US Cellular 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Annual Report

uscellular.com

Table of contents

-

Page 1

2012 Annual Report uscellular.com -

Page 2

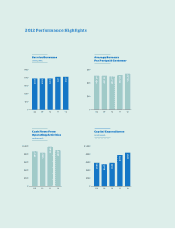

2012 Performance Highlights Service Revenues (IN BILLIONS) Average Revenue Per Postpaid Customer $5.0 $60 $51.20 $40 $3.0 $2.0 $20 $1.0 0 08 09 10 11 12 0 08 09 10 11 12 Cash Flows From Operating Activities (IN MILLIONS) Capital Expenditures (IN MILLIONS) $1,000 $1,000 $988 $834 $... -

Page 3

...execution, and by offering prepaid and postpaid service in Walmart stores nationwide. We increased smartphone penetration, data use and average revenue per postpaid customer with a strong device portfolio, including iconic 4G LTE devices that helped to drive migration to the expanding 4G LTE network... -

Page 4

... the year, and 4G LTE smartphones in particular were 22 percent of all devices sold in the year. To better monetize the resulting growth in data traffic, we introduced a range of tiered data plans. The growth in smartphone penetration and data use increased average revenue per postpaid customer by... -

Page 5

... Future We expanded 4G LTE access to 61 percent of postpaid customers in 2012, in conjunction with our partner King Street Wireless, and we plan to reach 87 percent of postpaid customers by the end of 2013. We also increased network capacity in 2012 with 146 additional cell sites. At the same time... -

Page 6

... access to at least 87 percent of postpaid customers and introducing at least 11 new 4G LTE devices • Better manage equipment subsidies and data use costs • Implement our new billing and operational support system • Increase efficiency and reduce complexity and cost across the company... -

Page 7

... financial statements and certain other financial information for the year ended December 31, 2012, represent U.S. Cellular's annual report to shareholders as required by the rules and regulations of the Securities and Exchange Commission (''SEC''). The following information was filed with the SEC... -

Page 8

... Balance Sheet-Assets ...Consolidated Balance Sheet-Liabilities and Equity ...Consolidated Statement of Changes in Equity ...Notes to Consolidated Financial Statements ...Reports of Management ...Report of Independent Registered Public Accounting Firm ...Selected Consolidated Financial Data... -

Page 9

... new distribution options. • In March 2012, U.S. Cellular, in conjunction with King Street Wireless L.P ., began offering fourth generation Long-term Evolution (''4G LTE'') service; as of December 31, 2012, the 4G LTE network covered approximately 61% of U.S. Cellular's postpaid customers. 4G LTE... -

Page 10

... Evolution (''4G LTE'') equipment, outfit new and remodel existing retail stores, develop new billing and other customer management related systems and platforms, and enhance existing office systems. Total cell sites in service increased by 146, or 2%, year-over-year to 8,028. • Operating income... -

Page 11

... revenues from voice services; - Rapid growth in the demand for new data devices and services which may result in increased cost of equipment sold and other operating expenses and the need for additional investment in network capacity; - Costs of developing and enhancing office and customer support... -

Page 12

... Cellular's business, financial condition or results of operations. On September 27, 2012, the FCC conducted a single round, sealed bid, reverse auction to award up to $300 million in one-time Mobility Fund Phase I support to successful bidders that commit to provide 3G, or better, wireless service... -

Page 13

..., including cash, accounts receivable, inventory, naming rights, real estate, 561 owned cell sites including towers, network equipment, stores, retail equipment, furniture and fixtures, and all other assets, including corporate and other facilities located in the Divestiture Markets. The Retained... -

Page 14

... and Sale Agreement, and the Sprint Cost Reimbursement is up to $200 million. After the closing, U.S. Cellular intends to invest the Purchase Price in excess of non-reimbursed exit costs and income tax payments in temporary investments and these funds will be available for use for general corporate... -

Page 15

... Markets in order for U.S. Cellular to provide transition services to Sprint. Certain of these costs will be reimbursed by Sprint pursuant to the Customer Transition Service Agreement and the Network Transition Services Agreement described above. 2013 ESTIMATES U.S. Cellular's estimates of full-year... -

