US Cellular 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

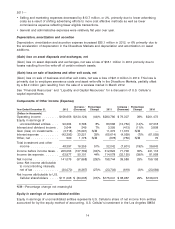

Consolidated Balance Sheet. For these investments, U.S. Cellular’s objective is to earn a higher rate of

return on funds that are not anticipated to be required to meet liquidity needs in the near term, while

maintaining a low level of investment risk. See Note 3—Fair Value Measurements in the Notes to

Consolidated Financial Statements for additional details on Short-term and Long-term investments.

Revolving Credit Facility

U.S. Cellular has a revolving credit facility available for general corporate purposes.

In connection with U.S. Cellular’s revolving credit facility, TDS and U.S. Cellular entered into a

subordination agreement dated December 17, 2010 together with the administrative agent for the lenders

under U.S. Cellular’s revolving credit facility. At December 31, 2012, no U.S. Cellular debt was

subordinated pursuant to this subordination agreement.

U.S. Cellular’s interest cost on its revolving credit facility is subject to increase if its current credit rating

from nationally recognized credit rating agencies is lowered, and is subject to decrease if the rating is

raised. The credit facility would not cease to be available nor would the maturity date accelerate solely

as a result of a downgrade in U.S. Cellular’s credit rating. However, a downgrade in U.S. Cellular’s credit

rating could adversely affect its ability to renew the credit facility or obtain access to other credit facilities

in the future.

As of December 31, 2012, U.S. Cellular’s credit ratings from the nationally recognized credit rating

agencies remained at investment grade.

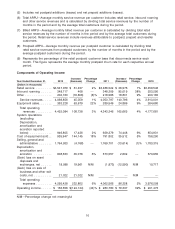

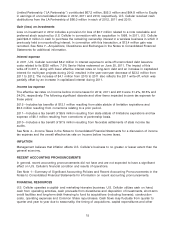

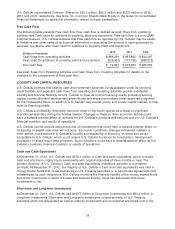

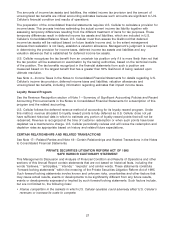

The following table summarizes the terms of U.S. Cellular’s revolving credit facility as of December 31,

2012:

(Dollars in millions)

Maximum borrowing capacity ............................ $ 300.0

Letter of credit outstanding .............................. $ 0.2

Amount borrowed ..................................... $ —

Amount available for use ............................... $ 299.8

Agreement date ...................................... December 2010

Maturity date ........................................ December 2017

U.S. Cellular may seek to extend the maturity date from time to time. In 2012, the U.S. Cellular revolving

credit facility was amended to extend the maturity date from December 2015 to December 2017.

The continued availability of the revolving credit facility requires U.S. Cellular to comply with certain

negative and affirmative covenants, maintain certain financial ratios and make representations regarding

certain matters at the time of each borrowing. The covenants also prescribe certain terms associated

with intercompany loans from TDS or TDS subsidiaries to U.S. Cellular or U.S. Cellular subsidiaries.

There were no intercompany loans at December 31, 2012 or 2011. U.S. Cellular believes it was in

compliance as of December 31, 2012 with all of the covenants and requirements set forth in its revolving

credit facility.

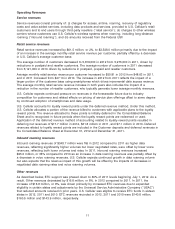

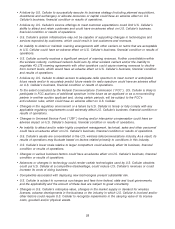

Long-Term Financing

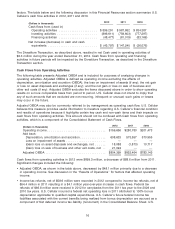

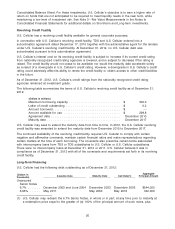

U.S. Cellular had the following debt outstanding as of December 31, 2012:

Aggregate

(Dollars in Issuance Date Maturity Date Call Date(1) Principal Amount

thousands)

Unsecured

Senior Notes

6.7% ....... December 2003 and June 2004 December 2033 December 2003 $544,000

6.95% ...... May 2011 May 2060 May 2016 342,000

(1) U.S. Cellular may redeem the 6.7% Senior Notes, in whole or in part, at any time prior to maturity at

a redemption price equal to the greater of (a) 100% of the principal amount of such notes, plus

20