US Cellular 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

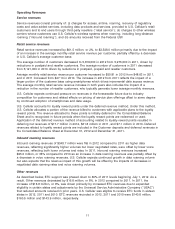

multi-device users among its existing customers, and attracting wireless users switching from other

wireless carriers. U.S. Cellular is focusing on opportunities to increase revenues, pursuing cost reduction

initiatives in various areas and implementing a number of initiatives to enable future growth. The

initiatives are intended, among other things, to allow U.S. Cellular to accelerate its introduction of new

products and services, better segment its customers for new services and retention, sell additional

services such as data, expand its distribution channels, enhance its internet sales and customer service

capabilities, improve its prepaid products and services and reduce operational expenses over the long

term.

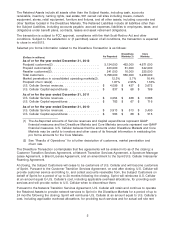

RESULTS OF OPERATIONS

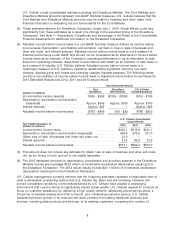

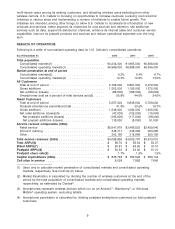

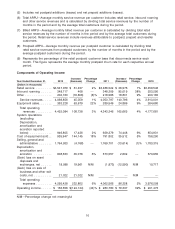

Following is a table of summarized operating data for U.S. Cellular’s consolidated operations.

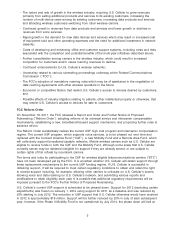

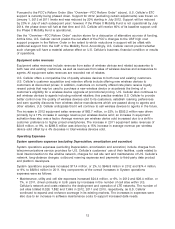

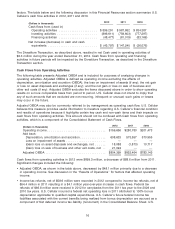

As of December 31, 2012 2011 2010

Total population

Consolidated markets(1) ............................ 93,244,000 91,965,000 90,468,000

Consolidated operating markets(1) .................... 46,966,000 46,888,000 46,546,000

Market penetration at end of period

Consolidated markets(2) ............................ 6.2% 6.4% 6.7%

Consolidated operating markets(2) .................... 12.3% 12.6% 13.0%

All Customers

Total at end of period .............................. 5,798,000 5,891,000 6,072,000

Gross additions .................................. 1,302,000 1,155,000 1,372,000

Net additions (losses) .............................. (88,000) (186,000) (69,000)

Smartphones sold as a percent of total devices sold(3) ...... 55.8% 44.0% 24.6%

Retail Customers

Total at end of period .............................. 5,557,000 5,608,000 5,729,000

Postpaid smartphone penetration(3)(4) .................. 41.8% 30.5% 16.7%

Gross additions .................................. 1,248,000 1,064,000 1,205,000

Net retail additions (losses)(5) ........................ (47,000) (125,000) (15,000)

Net postpaid additions (losses) ..................... (165,000) (117,000) (66,000)

Net prepaid additions (losses) ...................... 118,000 (8,000) 51,000

Service revenue components (000s)

Retail service .................................... $3,547,979 $3,486,522 $3,459,546

Inbound roaming ................................. 348,717 348,309 253,290

Other .......................................... 202,160 218,966 200,165

Total service revenues (000s) ......................... $4,098,856 $4,053,797 $3,913,001

Total ARPU(6) .................................... $ 58.70 $ 56.54 $ 53.27

Billed ARPU(7) .................................... $ 50.81 $ 48.63 $ 47.10

Postpaid ARPU(8) ................................. $ 54.32 $ 54.00 $ 51.21

Postpaid churn rate(9) .............................. 1.7% 1.5% 1.5%

Capital expenditures (000s) .......................... $ 836,748 $ 782,526 $ 583,134

Cell sites in service ................................ 8,028 7,882 7,645

(1) Used only to calculate market penetration of consolidated markets and consolidated operating

markets, respectively. See footnote (2) below.

(2) Market Penetration is calculated by dividing the number of wireless customers at the end of the

period by the total population of consolidated markets and consolidated operating markets,

respectively, as estimated by Claritas.

(3) Smartphones represent wireless devices which run on an Android, Blackberry, or Windows

Mobile operating system, excluding tablets.

(4) Smartphone penetration is calculated by dividing postpaid smartphone customers by total postpaid

customers.

9