Page 16

... plans, a broad line of wireless devices and other products, and outstanding customer service. U.S. Cellular believes that future growth in its revenues will result primarily from selling additional products and services, including data products and services, to its existing customers, increasing... -

Page 17

... sales and customer service capabilities, improve its prepaid products and services and reduce operational expenses over the long term. RESULTS OF OPERATIONS Following is a table of summarized operating data for U.S. Cellular's consolidated operations. As of December 31, 2012 2011 2010 Total... -

Page 18

...the average monthly postpaid churn rate for each respective annual period. Components of Operating Income Year Ended December 31, (Dollars in thousands) 2012 Increase/ Percentage (Decrease) Change 2011 Increase/ Percentage (Decrease) Change 2010 Retail service ...$3,547,979 $ 61,457 Inbound roaming... -

Page 19

...regulatory costs and value-added services, including data products and services, provided to U.S. Cellular's retail customers and to end users through third-party resellers (''retail service''); (ii) charges to other wireless carriers whose customers use U.S. Cellular's wireless systems when roaming... -

Page 20

... offered rate plans receive loyalty reward points that may be used to purchase a new wireless device or accelerate the timing of a customer's eligibility for a wireless device upgrade at promotional pricing. U.S. Cellular also continues to sell wireless devices to agents including national retailers... -

Page 21

... similar 3G devices. However, 4G LTE technology results in lower system operations expense during a customer's lifecycle. U.S. Cellular's loss on equipment, defined as equipment sales revenues less cost of equipment sold, was $582.7 million, $502.3 million and $491.6 million for 2012, 2011 and 2010... -

Page 22

...sale of a wireless market in March 2012. See ''Financial Resources'' and ''Liquidity and Capital Resources'' for a discussion of U.S. Cellular's capital expenditures. Components of Other Income (Expense) Year Ended December 31, (Dollars in thousands) 2012 Increase / Percentage (Decrease) Change 2011... -

Page 23

... and Exchanges in the Notes to Consolidated Financial Statements for additional information. Interest expense In 2011, U.S. Cellular recorded $8.2 million in interest expense to write-off unamortized debt issuance costs related to its $330 million, 7.5% Senior Notes redeemed on June 20, 2011. The... -

Page 24

...received in 2012 for carrybacks from the 2011 tax year to the 2009 and 2010 tax years. U.S. Cellular incurred a federal net operating loss in 2011 attributed to 100% bonus depreciation applicable to qualified capital expenditures. U.S. Cellular's future federal income tax liabilities associated with... -

Page 25

... payable were primarily driven by payment timing differences related to network equipment and device purchases. • Changes in Customer deposits and deferred revenues provided $34.9 million and $6.2 million in 2011 and 2010, respectively, resulting in a year-over-year increase in cash flows of $28... -

Page 26

... in 2012, 2011 and 2010, respectively. These expenditures were made to construct new cell sites, build out 4G LTE networks in certain markets, increase capacity in existing cell sites and switches, develop new and enhance existing office systems such as the new Billing and Operational Support System... -

Page 27

...Cellular may be useful to investors and other users of its financial information in evaluating the amount of cash generated by business operations, after Cash used for additions to property, plant and equipment. (Dollars in thousands) 2012 2011 2010 Cash flows from operating activities ...Cash used... -

Page 28

... for use ...Agreement date ...Maturity date ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... $ $ $ $ 300.0 0.2 - 299.8 December 2010 December 2017 U.S. Cellular may seek to extend the maturity date from time to time. In 2012, the... -

Page 29

... increased network usage, principally data usage, by current customers; • Continue to deploy 4G LTE technology in certain markets; • Enhance U.S. Cellular's retail store network; • Develop and enhance office systems; and • Develop new billing and other customer management related systems... -

Page 30

... and Exchanges in the Notes to Consolidated Financial Statements, U.S. Cellular expects to incur network-related exit costs in the Divestiture Markets as a result of the transaction, including: (i) costs to decommission cell sites and mobile telephone switching office (''MTSO'') sites, (ii) costs to... -

