Spirit Airlines 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

81

derivative contracts are recorded in aircraft fuel expense. During 2014, the Company paid $9.7 million in premiums to acquire

fuel options.

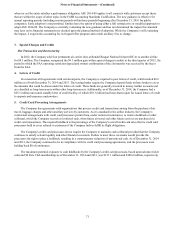

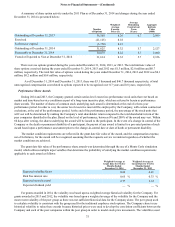

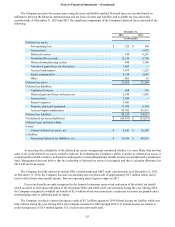

The following table summarizes the components of aircraft fuel expense for the years ended December 31, 2014, 2013

and 2012:

Year Ended December 31,

2014 2013 2012

(in thousands)

Into-plane fuel cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 608,033 $ 542,523 $ 471,542

Realized losses (gains). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 995 8,958 175

Unrealized mark-to-market losses (gains) . . . . . . . . . . . . . . . . . . . . . . . 3,881 265 46

Aircraft fuel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 612,909 $ 551,746 $ 471,763

Premiums and settlements received or paid on fuel derivative contracts are reflected in the accompanying statements of

cash flows in net cash provided by operating activities.

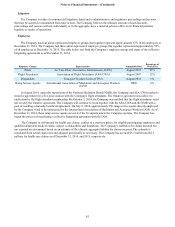

During the third quarter of 2014, the Company became aware of an underpayment of Federal Excise Tax (FET) for fuel

purchases during the period between July 1, 2009 and August 31, 2014. The commencement of the period in which the

Company underpaid FET coincided with a change in its fuel service provider that took place in July 2009. The amount of

underpayment of jet fuel FET from July 1, 2009 through December 31, 2013 is $9.3 million along with an additional $2.1

million for the year ended December 31, 2014. Approximately, $0.8 million of interest was incurred related to the past-due tax

payments. The Company does not believe the error to be material to the 2009 through 2013 financial statements nor for the

cumulative out of period error to be material to the current year financial statements.

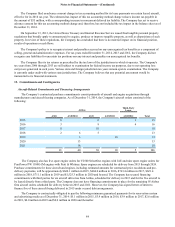

As of December 31, 2014, the Company had fuel derivatives consisting of jet fuel options with refined products as the

underlying commodities designed to protect 88.7 million gallons, or approximately 35% of its 2015 anticipated jet fuel

consumption, at a weighted-average ceiling price of $2.07. As of December 31, 2013, the Company had no outstanding fuel

derivatives in place.

Interest Rate Swaps

On October 23, 2014, the Company entered into six forward interest rate swaps, with a total notional amount of $120

million. The interest rate swaps fix the benchmark interest rate component of the forecasted interest payments on the debt

related to three Airbus A321 aircraft with expected delivery dates ranging from July 2015 to September 2015. These

instruments limit the Company's exposure to changes in the benchmark interest rate in the period from the trade date through

the date of maturity, ranging from July 2015 to September 2015. The interest rate swaps are designated as cash flow hedges.

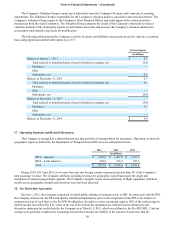

The Company accounts for these interest rate swaps at fair value and recognizes them in the balance sheet in prepaid expenses

and other current assets or other current liabilities with changes in fair value recorded within accumulated other comprehensive

income (AOCI). Realized gains and losses from cash flow hedges are recorded in the statement of cash flows as a component

of cash flows from operating activities. For the twelve months ended December 31, 2014, a loss of $0.7 million, net of deferred

taxes of $0.4 million, was recorded within AOCI related to these instruments. As of December 31, 2014, the interest rate swaps

are recorded as a liability of approximately $1.1 million.

In 2014, the Company recorded no ineffectiveness associated with the Company's interest rate cash flow hedges. The

Company expects the swaps will be highly effective in offsetting changes in cash flows attributable to the hedged risk.

However, given that there may be some uncertainty regarding the exact date on which the Company will issue its fixed-rate

debt, the Company will evaluate the effect of such uncertainty on the effectiveness of the hedging relationship designated

hereunder each reporting period. Any ineffectiveness will be recorded within other non-operating expense in the Company's

statement of operations.

Subsequent to the issuance of each debt instrument, amounts remaining in AOCI will be amortized over the life of the

fixed-rate debt instrument.