Spirit Airlines 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

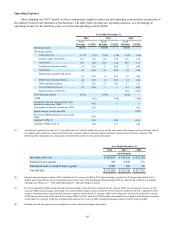

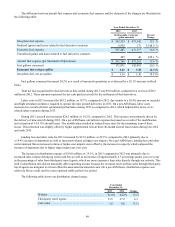

The following table shows our distribution channel usage:

Year Ended

December 31,

2014 2013 Change

Website . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61.1% 61.0% 0.1

Third-party travel agents . . . . . . . . . . . . . . . . . . . . . . . . . . 34.4 33.5 0.9

Call center . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.5 5.5 (1.0)

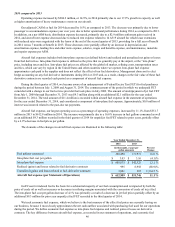

Maintenance, materials and repair costs increased by $13.8 million, or 23.0%, in 2014, as compared to 2013. The

increase in maintenance costs was primarily due to the aging of our fleet, which requires more comprehensive work during

routine scheduled maintenance, as well as the timing of the mix of maintenance checks performed during 2014 as compared to

2013. In addition, during the third quarter of 2014, we recorded $2.3 million of expense in connection with an engine failure

incident that occurred in 2013. For a detailed discussion of the engine expense, please see Note 1. In addition, the increase in

maintenance costs on a dollar basis and per unit basis resulted from an increase in both the number and cost of scheduled

maintenance events during the year ended December 31, 2014, as compared to the prior year. We expect maintenance expense

to increase significantly as our fleet continues to grow and age, resulting in the need for additional or more frequent repairs

over time.

Depreciation and amortization increased by $15.0 million, or 47.0%, primarily due to higher amortization of deferred

heavy maintenance. As our fleet continues to age, the amount of deferred heavy maintenance events capitalized will increase

and will result in an increase in the amortization of those costs.

Other operating expenses in 2014 increased by $5.1 million, or 3.5%, compared to 2013 primarily due to an increase in

departures of 13.6% and our overall growth. On a per-ASM basis, our other operating expenses decreased, as compared to the

same period in 2013, due to lower passenger re-accommodation expense resulting from improved operational reliability.

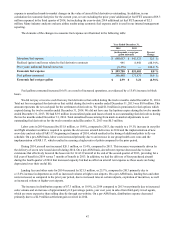

2013 compared to 2012

Operating expense increased by $227.7 million, or 19.9%, in 2013 primarily due to our 22.2% growth in capacity as well

as higher amortization of heavy maintenance events on our aircraft.

Our adjusted CASM ex fuel for 2013 decreased by 1.5% as compared to 2012. Better operational performance during

2013 as compared to 2012 helped drive lower wages and passenger re-accommodation expenses. In addition, during 2013, we

entered into lease extensions covering 14 of our existing A319 aircraft resulting in reduced lease rates for the remaining term of

the leases which contributed to the decrease in adjusted CASM ex-fuel as compared to 2012. These decreases were partially

offset by higher heavy maintenance amortization expense for 2013 resulting from the increase in deferred heavy aircraft

maintenance events as compared to 2012.

Aircraft fuel expense increased by 17% from $471.8 million in 2012 to $551.7 million in 2013. The increase was

primarily due to a 20.2% increase in fuel gallons consumed partially offset by a 2.7% decrease in fuel prices per gallon.