Spirit Airlines 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

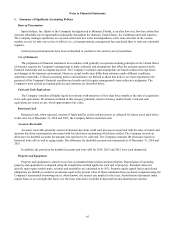

Notes to Financial Statements—(Continued)

69

On October 15, 2013, a Company aircraft experienced an engine failure resulting in damage to the airframe and engine.

In 2013, the Company expensed the insurance deductible related to this incident of approximately $0.8 million. As of

December 31, 2014, the Company received insurance proceeds for a portion of the damage incurred. During 2014, the

Company received a new replacement engine from the manufacturer in exchange for a $2.3 million payment to the

manufacturer which was expensed within maintenance, materials and repairs in the statement of operations for the twelve

months ended December 31, 2014.

The Company outsources certain routine, non-heavy maintenance functions under contracts that require payment on a

utilization basis, such as flight hours. Costs incurred for maintenance and repair under flight hour maintenance contracts, where

labor and materials price risks have been transferred to the service provider, are expensed based on contractual payment terms.

All other costs for routine maintenance of the airframes and engines are charged to expense as performed.

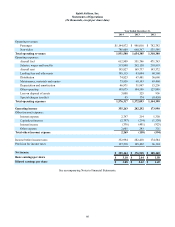

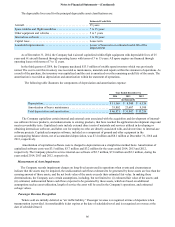

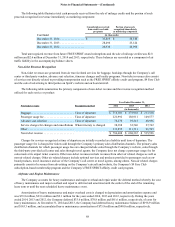

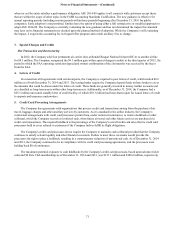

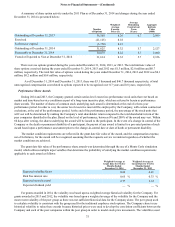

The table below summarizes the extent to which the Company’s maintenance costs are rate capped due to flight hour

maintenance contracts:

Year Ended December 31,

2014 2013 2012

(in thousands)

Flight hour-based maintenance expense . . . . . . . . . . . . . . . . . . . $ 35,675 $ 30,322 $ 25,748

Non-flight hour-based maintenance expense. . . . . . . . . . . . . . . . 38,281 29,821 23,712

Total maintenance, materials and repairs. . . . . . . . . . . . . . . . . . . $ 73,956 $ 60,143 $ 49,460

Leased Aircraft Return Costs

The Company's aircraft lease agreements often contain provisions that require the Company to return aircraft airframes

and engines to the lessor in a certain maintenance condition or pay an amount to the lessor based on the airframe and engine's

actual return condition. Lease return costs, which could include cost to perform maintenance to airframes and engines to

acceptable conditions prior to return, will be recognized as expense beginning when it is probable that such costs will be

incurred and they can be estimated. Incurrence of lease return costs becomes probable and the amount of those costs can

typically be estimated near the end of the lease term (that is, after the aircraft has completed its last maintenance cycle prior to

being returned). The Company will evaluate all lease return conditions after the second to last maintenance event as it relates to

the respective component or airframe from the lease return. If at this point it becomes both probable and estimable that a return

cost will be incurred, the Company will accrue the cost on a straight-line basis as contingent rent through the remaining lease

term. Return costs are recorded as a component of supplemental rent.

Aircraft Fuel

Aircraft fuel expense includes jet fuel and associated “into-plane” costs, taxes, and oil, and realized and unrealized gains

and losses associated with fuel derivative contracts.

Derivative Instruments

The Company accounts for derivative financial instruments at fair value and recognizes them in the balance sheet in

prepaid expenses and other current assets or other current liabilities. For derivatives designated as cash flow hedges, changes in

fair value of the derivative are generally reported in other comprehensive income and are subsequently reclassified into

earnings when the hedged item affects earnings. On October 23, 2014, the Company entered into six forward interest rate

swaps that fix the benchmark interest rate component of the forecasted interest payments on the debt related to three Airbus

A321 aircraft with expected delivery dates ranging from July 2015 to September 2015 to limit the Company's exposure to

changes in the benchmark interest rate in the period from the trade date through the aircraft delivery date. These interest rate

swaps are designated as cash flow hedges. As a result, changes in the fair value of such derivatives are recorded within other

accumulated comprehensive income.

For the years ended 2014, 2013 and 2012, the Company did not hold fuel derivative instruments that were designated as

cash flow hedges for accounting purposes. As a result, changes in the fair value of such fuel derivative contracts were recorded

within aircraft fuel expense in the accompanying statements of operations. These amounts include both realized gains and

losses and mark-to-market adjustments of the fair value of unsettled derivative instruments at the end of each period. See Note

12 for additional information.