million, and is included in Noncontrolling

interests in the Consolidated Balance Sheet. The excess of the aggregate settlement value over the

aggregate carrying value of these mandatorily redeemable noncontrolling interests is primarily due to the

unrecognized appreciation of the noncontrolling interest holders’ share of the underlying net assets in

the consolidated partnerships and LLCs. Neither the noncontrolling interest holders’ share, nor U.S.

Cellular’s share, of the appreciation of the underlying net assets of these subsidiaries is reflected in the

consolidated financial statements.

48