US Cellular 2012 Annual Report Download - page 20

Download and view the complete annual report

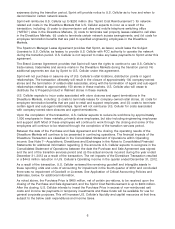

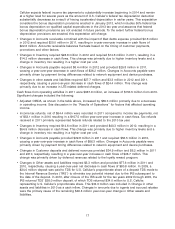

Please find page 20 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pursuant to the FCC’s Reform Order (See ‘‘Overview—FCC Reform Order’’ above), U.S. Cellular’s ETC

support is currently being phased down. Support for 2012 (excluding certain adjustments) was frozen on

January 1, 2012 at 2011 levels and was reduced by 20% starting in July 2012. Support will be reduced

by 20% in July of each subsequent year; however, if the Phase II Mobility Fund is not operational by July

2014, the phase down will halt at that time and U.S. Cellular will receive 60% of its baseline support until

the Phase II Mobility Fund is operational.

See the ‘‘Overview—FCC Reform Order’’ section above for a discussion of alternative sources of funding.

At this time, U.S. Cellular cannot predict the net effect of the FCC’s changes to the USF high cost

support program in the Reform Order or the extent to which reductions in support will be offset with

additional support from the CAF or the Mobility Fund. Accordingly, U.S. Cellular cannot predict whether

such changes will have a material adverse effect on U.S. Cellular’s business, financial condition or results

of operations.

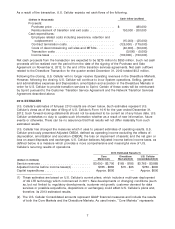

Equipment sales revenues

Equipment sales revenues include revenues from sales of wireless devices and related accessories to

both new and existing customers, as well as revenues from sales of wireless devices and accessories to

agents. All equipment sales revenues are recorded net of rebates.

U.S. Cellular offers a competitive line of quality wireless devices to both new and existing customers.

U.S. Cellular’s customer acquisition and retention efforts include offering new wireless devices to

customers at discounted prices; in addition, customers on currently offered rate plans receive loyalty

reward points that may be used to purchase a new wireless device or accelerate the timing of a

customer’s eligibility for a wireless device upgrade at promotional pricing. U.S. Cellular also continues to

sell wireless devices to agents including national retailers; this practice enables U.S. Cellular to provide

better control over the quality of wireless devices sold to its customers, establish roaming preferences

and earn quantity discounts from wireless device manufacturers which are passed along to agents and

other retailers. U.S. Cellular anticipates that it will continue to sell wireless devices to agents in the future.

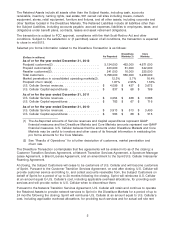

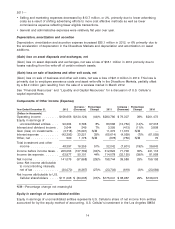

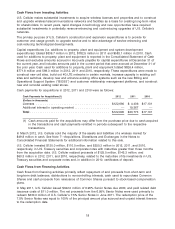

The increase in 2012 equipment sales revenues of $63.7 million, or 22%, to $353.2 million was driven

primarily by a 17% increase in average revenue per wireless device sold; an increase in equipment

activation fees also was a factor. Average revenue per wireless device sold increased due to a shift in

customer preference to higher priced smartphones. The increase in 2011 equipment sales revenues of

$24.9 million, or 9%, to $289.5 million was driven by a 15% increase in average revenue per wireless

device sold offset by a 4% decrease in total wireless devices sold.

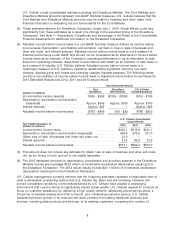

Operating Expenses

System operations expenses (excluding Depreciation, amortization and accretion)

System operations expenses (excluding Depreciation, amortization and accretion) include charges from

telecommunications service providers for U.S. Cellular’s customers’ use of their facilities, costs related to

local interconnection to the wireline network, charges for cell site rent and maintenance of U.S. Cellular’s

network, long-distance charges, outbound roaming expenses and payments to third-party data product

and platform developers.

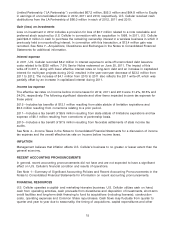

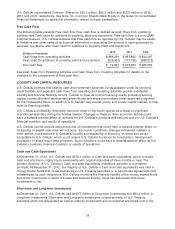

System operations expenses increased $17.4 million, or 2%, to $946.8 million in 2012 and $74.4 million,

or 9%, to $929.4 million in 2011. Key components of the overall increases in System operations

expenses were as follows:

• Maintenance, utility and cell site expenses increased $24.4 million, or 6%, in 2012 and $26.4 million, or

7%, in 2011, driven primarily in both years by increases in the number of cell sites within U.S.

Cellular’s network and costs related to the deployment and operation of LTE networks. The number of

cell sites totaled 8,028, 7,882 and 7,645 in 2012, 2011 and 2010, respectively, as U.S. Cellular

continued to expand and enhance coverage in its existing markets. The increases in expenses were

also due to an increase in software maintenance costs to support increased data needs.

12