US Cellular 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to the Consolidated Financial Statements (Continued)

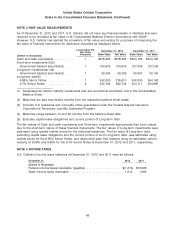

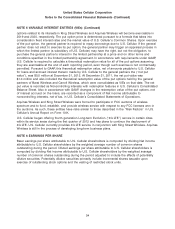

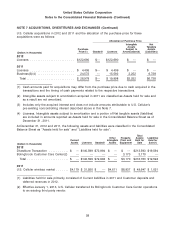

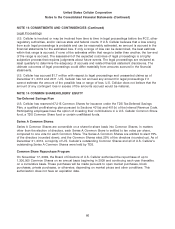

NOTE 7 ACQUISITIONS, DIVESTITURES AND EXCHANGES (Continued)

date. Sprint will reimburse U.S. Cellular for providing such services at an amount equal to U.S. Cellular’s

cost, including applicable overhead allocations. In addition, these agreements will require Sprint to

reimburse U.S. Cellular up to $200 million for certain network decommissioning costs, network site lease

rent and termination costs, network access termination costs, and employee termination benefits for

specified engineering employees.

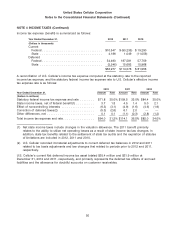

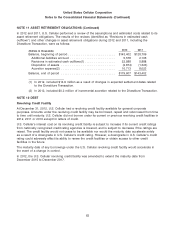

Financial impacts of the Divestiture Transaction are classified in the Consolidated Statement of

Operations within Operating income. The table below describes the amounts U.S. Cellular expects to

recognize in the Consolidated Statement of Operations between the date the Purchase and Sale

Agreement was signed and the end of the transition services period, and the actual amounts incurred

during the year ended December 31, 2012, as a result of the transaction.

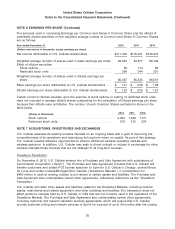

Actual

Amount

Expected Incurred

Period of Year Ended

Realization / December 31,

Incurrence(1) Projected Range 2012

(Dollars in thousands)

(Gain) loss on sale of business and other exit

costs, net

Proceeds from Sprint

Purchase price ........................ 2013 $(480,000) $(480,000) $ —

Reimbursement of transition and exit costs .... 2013-2014 (150,000) (200,000) —

Net assets transferred .................... 2013 210,000 230,000 —

Non-cash charges for the write-off and write-down

of property under construction and related

assets .............................. 2012-2013 5,000 15,000 10,672

Employee related costs including severance,

retention and outplacement ............... 2012-2014 15,000 25,000 12,609

Contract termination costs ................. 2012-2014 125,000 175,000 59

Transaction costs ........................ 2012-2013 3,000 5,000 1,137

Total (Gain) loss on sale of business and other

exit costs, net ....................... $(272,000) $(230,000) $24,477

Depreciation, amortization and accretion expense

Incremental depreciation, amortization and

accretion, net of salvage values(2) .......... 2012-2014 150,000 210,000 20,058

Other Operating expenses

Non-cash charges for the write-off and write-down

of various operating assets and liabilities ..... 2013 — 10,000 —

(Increase) decrease in Operating income ....... $(122,000) $ (10,000) $44,535

(1) Represents the estimated period in which a substantial majority of such amounts will be realized or

incurred.

(2) Represents incremental depreciation, amortization and accretion anticipated to be recorded in the

specified time periods as a result of revising the useful life of certain assets and revising the

settlement dates of certain asset retirement obligations in conjunction with the Divestiture

Transaction. Specifically, for the years indicated, this is estimated depreciation, amortization and

accretion recorded on assets and liabilities of the Divestiture Markets after the November 6, 2012

transaction date less depreciation, amortization and accretion that would have been recorded on

such assets and liabilities in the normal course, absent the Divestiture Transaction.

56