US Cellular 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.accrued and unpaid interest, or (b) the sum of the present values of the remaining scheduled

payments of principal and interest thereon discounted to the redemption date on a semi-annual

basis at the Treasury Rate plus 30 basis points. U.S. Cellular may redeem the 6.95% Senior Notes,

in whole or in part at any time after the call date, at a redemption price equal to 100% of the

principal amount redeemed plus accrued and unpaid interest.

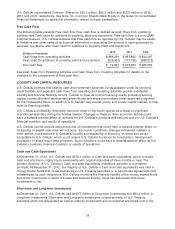

U.S. Cellular’s long-term debt indenture does not contain any provisions resulting in acceleration of the

maturities of outstanding debt in the event of a change in U.S. Cellular’s credit rating. However, a

downgrade in U.S. Cellular’s credit rating could adversely affect its ability to obtain long-term debt

financing in the future. U.S. Cellular believes it was in compliance as of December 31, 2012 with all

covenants and other requirements set forth in its long-term debt indenture. U.S. Cellular has not failed to

make nor does it expect to fail to make any scheduled payment of principal or interest under such

indenture.

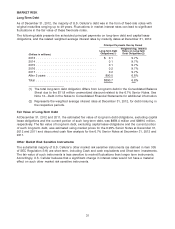

The long-term debt principal payments due for the next five years represent less than 1% of the total

long-term debt obligation at December 31, 2012. Refer to Market Risk—Long-Term Debt for additional

information regarding required principal payments and the weighted average interest rates related to U.S.

Cellular’s long-term debt.

U.S. Cellular, at its discretion, may from time to time seek to retire or purchase its outstanding debt

through cash purchases and/or exchanges for other securities, in open market purchases, privately

negotiated transactions, tender offers, exchange offers or otherwise. Such repurchases or exchanges, if

any, will depend on prevailing market conditions, liquidity requirements, contractual restrictions and other

factors. The amounts involved may be material.

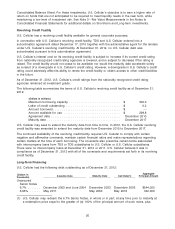

U.S. Cellular has an effective shelf registration statement on Form S-3 that it may use to issue senior

debt securities. The proceeds from any such issuance may be used for general corporate purposes,

including to finance the redemption of any of the above existing debt. The U.S. Cellular shelf registration

statement permits U.S. Cellular to issue at any time and from time to time senior debt securities in one or

more offerings up to an aggregate principal amount of $500 million. The ability of U.S. Cellular to

complete an offering pursuant to such shelf registration statement is subject to market conditions and

other factors at the time.

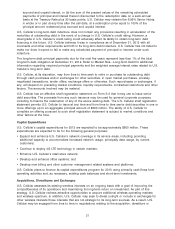

Capital Expenditures

U.S. Cellular’s capital expenditures for 2013 are expected to be approximately $600 million. These

expenditures are expected to be for the following general purposes:

• Expand and enhance U.S. Cellular’s network coverage in its service areas, including providing

additional capacity to accommodate increased network usage, principally data usage, by current

customers;

• Continue to deploy 4G LTE technology in certain markets;

• Enhance U.S. Cellular’s retail store network;

• Develop and enhance office systems; and

• Develop new billing and other customer management related systems and platforms.

U.S. Cellular plans to finance its capital expenditures program for 2013 using primarily cash flows from

operating activities and, as necessary, existing cash balances and short-term investments.

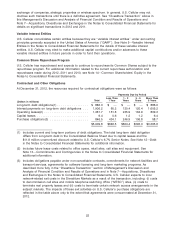

Acquisitions, Divestitures and Exchanges

U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the

competitiveness of its operations and maximizing its long-term return on investment. As part of this

strategy, U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets

and wireless spectrum. In addition, U.S. Cellular may seek to divest outright or include in exchanges for

other wireless interests those interests that are not strategic to its long-term success. As a result, U.S.

Cellular may be engaged from time to time in negotiations relating to the acquisition, divestiture or

21