Page 31

...Notes to Consolidated Financial Statements. Off-Balance Sheet Arrangements U.S. Cellular had no transactions, agreements or other contractual arrangements with unconsolidated entities involving ''off-balance sheet arrangements,'' as defined by Securities and Exchange Commission (''SEC'') rules, that... -

Page 32

... weighted-average expected revenue growth rate for the next five years was due to a decrease in projected customer penetration growth rate of market participants. In spite of lower overall market interest rates, the discount rate used to estimate cash flows increased from 10.5% in November 2011 to... -

Page 33

... (as revenue) ...Long-term service revenue growth rate ...Customer penetration rates ... ...a % of service ... 7 years 8.5% 33.9% 14.5% 2.0% 13-17% 7 years 9.0% 32.2% 13.0% 2.0% 11-16% The discount rate used to estimate the fair value of built licenses was based on market participant capital... -

Page 34

... of the units of accounting above, except Mississippi Valley and the New York Region, include licenses awarded to the limited partnerships. (2) Operated by Verizon Wireless. (3) Between November 1, 2012 and December 31, 2012, U.S. Cellular reclassified licenses to Assets held for sale as a result of... -

Page 35

... in the Notes to Consolidated Financial Statements for a description of this program and the related accounting. U.S. Cellular follows the deferred revenue method of accounting for its loyalty reward program. Under this method, revenue allocated to loyalty reward points is fully deferred as... -

Page 36

... network build-outs by other wireless carriers and/or the inability to negotiate 4G LTE roaming agreements with other operators could cause roaming revenues to decline from current levels, which would have an adverse effect on U.S. Cellular's business, financial condition and results of operations... -

Page 37

...Securities and Exchange Commission (''SEC''). Such amendments or restatements and related matters, including resulting delays in filing periodic reports with the SEC, could have an adverse effect on U.S. Cellular's business, financial condition or results of operations. • The existence of material... -

Page 38

...See ''Risk Factors'' in U.S. Cellular's Annual Report on Form 10-K for the year ended December 31, 2012 for a further discussion of these risks. U.S. Cellular undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise... -

Page 39

..., and the related weighted average interest rates by maturity dates at December 31, 2012: Principal Payments Due by Period Weighted-Avg. Interest Long-Term Debt Rates on Long-Term Obligations(1) Debt Obligations(2) (Dollars in millions) 2013 ...2014 ...2015 ...2016 ...2017 ...After 5 years... -

Page 40

United States Cellular Corporation Consolidated Statement of Operations Year Ended December 31, (Dollars and shares in thousands, except per share amounts) 2012 2011 2010 Operating revenues Service ...Equipment sales ...Total operating revenues ...Operating expenses System operations (excluding ... -

Page 41

United States Cellular Corporation Consolidated Statement of Cash Flows Year Ended December 31, (Dollars in thousands) 2012 2011 2010 Cash flows from operating activities Net income ...Add (deduct) adjustments to reconcile net income to net cash flows from operating activities Depreciation, ... -

Page 42

... States Cellular Corporation Consolidated Balance Sheet-Assets December 31, (Dollars in thousands) 2012 2011 Current assets Cash and cash equivalents ...Short-term investments ...Accounts receivable Customers and agents, less allowances of $24,290 and $21,337, respectively ...Roaming ...Affiliated... -

Page 43

... States Cellular Corporation Consolidated Balance Sheet-Liabilities and Equity December 31, (Dollars and shares in thousands) 2012 2011 Current liabilities Current portion of long-term debt ...Accounts payable Affiliated ...Trade ...Customer deposits and deferred revenues Accrued taxes ...Accrued... -

Page 44

...of Common Shares ...Incentive and compensation plans ...Stock-based compensation awards ...Tax windfall (shortfall) from stock awards ...Distributions to noncontrolling interests ...Adjust investment in subsidiaries for noncontrolling interest purchases ...Other ...Balance, December 31, 2012 ... $88... -

Page 45

... Equity Balance, December 31, 2010 ...Add (Deduct) Net income attributable to U.S. Cellular shareholders ...Net income attributable to noncontrolling interests classified as equity ...Repurchase of Common Shares ...Incentive and compensation plans ...Stock-based compensation awards ...Tax windfall... -

