Spirit Airlines 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

78

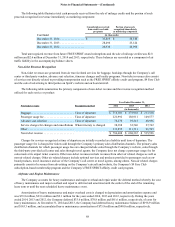

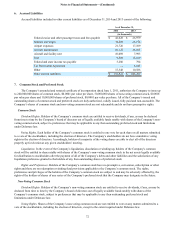

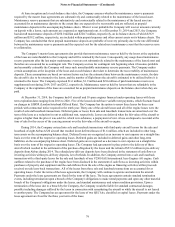

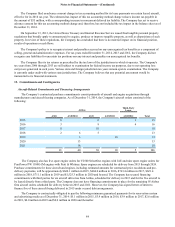

As of December 31, 2014, the Company's capital leases are comprised of two quick engine change kits (QEC kit) and

office equipment. Aggregate annual principal maturities of capital leases as of December 31, 2014 and December 31, 2013 are as

follows:

As of December 31,

2014 2013

(in thousands)

2015 $ 1,289 $ 1,083

2016 1,002 966

2017 39 —

2018 42 —

2019 11 —

2020 and thereafter . . . . . . . . . . . . . . . . . . . . . . . — —

Total principal maturities $ 2,383 $ 2,049

As of December 31, 2014 and 2013, the Company had a line of credit for $18.6 million related to corporate credit cards.

Respectively, the Company had drawn $4.5 million and $3.7 million as of December 31, 2014 and 2013, which is included in

accounts payable.

As of December 31, 2014, the Company had lines of credit with counterparties for fuel derivatives and physical fuel

delivery in the amount of $38.0 million. As of December 31, 2014, the Company had drawn $9.3 million on these lines of credit,

which is included in other current liabilities. As of December 31, 2013, the Company had lines of credit with counterparties for

both physical fuel delivery and fuel derivatives in the amount $34.5 million. As of December 31, 2013, the Company had drawn

$13.8 million on these lines of credit, which is included in other current liabilities. The Company is required to post collateral for

any excess above the lines of credit if the fuel derivatives are in a net liability position and make periodic payments in order to

maintain an adequate undrawn portion for physical fuel delivery. As of December 31, 2014 and 2013, the Company did not hold

any fuel derivatives with requirements to post collateral.

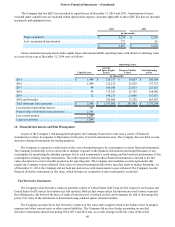

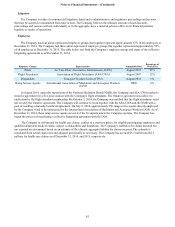

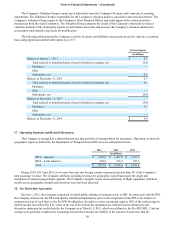

11. Leases and Prepaid Maintenance Deposits

The Company leases various types of equipment and property, primarily aircraft, spare engines and airport facilities

under leases, which expire in various years through 2032. Lease terms are generally 3 to 15 years for aircraft and up to 25 years

for other leased equipment and property.

Total rental expense for all leases charged to operations for the years ended 2014, 2013 and 2012 was $254.3 million,

$214.6 million and $178.4 million, respectively. Total rental expense charged to operations for aircraft and engine operating

leases for the years ended December 31, 2014, 2013 and 2012 was $195.8 million, $169.7 million and $143.6 million,

respectively. Supplemental rent is made up of maintenance reserves paid or to be paid to aircraft lessors in advance of the

performance of major maintenance activities that are not probable of being reimbursed and probable return condition

obligations. The Company expensed $7.5 million, $5.2 million and $2.0 million of supplemental rent recorded within aircraft

rent during 2014, 2013 and 2012, respectively.

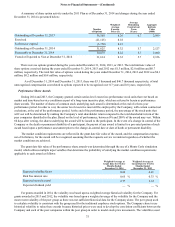

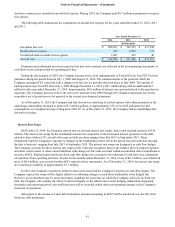

Some of the Company’s master lease agreements provide that the Company pays maintenance reserves to aircraft lessors

to be held as collateral in advance of the Company’s required performance of major maintenance activities. Some maintenance

reserve payments are fixed contractual amounts, while others are based on actual flight hours. Fixed maintenance reserve

payments for these aircraft and related flight equipment, including estimated amounts for contractual price escalations, will be

approximately $7.6 million in 2015, $8.0 million in 2016, $7.4 million in 2017, $5.8 million in 2018, $4.2 million in 2019 and

$14.1 million in 2020 and beyond. These lease agreements provide that maintenance reserves are reimbursable to the Company

upon completion of the maintenance event in an amount equal to either (1) the amount of the maintenance reserve held by the

lessor associated with the specific maintenance event or (2) the qualifying costs related to the specific maintenance event.

Substantially all of these maintenance reserve payments are calculated based on a utilization measure, such as flight hours or

cycles, and are used solely to collateralize the lessor for maintenance time run off the aircraft until the completion of the

maintenance of the aircraft. Some of the master lease agreements do not require that the Company pay maintenance reserves so

long as the Company's cash balance does not fall below a certain level. The Company is in full compliance with those

requirements and does not anticipate having to pay reserves related to these master leases in the future.