US Cellular 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Notes to the Consolidated Financial Statements (Continued)

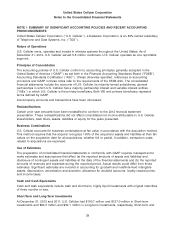

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

management about factors that are uncertain including future cash flows, the appropriate discount rate,

and other inputs. Different assumptions for these inputs could create materially different results.

U.S. Cellular tests Goodwill for impairment at the level of reporting referred to as a reporting unit. For

purposes of its impairment testing of Goodwill in 2012 and 2011, U.S. Cellular identified five reporting

units. The five reporting units represent five geographic groupings of FCC licenses, representing five

geographic service areas.

A discounted cash flow approach was used to value each reporting unit for purposes of the Goodwill

impairment review by using value drivers and risks specific to the current industry and economic

markets. The cash flow estimates incorporated assumptions that market participants would use in their

estimates of fair value. Key assumptions made in this process were the discount rate, estimated

expected revenue growth rate, projected capital expenditures and the terminal growth rate.

U.S. Cellular tests Licenses for impairment at the level of reporting referred to as a unit of accounting.

For purposes of its 2012 impairment testing of Licenses, U.S. Cellular separated its FCC licenses into

thirteen units of accounting based on geographic service areas. One unit of accounting includes the

licenses to be transferred as a result of the Divestiture Transaction more fully described in Note 7—

Acquisitions, Divestitures and Exchanges. For purposes of its 2011 impairment testing of Licenses, U.S.

Cellular separated its FCC licenses into twelve units of accounting based on geographic service areas. In

both 2012 and 2011 testing, seven of the units of accounting represented geographic groupings of

licenses which, because they were not being utilized and, therefore, were not expected to generate cash

flows from operating activities in the foreseeable future, were considered separate units of accounting for

purposes of impairment testing.

U.S. Cellular estimates the fair value of built licenses for purposes of impairment testing using the

build-out method. The build-out method estimates the fair value of Licenses by calculating future cash

flows from a hypothetical start-up wireless company and assuming that the only assets available upon

formation are the underlying Licenses. To apply this method, a hypothetical build-out of the company’s

wireless network, infrastructure, and related costs are projected based on market participant information.

Calculated cash flows, along with a terminal value, are discounted to the present and summed to

determine the estimated fair value.

For units of accounting which consist of unbuilt licenses, U.S. Cellular prepares estimates of fair value by

reference to prices paid in recent auctions and market transactions where available. If such information is

not available, the fair value of the unbuilt licenses is assumed to change by the same percentage, and in

the same direction, that the fair value of built licenses measured using the build-out method changed

during the period.

Investments in Unconsolidated Entities

Investments in unconsolidated entities consist of amounts invested in wireless entities in which U.S.

Cellular holds a noncontrolling interest. U.S. Cellular follows the equity method of accounting for such

investments in which its ownership interest equals or exceeds 20% for corporations and equals or

exceeds 3% for partnerships and limited liability companies. The cost method of accounting is followed

for such investments in which U.S. Cellular’s ownership interest is less than 20% for corporations and is

less than 3% for partnerships and limited liability companies and for investments for which U.S. Cellular

does not have the ability to exercise significant influence.

For its equity method investments for which financial information is readily available, U.S. Cellular records

its equity in the earnings of the entity in the current period. For its equity method investments for which

42