Spirit Airlines 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Financial Statements—(Continued)

71

when (or as) the entity satisfies a performance obligation. ASU 2014-09 applies to all contracts with customers except those

that are within the scope of other topics in the FASB Accounting Standards Codification. The new guidance is effective for

annual reporting periods (including interim periods within those periods) beginning after December 15, 2016 for public

companies. Early adoption is not permitted. Entities have the option of using either a full retrospective or modified approach to

adopt ASU 2014-09. The Company is currently evaluating the new guidance and has not determined the impact this standard

may have on its financial statements nor decided upon the planned method of adoption. While the Company is still evaluating

the impact, it expects the accounting for its frequent flier program and certain ancillary fees to change.

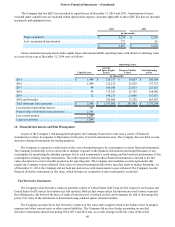

3. Special Charges and Credits

Slot Transaction and Restructuring

In 2012, the Company sold four permanent air carrier slots at Ronald Reagan National Airport (DCA) to another airline

for $9.1 million. The Company recognized the $9.1 million gain within special charges (credits) in the third quarter of 2012, the

period in which the FAA operating restriction lapsed and written confirmation of the slot transfer was received by the buyer

from the FAA.

4. Letters of Credit

In connection with agreements with certain airports, the Company is required to post letters of credit, which totaled $0.2

million as of both December 31, 2014 and 2013. The issuing banks require the Company deposit funds at those banks to cover

the amounts that could be drawn under the letters of credit. These funds are generally invested in money market accounts and

are classified as long-term assets within other long-term assets. Additionally, as of December 31, 2014, the Company had a

$25.1 million unsecured standby letter of credit facility, of which $10.3 million had been drawn upon for issued letters of credit

to airports and insurance underwriters.

5. Credit Card Processing Arrangements

The Company has agreements with organizations that process credit card transactions arising from the purchase of air

travel, baggage charges and other ancillary services by customers. As it is standard in the airline industry, the Company's

contractual arrangements with credit card processors permit them, under certain circumstances, to retain a holdback or other

collateral, which the Company records as restricted cash, when future air travel and other future services are purchased via

credit card transactions. The required holdback is the percentage of the Company's overall credit card sales that its credit card

processors hold to cover refunds to customers if the Company fails to fulfill its flight obligations.

The Company's credit card processors do not require the Company to maintain cash collateral provided that the Company

continues to satisfy certain liquidity and other financial covenants. Failure to meet these covenants would provide the

processors the right to place a holdback, resulting in a commensurate reduction of unrestricted cash. As of December 31, 2014

and 2013, the Company continued to be in compliance with its credit card processing agreements, and the processors were

holding back $0 of remittances.

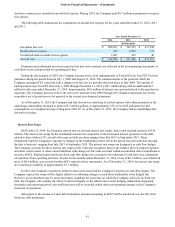

The maximum potential exposure to cash holdbacks by the Company's credit card processors, based upon advance ticket

sales and $9 Fare Club memberships as of December 31, 2014 and 2013, was $217.1 million and $188.6 million, respectively.