US Cellular 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MARKET RISK

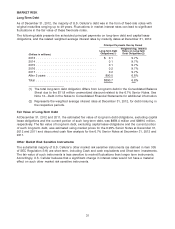

Long-Term Debt

As of December 31, 2012, the majority of U.S. Cellular’s debt was in the form of fixed-rate notes with

original maturities ranging up to 49 years. Fluctuations in market interest rates can lead to significant

fluctuations in the fair value of these fixed-rate notes.

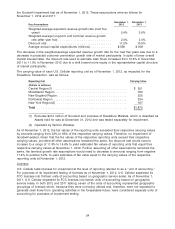

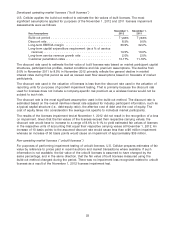

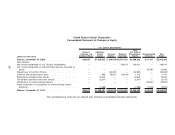

The following table presents the scheduled principal payments on long-term debt and capital lease

obligations, and the related weighted average interest rates by maturity dates at December 31, 2012:

Principal Payments Due by Period

Weighted-Avg. Interest

Long-Term Debt Rates on Long-Term

Obligations(1) Debt Obligations(2)

(Dollars in millions)

2013 ................................. $ 0.1 9.7%

2014 ................................. 0.1 9.7%

2015 ................................. 0.1 9.7%

2016 ................................. 0.2 9.7%

2017 ................................. 0.2 9.7%

After 5 years ........................... 890.0 6.8%

Total ................................. $890.7 6.8%

(1) The total long-term debt obligation differs from Long-term debt in the Consolidated Balance

Sheet due to the $11.8 million unamortized discount related to the 6.7% Senior Notes. See

Note 12—Debt in the Notes to Consolidated Financial Statements for additional information.

(2) Represents the weighted average interest rates at December 31, 2012, for debt maturing in

the respective periods.

Fair Value of Long-Term Debt

At December 31, 2012 and 2011, the estimated fair value of long-term debt obligations, excluding capital

lease obligations and the current portion of such long-term debt, was $959.4 million and $899.0 million,

respectively. The fair value of long-term debt, excluding capital lease obligations and the current portion

of such long-term debt, was estimated using market prices for the 6.95% Senior Notes at December 31,

2012 and 2011 and discounted cash flow analysis for the 6.7% Senior Notes at December 31, 2012 and

2011.

Other Market Risk Sensitive Instruments

The substantial majority of U.S. Cellular’s other market risk sensitive instruments (as defined in item 305

of SEC Regulation S-K) are short-term, including Cash and cash equivalents and Short-term investments.

The fair value of such instruments is less sensitive to market fluctuations than longer term instruments.

Accordingly, U.S. Cellular believes that a significant change in interest rates would not have a material

effect on such other market risk sensitive instruments.

31