US Cellular 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

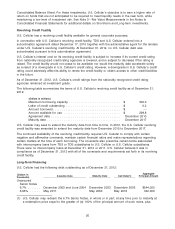

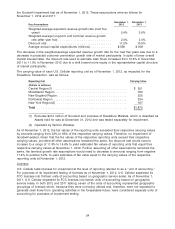

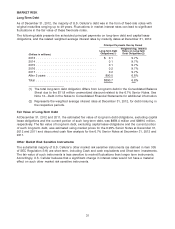

Carrying Value of Licenses

The carrying value of licenses at November 1, 2012 was as follows:

Unit of Accounting(1) Carrying Value

(Dollars in millions)

Developed Operating markets (6 units of accounting)

Central Region .......................................... $ 693

Licenses to be transferred as a result of the Divestiture Transaction .... 141

Mid-Atlantic Region ....................................... 228

New England Region ...................................... 103

Northwest Region ........................................ 67

New York Region(2) ...................................... —

Non-operating markets (7 units of accounting)

North Northwest (2 states) .................................. 3

South Northwest (2 states) .................................. 2

North Central (5 states) .................................... 51

South Central (5 states) .................................... 24

East Central (5 states) ..................................... 127

Mid-Atlantic (8 states) ..................................... 50

Mississippi Valley (13 states) ................................ 43

Total(3) ............................................... $1,532

(1) U.S. Cellular participated in spectrum auctions indirectly through its interests in Aquinas

Wireless L.P. (‘‘Aquinas Wireless’’) and King Street Wireless L.P. (‘‘King Street Wireless’’),

collectively, the ‘‘limited partnerships.’’ Interests in other limited partnerships that

participated in spectrum auctions have since been acquired. Each limited partnership

participated in and was awarded spectrum licenses in one of two separate spectrum

auctions (FCC Auctions 78 and 73). All of the units of accounting above, except Mississippi

Valley and the New York Region, include licenses awarded to the limited partnerships.

(2) Operated by Verizon Wireless.

(3) Between November 1, 2012 and December 31, 2012, U.S. Cellular reclassified licenses to

Assets held for sale as a result of the Divestiture Transaction in the amount of

$140.6 million, obtained licenses through acquisitions in the amount of $64.2 million and

capitalized interest on certain licenses pursuant to current network build-outs in the amount

of $0.8 million.

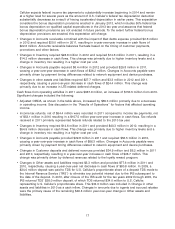

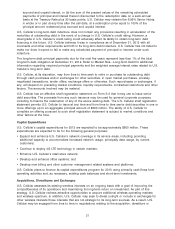

Licenses with an aggregate carrying value of $70.2 million were in units of accounting where the fair

value exceeded the carrying value by amounts less than 10% of the carrying value. Any further declines

in the fair value of such licenses in future periods could result in the recognition of impairment losses on

such licenses and any such impairment losses would have a negative impact on future results of

operations. The impairment losses on licenses are not expected to have a future impact on liquidity. U.S.

Cellular is unable to predict the amount, if any, of future impairment losses attributable to licenses.

Further, historical operating results, particularly amounts related to impairment losses, are not indicative

of future operating results.

Income Taxes

U.S. Cellular is included in a consolidated federal income tax return with other members of the TDS

consolidated group. TDS and U.S. Cellular are parties to a Tax Allocation Agreement which provides that

U.S. Cellular and its subsidiaries be included with the TDS affiliated group in a consolidated federal

income tax return and in state income or franchise tax returns in certain situations. For financial

statement purposes, U.S. Cellular and its subsidiaries calculate their income, income tax and credits as if

they comprised a separate affiliated group. Under the Tax Allocation Agreement, U.S. Cellular remits its

applicable income tax payments to TDS.

26