Page 46

... Equity Balance, December 31, 2009 ...Add (Deduct) Net income attributable to U.S. Cellular shareholders ...Net income attributable to noncontrolling interests classified equity ...Repurchase of Common Shares ...Incentive and compensation plans ...Stock-based compensation awards ...Tax windfall... -

Page 47

... Delaware Corporation, is an 84%-owned subsidiary of Telephone and Data Systems, Inc. (''TDS''). Nature of Operations U.S. Cellular owns, operates and invests in wireless systems throughout the United States. As of December 31, 2012, U.S. Cellular served 5.8 million customers. U.S. Cellular operates... -

Page 48

...for wireless services and equipment sales, by agents for sales of equipment to them and by other wireless carriers whose customers have used U.S. Cellular's wireless systems. The allowance for doubtful accounts is the best estimate of the amount of probable credit losses related to existing accounts... -

Page 49

... market prices in active markets are the best evidence of fair value of an intangible asset or reporting unit and are used when available. If quoted market prices are not available, the estimate of fair value is based on the best information available, including prices for similar assets and the use... -

Page 50

... underlying Licenses. To apply this method, a hypothetical build-out of the company's wireless network, infrastructure, and related costs are projected based on market participant information. Calculated cash flows, along with a terminal value, are discounted to the present and summed to determine... -

Page 51

... second step compares the carrying value of the asset to its estimated fair value. If the carrying value exceeds the estimated fair value (less cost to sell), an impairment loss is recognized for the difference. Quoted market prices in active markets are the best evidence of fair value of a tangible... -

Page 52

... for access, airtime, roaming, long distance, data and other value added services provided to U.S. Cellular's retail customers and to end users through third-party resellers; • Charges to carriers whose customers use U.S. Cellular's systems when roaming; • Sales of equipment and accessories... -

Page 53

...-line bill payment methods, are recognized as a reduction of Operating revenues concurrently with the associated revenue, and are allocated to the various products and services in the bundled offering based on their respective relative selling price. In order to provide better control over wireless... -

Page 54

...Device activation fees charged at agent locations, where U.S. Cellular does not also sell a wireless device to the customer, are deferred and recognized over the average device life. Device activation fees charged as a result of handset sales at Company-owned retail stores are recognized at the time... -

Page 55

... these plans is required. U.S. Cellular values its share-based payment transactions using a Black-Scholes valuation model. Stockbased compensation cost recognized during the period is based on the portion of the share-based payment awards that is ultimately expected to vest. Accordingly, stock-based... -

Page 56

... Corporation Notes to the Consolidated Financial Statements (Continued) NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RECENT ACCOUNTING PRONOUNCEMENTS (Continued) Operating Leases U.S. Cellular is a party to various lease agreements for office space, retail stores, cell sites and equipment... -

Page 57

... using market prices for the 6.95% Senior Notes, and discounted cash flow analysis using an estimated yield to maturity of 6.09% and 6.85% for the 6.7% Senior Notes at December 31, 2012 and 2011, respectively. NOTE 4 INCOME TAXES U.S. Cellular's income taxes balances at December 31, 2012 and 2011... -

Page 58

United States Cellular Corporation Notes to the Consolidated Financial Statements (Continued) NOTE 4 INCOME TAXES (Continued) Income tax expense (benefit) is summarized as follows: Year Ended December 31, (Dollars in thousands) 2012 2011 2010 Current Federal . State . . Deferred Federal . State . ... -

Page 59

... expire before they can be utilized. A summary of U.S. Cellular's deferred tax asset valuation allowance is as follows: (Dollars in thousands) 2012 2011 2010 Balance at January 1, ...Charged to income tax expense ...Charged to other accounts ...Balance at December 31, ... $30,261 3,033 8,001 $41... -

Page 60

United States Cellular Corporation Notes to the Consolidated Financial Statements (Continued) NOTE 4 INCOME TAXES (Continued) A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows: (Dollars in thousands) 2012 2011 2010 Unrecognized tax benefits balance at ... -

Page 61

... Cellular's controlling financial interest in the entities. The power to direct the activities that most significantly impact the economic performance of Aquinas Wireless and King Street Wireless is shared. Specifically, the general partner of these VIEs has the exclusive right to manage, operate... -

