US Cellular 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to the Consolidated Financial Statements (Continued)

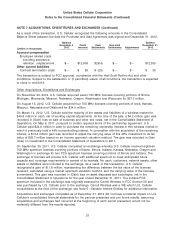

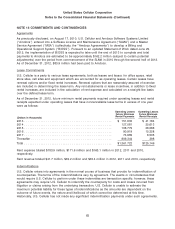

NOTE 6 EARNINGS PER SHARE (Continued)

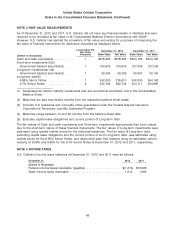

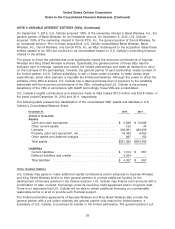

The amounts used in computing Earnings per Common and Series A Common Share and the effects of

potentially dilutive securities on the weighted average number of Common and Series A Common Shares

are as follows:

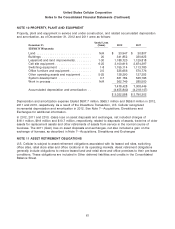

Year ended December 31, 2012 2011 2010

(Dollars and shares in thousands, except earnings per share)

Net income attributable to U.S. Cellular shareholders ............. $111,006 $175,041 $136,074

Weighted average number of shares used in basic earnings per share 84,645 84,877 86,128

Effect of dilutive securities:

Stock options ........................................ 58 114 89

Restricted stock units .................................. 364 344 301

Weighted average number of shares used in diluted earnings per

share .............................................. 85,067 85,335 86,518

Basic earnings per share attributable to U.S. Cellular shareholders . . . $ 1.31 $ 2.06 $ 1.58

Diluted earnings per share attributable to U.S. Cellular shareholders . . $ 1.30 $ 2.05 $ 1.57

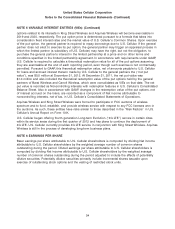

Certain Common Shares issuable upon the exercise of stock options or vesting of restricted stock units

were not included in average diluted shares outstanding for the calculation of Diluted earnings per share

because their effects were antidilutive. The number of such Common Shares excluded is shown in the

table below.

2012 2011 2010

(Shares in thousands)

Stock options .................................... 2,452 1,399 1,771

Restricted stock units ............................... 318 215 224

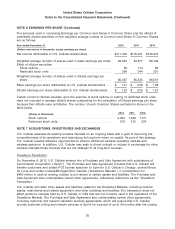

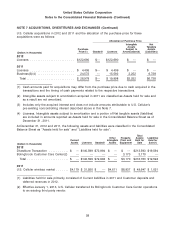

NOTE 7 ACQUISITIONS, DIVESTITURES AND EXCHANGES

U.S. Cellular assesses its existing wireless interests on an ongoing basis with a goal of improving the

competitiveness of its operations and maximizing its long-term return on capital. As part of this strategy,

U.S. Cellular reviews attractive opportunities to acquire additional wireless operating markets and

wireless spectrum. In addition, U.S. Cellular may seek to divest outright or include in exchanges for other

wireless interests those interests that are not strategic to its long-term success.

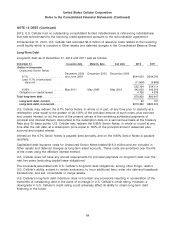

Divestiture Transaction

On November 6, 2012, U.S. Cellular entered into a Purchase and Sale Agreement with subsidiaries of

Sprint Nextel Corporation (‘‘Sprint’’). The Purchase and Sale Agreement provides that U.S. Cellular will

transfer customers and certain PCS license spectrum to Sprint in U.S. Cellular’s Chicago, central Illinois,

St. Louis and certain Indiana/Michigan/Ohio markets (‘‘Divestiture Markets’’) in consideration for

$480 million in cash at closing, subject to pro-rations of certain assets and liabilities. The Purchase and

Sale Agreement also contemplates certain other agreements, collectively referred to as the ‘‘Divestiture

Transaction.’’

U.S. Cellular will retain other assets and liabilities related to the Divestiture Markets, including network

assets, retail stores and related equipment, and other buildings and facilities. The transaction does not

affect spectrum licenses held by U.S. Cellular or VIEs that are not currently used in the operations of the

Divestiture Markets. The Purchase and Sale Agreement also contemplates certain other agreements,

including customer and network transition services agreements, which will require that U.S. Cellular

provide customer, billing and network services to Sprint for a period of up to 24 months after the closing

55