Spirit Airlines 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

87

readily available from public markets; therefore, the Company categorizes these instruments as Level 2. The interest rate swaps

are designated as cash flow hedges and, as a result, the changes in fair value of these derivatives are recorded in accumulated

other comprehensive income within the balance sheet and statement of other comprehensive income.

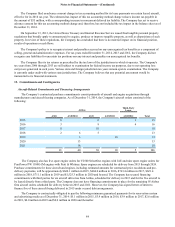

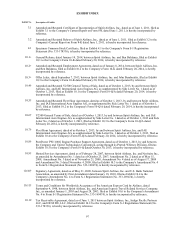

Long-Term Debt

The estimated fair value of the Company's non publicly held debt agreements has been determined to be Level 3, as

certain inputs used to determine the fair value of these agreements are unobservable. The Company utilizes a discounted cash

flow method to estimate the fair value of the Level 3 long-term debt.

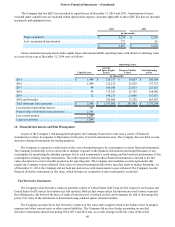

The carrying amounts and estimated fair values of our long-term debt at December 31, 2014 were as follows:

Carrying value Estimated fair value

(in millions)

Senior long-term debt $ 132.0 $ 132.0

Junior long-term debt 16.0 16.1

Total long-term debt $ 148.0 $ 148.1

Cash and Cash Equivalents

Cash and cash equivalents at December 31, 2014 and December 31, 2013 are comprised of liquid money market funds

and cash and are categorized as Level 1 instruments. The Company maintains cash with various high-quality financial

institutions.

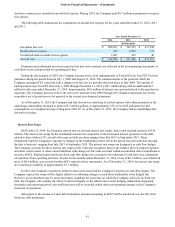

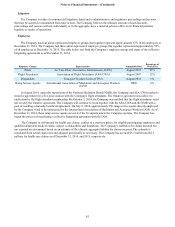

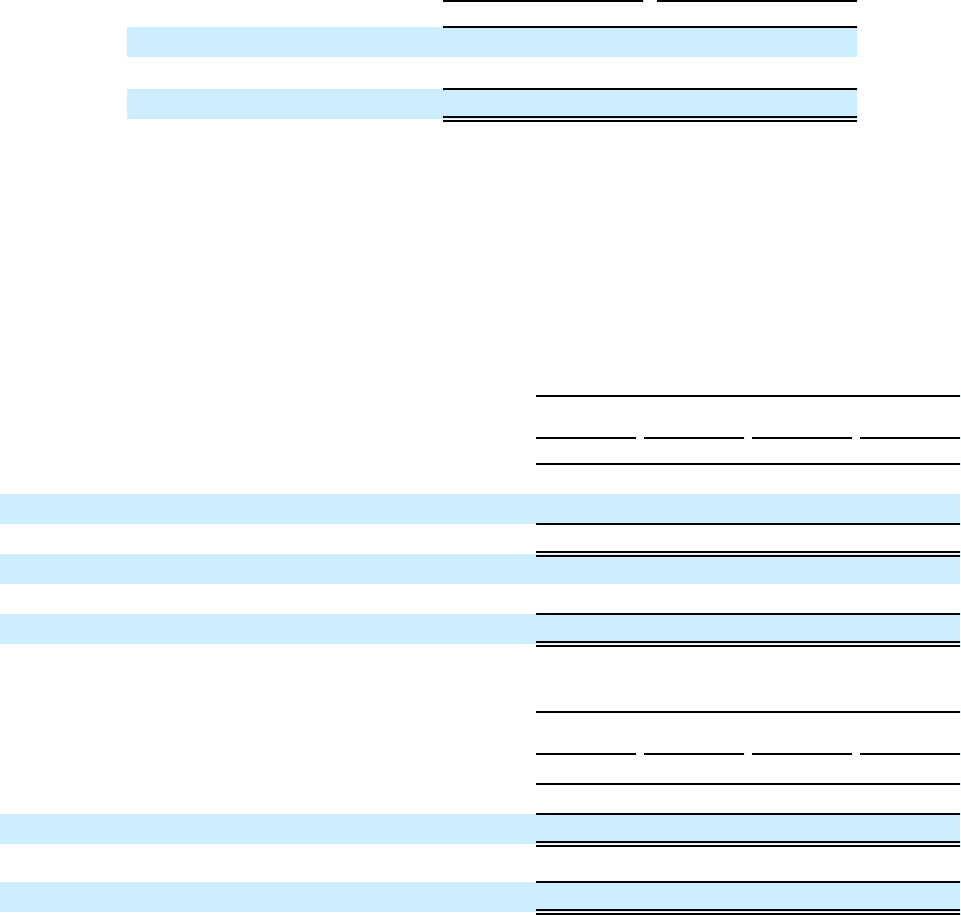

Assets and liabilities measured at gross fair value on a recurring basis are summarized below:

Fair Value Measurements as of December 31, 2014

Total Level

1Level

2Level

3

(in millions)

Cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 632.8 $ 632.8 $ — $ —

Jet fuel options. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.8 — — 4.8

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 637.6 $ 632.8 $ — $ 4.8

Interest rate swaps . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.1 $ — $ 1.1 $ —

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.1 $ — $ 1.1 $ —

Fair Value Measurements as of December 31, 2013

Total Level

1Level

2Level

3

(in millions)

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 530.6 $ 530.6 $ — $ —

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 530.6 $ 530.6 $ — $ —

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ — $ —

The Company had no transfers of assets or liabilities between any of the above levels during the years ended

December 31, 2014 and 2013.