Page 62

... its service areas during the first quarter of 2012 and has plans to continue the deployment of 4G LTE. U.S. Cellular currently provides 4G LTE service in conjunction with King Street Wireless. Aquinas Wireless is still in the process of developing long-term business plans. NOTE 6 EARNINGS PER SHARE... -

Page 63

... currently used in the operations of the Divestiture Markets. The Purchase and Sale Agreement also contemplates certain other agreements, including customer and network transition services agreements, which will require that U.S. Cellular provide customer, billing and network services to Sprint for... -

Page 64

... year ended December 31, 2012, as a result of the transaction. Actual Amount Incurred Year Ended December 31, 2012 (Dollars in thousands) Expected Period of Realization / Incurrence(1) Projected Range (Gain) loss on sale of business and other exit costs, net Proceeds from Sprint Purchase price... -

Page 65

...disposals and exchanges, net in the Consolidated Statement of Operations for the year ended December 31, 2011. The Indiana PCS spectrum included in the exchange was originally awarded to Carroll Wireless in FCC Auction 58 and was purchased by U.S. Cellular prior to the exchange. Carroll Wireless was... -

Page 66

...937 $ 49,647 $ 1,051 (1) Liabilities held for sale primarily consisted of Current liabilities in 2011 and Customer deposits and deferred revenues in 2012. (2) Effective January 1, 2013, U.S. Cellular transferred its Bolingbrook Customer Care Center operations to an existing third party vendor. 58 -

Page 67

...470,769 Balance, end of year ...Goodwill Year Ended December 31, (Dollars in thousands) 2012 2011 Assigned value at time of acquisition ...Accumulated impairment losses in prior periods ...Balance, beginning of year ...Acquisitions ...Transferred to Assets held for sale ...Balance, end of year... -

Page 68

... million and $64.8 million in 2012, 2011 and 2010, respectively. U.S. Cellular held a 5.5% ownership interest in the LA Partnership throughout and at the end of each of these years. The following tables, which are based on information provided in part by third parties, summarize the combined assets... -

Page 69

... Note 7-Acquisitions, Divestitures and Exchanges NOTE 11 ASSET RETIREMENT OBLIGATIONS U.S. Cellular is subject to asset retirement obligations associated with its leased cell sites, switching office sites, retail store sites and office locations in its operating markets. Asset retirement obligations... -

Page 70

United States Cellular Corporation Notes to the Consolidated Financial Statements (Continued) NOTE 11 ASSET RETIREMENT OBLIGATIONS (Continued) In 2012 and 2011, U.S. Cellular performed a review of the assumptions and estimated costs related to its asset retirement obligations. The results of the ... -

Page 71

... 31, 2012: (Dollars in millions) Maximum borrowing capacity ...Letters of credit outstanding ...Amount borrowed ...Amount available for use ...Borrowing rate: One-month London Interbank Offered Rate (''LIBOR'') plus contractual spread(1) ...LIBOR ...Contractual spread ...Range of commitment fees on... -

Page 72

...values of the remaining scheduled payments of principal and interest thereon discounted to the redemption date on a semi-annual basis at the Treasury Rate plus 30 basis points. U.S. Cellular may redeem the 6.95% Senior Notes, in whole or in part at any time after the call date, at a redemption price... -

Page 73

...2010 through the second half of 2013. As of December 31, 2012, $83.9 million had been paid to Amdocs. Lease Commitments U.S. Cellular is a party to various lease agreements, both as lessee and lessor, for office space, retail store sites, cell sites and equipment which are accounted for as operating... -

Page 74

... Repurchase Program On November 17, 2009, the Board of Directors of U.S. Cellular authorized the repurchase of up to 1,300,000 Common Shares on an annual basis beginning in 2009 and continuing each year thereafter, on a cumulative basis. These purchases will be made pursuant to open market purchases... -

Page 75

... and prior authorizations, were as follows: Year Ended December 31, (Dollars and share amounts in thousands) Number of Shares Average Cost Per Share Amount 2012 U.S. Cellular Common Shares ...2011 U.S. Cellular Common Shares ...2010 U.S. Cellular Common Shares ... 571 1,276 1,235 $35.11 $48... -

