US Cellular 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to the Consolidated Financial Statements (Continued)

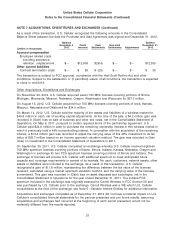

NOTE 7 ACQUISITIONS, DIVESTITURES AND EXCHANGES (Continued)

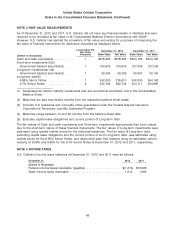

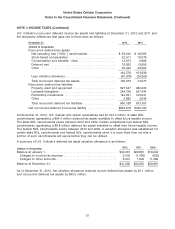

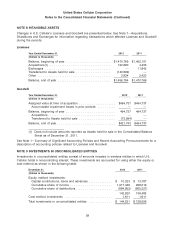

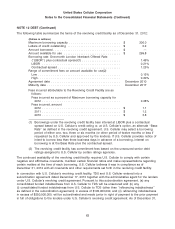

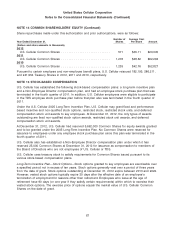

As a result of the transaction, U.S. Cellular recognized the following amounts in the Consolidated

Balance Sheet between the date the Purchase and Sale Agreement was signed and December 31, 2012:

Balance Balance

November 6, Costs Cash Non-cash December 31,

2012 Incurred Settlements Settlements Adjustments 2012

(Dollars in thousands)

Accrued compensation

Employee related costs

including severance,

retention, outplacement . $— $12,609 $(304) $— $— $12,305

Other current liabilities

Contract termination costs $— $ 59 $ (29) $— $— $ 30

The transaction is subject to FCC approval, compliance with the Hart-Scott-Rodino Act and other

conditions. Subject to the satisfaction or (if permitted) waiver of all conditions, the transaction is expected

to close in mid-2013.

Other Acquisitions, Divestitures and Exchanges

On November 20, 2012, U.S. Cellular acquired seven 700 MHz licenses covering portions of Illinois,

Michigan, Minnesota, Missouri, Nebraska, Oregon, Washington and Wisconsin for $57.7 million.

On August 15, 2012, U.S. Cellular acquired four 700 MHz licenses covering portions of Iowa, Kansas,

Missouri, Nebraska and Oklahoma for $34.0 million.

On March 14, 2012, U.S. Cellular sold the majority of the assets and liabilities of a wireless market for

$49.8 million in cash, net of working capital adjustments. At the time of the sale, a $4.2 million gain was

recorded in (Gain) loss on sale of business and other exit costs, net in the Consolidated Statement of

Operations. On May 9, 2011, pursuant to certain required terms of the partnership agreement, U.S.

Cellular paid $24.6 million in cash to purchase the remaining ownership interest in this wireless market in

which it previously held a 49% noncontrolling interest. In connection with the acquisition of the remaining

interest, a $13.4 million gain was recorded to adjust the carrying value of this 49% investment to its fair

value of $25.7 million based on an income approach valuation method. The gain was recorded in Gain

(loss) on investment in the Consolidated Statement of Operations in 2011.

On September 30, 2011, U.S. Cellular completed an exchange whereby U.S. Cellular received eighteen

700 MHz spectrum licenses covering portions of Idaho, Illinois, Indiana, Kansas, Nebraska, Oregon and

Washington in exchange for two PCS spectrum licenses covering portions of Illinois and Indiana. The

exchange of licenses will provide U.S. Cellular with additional spectrum to meet anticipated future

capacity and coverage requirements in several of its markets. No cash, customers, network assets, other

assets or liabilities were included in the exchange. As a result of this transaction, U.S. Cellular

recognized a gain of $11.8 million, representing the difference between the fair value of the licenses

received, calculated using a market approach valuation method, and the carrying value of the licenses

surrendered. This gain was recorded in (Gain) loss on asset disposals and exchanges, net in the

Consolidated Statement of Operations for the year ended December 31, 2011. The Indiana PCS

spectrum included in the exchange was originally awarded to Carroll Wireless in FCC Auction 58 and

was purchased by U.S. Cellular prior to the exchange. Carroll Wireless was a VIE which U.S. Cellular

consolidated at the time of the exchange; see Note 5—Variable Interest Entities for additional information.

Acquisitions and exchanges completed as of December 31, 2012 did not have a material impact on U.S.

Cellular’s consolidated financial statements for the periods presented and pro forma results, assuming

acquisitions and exchanges had occurred at the beginning of each period presented, would not be

materially different from the results reported.

57