Spirit Airlines 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

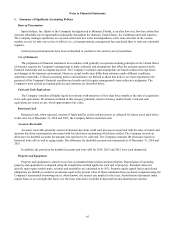

Notes to Financial Statements—(Continued)

72

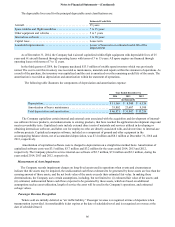

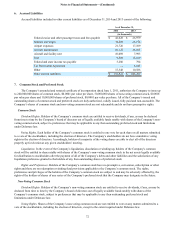

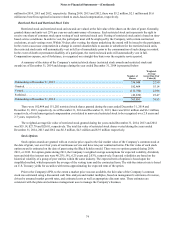

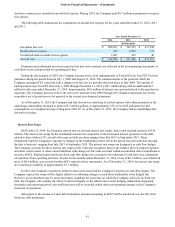

6. Accrued Liabilities

Accrued liabilities included in other current liabilities as of December 31, 2014 and 2013 consist of the following:

As of December 31,

2014 2013

(in thousands)

Federal excise and other passenger taxes and fees payable $ 42,628 $ 26,979

Salaries and wages 34,209 26,174

Airport expenses 21,726 17,109

Aircraft maintenance 16,127 36,165

Aircraft and facility rent 10,089 7,993

Fuel 9,508 13,819

Federal and state income tax payable 3,286 794

Tax Receivable Agreement — 5,643

Other 15,348 10,586

Other current liabilities $ 152,921 $ 145,262

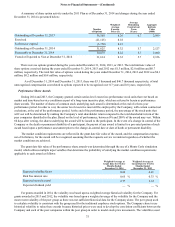

7. Common Stock and Preferred Stock

The Company’s amended and restated certificate of incorporation dated June 1, 2011, authorizes the Company to issue up

to 240,000,000 shares of common stock, $0.0001 par value per share, 50,000,000 shares of non-voting common stock, $0.0001

par value per share and 10,000,000 shares of preferred stock, $0.0001 par value per share. All of the Company’s issued and

outstanding shares of common stock and preferred stock are duly authorized, validly issued, fully paid and non-assessable. The

Company’s shares of common stock and non-voting common stock are not redeemable and do not have preemptive rights.

Common Stock

Dividend Rights. Holders of the Company’s common stock are entitled to receive dividends, if any, as may be declared

from time to time by the Company’s board of directors out of legally available funds ratably with shares of the Company’s non-

voting common stock, subject to preferences that may be applicable to any then outstanding preferred stock and limitations

under Delaware law.

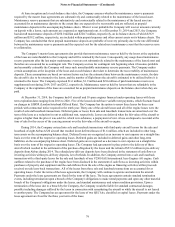

Voting Rights. Each holder of the Company’s common stock is entitled to one vote for each share on all matters submitted

to a vote of the stockholders, including the election of directors. The Company’s stockholders do not have cumulative voting

rights in the election of directors. Accordingly, holders of a majority of the voting shares are able to elect all of the directors

properly up for election at any given stockholders’ meeting.

Liquidation. In the event of the Company’s liquidation, dissolution or winding up, holders of the Company's common

stock will be entitled to share ratably with shares of the Company’s non-voting common stock in the net assets legally available

for distribution to stockholders after the payment of all of the Company’s debts and other liabilities and the satisfaction of any

liquidation preference granted to the holders of any then outstanding shares of preferred stock.

Rights and Preferences. Holders of the Company’s common stock have no preemptive, conversion, subscription or other

rights and there are no redemption or sinking fund provisions applicable to the Company’s common stock. The rights,

preferences and privileges of the holders of the Company’s common stock are subject to and may be adversely affected by, the

rights of the holders of shares of any series of the Company’s preferred stock that the Company may designate in the future.

Non-Voting Common Stock

Dividend Rights. Holders of the Company’s non-voting common stock are entitled to receive dividends, if any, as may be

declared from time to time by the Company’s board of directors out of legally available funds ratably with shares of the

Company’s common stock, subject to preferences that may be applicable to any then outstanding preferred stock and

limitations under Delaware law.

Voting Rights. Shares of the Company’s non-voting common stock are not entitled to vote on any matters submitted to a

vote of the stockholders, including the election of directors, except to the extent required under Delaware law.