Spirit Airlines 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

77

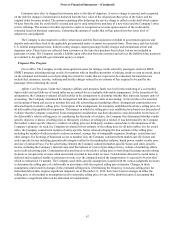

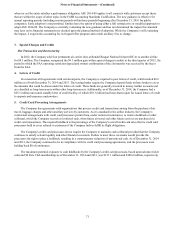

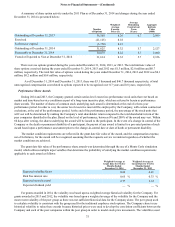

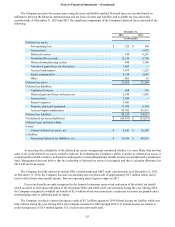

Long-term debt is comprised of the following:

As of December 31,

2014 2013 2014 2013

(in millions) (weighted-average interest rates)

Senior Term Loans due through 2026 $ 132.0 $ — 4.26% N/A

Junior Term Loans due through 2021 16.0 — 6.94% N/A

Long-term debt $ 148.0 $ —

Less current maturities 10.4 —

Less unamortized discount, net 1.8 —

Total $ 135.8 $ —

During 2014, the Company did not make any debt payments and is set to begin repayment in January 2015.

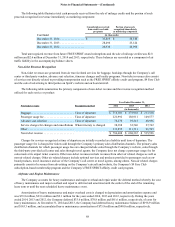

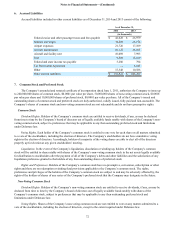

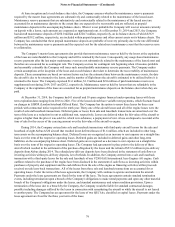

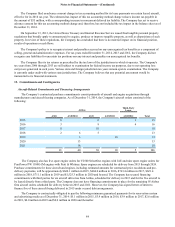

At December 31, 2014, long-term debt principal payments for the next five years and thereafter are as follows:

December 31, 2014

(in millions)

2015 $ 10.4

2016 10.9

2017 11.6

2018 12.0

2019 12.6

2020 and thereafter 90.5

Total debt principal payments $ 148.0

Subsequent to December 31, 2014 and as of the date of this filing, the Company has taken delivery of two A320 aircraft

resulting in $74.0 million of long-term debt.

Interest Expense

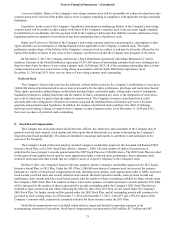

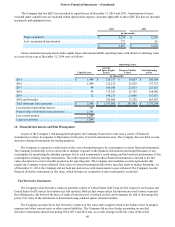

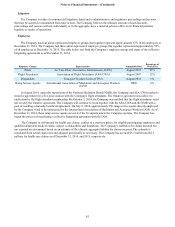

Interest expense related to debt consists of the following:

Year Ended December 31,

2014 2013

(in thousands)

Senior Term Loans $ 738 $ —

Junior Term Loans 145 —

Commitment fees 685 —

Amortization of deferred financing costs 9 —

Total $ 1,577 $ —

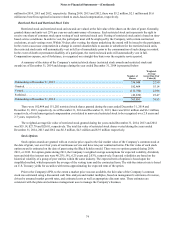

The Company had unamortized deferred financing costs of $0.7 million as of December 31, 2014. As of December 31,

2013, the Company had no deferred financing costs. The long-term portion of these amounts is classified as other long-term

assets on the balance sheet and is amortized over the term of the debt into interest expense.

The Company's senior and junior term loans have an annual commitment fee, related to undisbursed loan amounts, of

0.75% and 1.25%, respectively, which is paid on a quarterly basis. As of December 31, 2014, the Company has incurred $0.2

million in commitment fees related to four Airbus A320 aircraft delivered in 2014 and $0.5 million in commitment fees for three

Airbus A320 aircraft and three Airbus A321 aircraft scheduled for delivery in 2015. Commitment fee expense is included within

interest expense on the statement of operations.