US Cellular 2012 Annual Report Download - page 19

Download and view the complete annual report

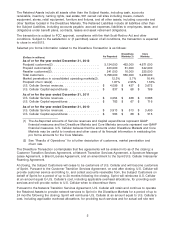

Please find page 19 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Revenues

Service revenues

Service revenues consist primarily of: (i) charges for access, airtime, roaming, recovery of regulatory

costs and value-added services, including data products and services, provided to U.S. Cellular’s retail

customers and to end users through third-party resellers (‘‘retail service’’); (ii) charges to other wireless

carriers whose customers use U.S. Cellular’s wireless systems when roaming, including long-distance

roaming (‘‘inbound roaming’’); and (iii) amounts received from the Federal USF.

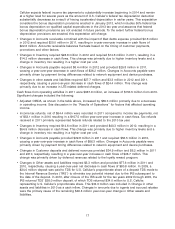

Retail service revenues

Retail service revenues increased by $61.5 million, or 2%, to $3,548.0 million primarily due to the impact

of an increase in the average monthly retail service revenue per customer, partially offset by a decrease

in U.S. Cellular’s average customer base.

The average number of customers decreased to 5,819,000 in 2012 from 5,975,000 in 2011, driven by

reductions in postpaid and reseller customers. The average number of customers in 2011 decreased

from 6,121,000 in 2010 driven by reductions in postpaid, prepaid and reseller customers.

Average monthly retail service revenue per customer increased to $50.81 in 2012 from $48.63 in 2011,

and in 2011 increased from $47.10 in 2010. The increase in 2012 from 2011 reflects the impact of a

larger portion of the customer base using smartphones which drives incremental data access revenue.

The average monthly retail service revenue increase in both years also includes the impact of a

reduction in the number of reseller customers, who typically generate lower average monthly revenues.

U.S. Cellular expects continued pressure on revenues in the foreseeable future due to industry

competition for customers and related effects on pricing of service plan offerings offset to some degree

by continued adoption of smartphones and data usage.

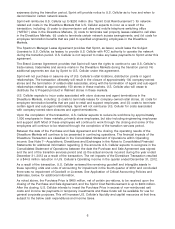

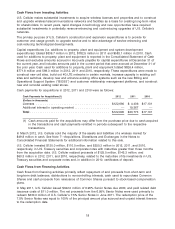

U.S. Cellular accounts for loyalty reward points under the deferred revenue method. Under this method,

U.S. Cellular allocates a portion of the revenue billed to customers with applicable plans to the loyalty

reward points. The revenue allocated to these points is initially deferred in the Consolidated Balance

Sheet and is recognized in future periods when the loyalty reward points are redeemed or used.

Application of the deferred revenue method of accounting related to loyalty reward points resulted in

deferring net revenues of $17.7 million in 2012, $31.8 million in 2011, and $7.1 million in 2010. Deferred

revenues related to loyalty reward points are included in the Customer deposits and deferred revenues in

the Consolidated Balance Sheet at December 31, 2012 and December 31, 2011.

Inbound roaming revenues

Inbound roaming revenues of $348.7 million were flat in 2012 compared to 2011 as higher data

revenues, reflecting significantly higher volumes but lower negotiated rates, were offset by lower voice

revenues, reflecting both lower volumes and rates. In 2011, inbound roaming revenues increased

$95.0 million, or 38% compared to 2010 as an increase in data roaming revenues was partially offset by

a decrease in voice roaming revenues. U.S. Cellular expects continued growth in data roaming volume

but also expects that the revenue impact of this growth will be offset by the impacts of decreases in

negotiated data roaming rates and voice roaming volumes.

Other revenues

As described below, ETC support was phased down to 80% of 2011 levels beginning July 1, 2012. As a

result, Other revenues decreased by $16.8 million, or 8%, in 2012 compared to 2011. In 2011, the

increase of $18.8 million, or 9%, was driven primarily by increased ETC revenues due to expanded

eligibility in certain states and adjustments by the Universal Service Administrative Company (‘‘USAC’’)

that reduced amounts received in prior years. U.S. Cellular was eligible to receive ETC funds in sixteen

states in 2012, 2011 and 2010. ETC revenues recorded in 2012, 2011 and 2010 were $140.8 million,

$160.5 million and $143.9 million, respectively.

11