US Cellular 2012 Annual Report Download - page 14

Download and view the complete annual report

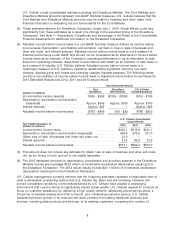

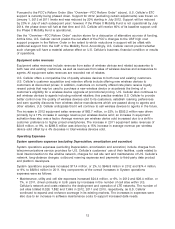

Please find page 14 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expenses during the transition period. Sprint will provide notice to U.S. Cellular as to how and when to

decommission certain network assets.

Sprint will reimburse U.S. Cellular up to $200 million (the ‘‘Sprint Cost Reimbursement’’) for network-

related exit costs in the Divestiture Markets that U.S. Cellular expects to incur as a result of the

transaction, including: (i) costs to decommission cell sites and mobile telephone switching office

(‘‘MTSO’’) sites in the Divestiture Markets, (ii) costs to terminate real property leases related to cell sites

in the Divestiture Markets, (iii) costs to terminate certain network access arrangements, and (iv) costs for

employee termination benefits that are paid to specified engineering employees in the Divestiture

Markets.

The Spectrum Manager Lease Agreement provides that Sprint, as lessor, would lease the Subject

Licenses to U.S. Cellular, as lessee, to provide U.S. Cellular with FCC authority to operate the network

during the transition period. U.S. Cellular is not required to make any lease payments to Sprint under this

agreement.

The Brand License Agreement provides that Sprint will have the rights to continue to use U.S. Cellular’s

trade-names, trademarks and service marks in the Divestiture Markets during the transition period. No

additional payments are due by Sprint to U.S. Cellular under this agreement.

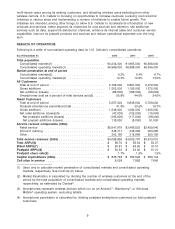

Sprint will not purchase or assume any of U.S. Cellular’s retail locations, distribution points or agent

relationships. The transaction ultimately will result in the closure of approximately 100 company-owned

stores and the termination of related retail associates, along with the termination of agent and sub-agent

relationships related to approximately 150 stores in these markets. U.S. Cellular also will cease to

distribute the U Prepaid product in Walmart stores in these markets.

U.S. Cellular expects to incur costs associated with store closures and agent terminations in the

Divestiture Markets, including: (i) costs to terminate leases for company-owned retail stores, (ii) costs for

employee termination benefits that are paid to retail and support employees, and (iii) costs to terminate

certain agent and sub-agent relationships. Sprint will not reimburse U.S. Cellular for costs associated

with company-owned store closures and agent terminations.

Upon the completion of the transaction, U.S. Cellular expects to reduce its workforce by approximately

1,000 employees in these markets, primarily store employees, but also including engineering employees

and support staff. Most of these employees will continue to work through the closing and some of the

employees will continue to be retained through the completion of the transition services period.

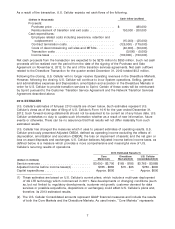

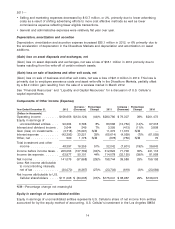

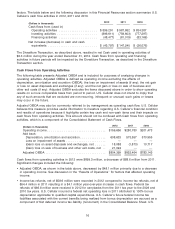

Between the date of the Purchase and Sale Agreement and the closing, the operating results of the

Divestiture Markets will continue to be presented in continuing operations. The financial impacts of the

Divestiture Transaction are classified in the Consolidated Statement of Operations within Operating

income. See Note 7—Acquisitions, Divestitures and Exchanges in the Notes to Consolidated Financial

Statements for additional information regarding (i) the amounts U.S. Cellular expects to recognize in the

Consolidated Statement of Operations between the date the Purchase and Sale Agreement was signed

and the end of the transition services period and (ii) the actual amounts incurred during the year ended

December 31, 2012 as a result of the transaction. The net impacts of the Divestiture Transaction resulted

in a $44.5 million reduction in U.S. Cellular’s Operating income in the quarter ended December 31, 2012.

As a result of the transaction, U.S. Cellular reviewed the remaining goodwill and intangible assets in

these reporting units and units of accounting for impairment in the fourth quarter of 2012 and concluded

there was no impairment of Goodwill or Licenses. See Application of Critical Accounting Policies and

Estimates, below, for additional information.

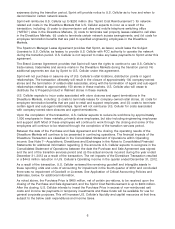

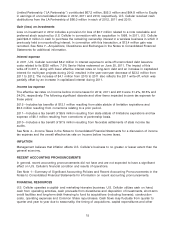

As noted above, the Purchase Price is $480 million, net of certain pro-rations, to be received upon the

closing of the Purchase and Sale Agreement, and the Sprint Cost Reimbursement is up to $200 million.

After the closing, U.S. Cellular intends to invest the Purchase Price in excess of non-reimbursed exit

costs and income tax payments in temporary investments and these funds will be available for use for

general corporate purposes. This will increase U.S. Cellular’s liquidity and capital resources at that time,

subject to the below cash expenditures and income taxes.

6