Page 76

United States Cellular Corporation Notes to the Consolidated Financial Statements (Continued) NOTE 15 STOCK-BASED COMPENSATION (Continued) U.S. Cellular estimated the fair value of stock options granted during 2012, 2011, and 2010 using the Black-Scholes valuation model and the assumptions shown in... -

Page 77

... (Continued) U.S. Cellular estimates the fair value of restricted stock units based on the closing market price of U.S. Cellular shares on the date of grant. The fair value is then recognized as compensation cost on a straight-line basis over the requisite service periods of the awards, which is... -

Page 78

... Cellular Corporation Notes to the Consolidated Financial Statements (Continued) NOTE 15 STOCK-BASED COMPENSATION (Continued) Stock-Based Compensation Expense The following table summarizes stock-based compensation expense recognized during 2012, 2011 and 2010: Year Ended December 31, (Dollars... -

Page 79

... disclosures regarding transactions related to stock-based compensation awards: Year Ended December 31, (Dollars in thousands) 2012 2011 2010 Common Shares withheld(1) ...Aggregate value of Common Shares withheld Cash receipts upon exercise of stock options Cash disbursements for payment of taxes... -

Page 80

... legal costs from Sidley Austin LLP of $10.7 million in 2012, $9.2 million in 2011 and $9.8 million in 2010. The Audit Committee of the Board of Directors is responsible for the review and evaluation of all relatedparty transactions as such term is defined by the rules of the New York Stock Exchange... -

Page 81

... Public Company Accounting Oversight Board (United States) and has expressed herein its unqualified opinion on these financial statements. /s/ Mary N. Dillon Mary N. Dillon President and Chief Executive Officer (principal executive officer) /s/ Steven T. Campbell Steven T. Campbell Executive Vice... -

Page 82

...'s management, including its Chief Executive Officer and Chief Financial Officer, U.S. Cellular conducted an evaluation of the effectiveness of its internal control over financial reporting as of December 31, 2012, based on the criteria established in Internal Control-Integrated Framework issued by... -

Page 83

... internal control over financial reporting as of December 31, 2012, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company's management is responsible for these financial statements... -

Page 84

... States Cellular Corporation SELECTED CONSOLIDATED FINANCIAL DATA Year Ended or at December 31, (Dollars in thousands, except per share amounts) 2012 2011 2010 2009 2008 Statement of Operations data Service revenues ...$4,098,856 $4,053,797 $3,913,001 $3,927,128 $3,939,695 Equipment sales ...353... -

Page 85

... The high, low and closing sales prices as reported by the New York Stock Exchange (''NYSE''). (5) During the quarter ended December 31, 2011, U.S. Cellular recorded an immaterial adjustment to correct its liabilities and prepaid expense related to property taxes for errors occurring primarily prior... -

Page 86

... for use in U.S. Cellular's business. See ''Consolidated Quarterly Information (Unaudited)'' for information on the high and low trading prices of the USM Common Shares for 2012 and 2011. Stock performance graph The following chart provides a comparison of U.S. Cellular's cumulative total return to... -

Page 87

Investor relations U.S. Cellular's annual report, SEC filings and news releases are available to investors, securities analysts and other members of the investment community. These reports are provided, without charge, upon request to our Corporate Office. Investors may also access these and other ... -

Page 88

(THIS PAGE INTENTIONALLY LEFT BLANK) -

Page 89

(THIS PAGE INTENTIONALLY LEFT BLANK) -

Page 90

(THIS PAGE INTENTIONALLY LEFT BLANK) -

Page 91

... know better when you see it. U.S. Cellular headquarters, Chicago, Ill. U.S. Cellular licensed markets Non-licensed markets with roaming coverage We're winning new customers with the best customer experience in wireless. • Earn Reward Points for things like faster phone upgrades, accessories and... -

Page 92

..., National Network Operations Edward Perez Vice President, Marketing and Sales Operations Thomas S. Weber Vice President, Financial and Real Estate Services Nick B. Wright Vice President, Sales, West Region LeRoy T. Carlson, Jr. Chairman, U.S. Cellular President and Chief Executive Officer...