Spirit Airlines 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

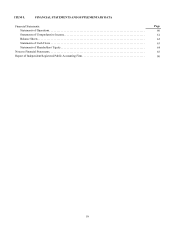

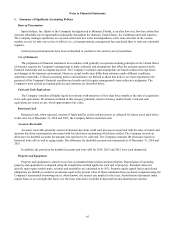

Notes to Financial Statements—(Continued)

66

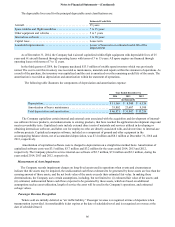

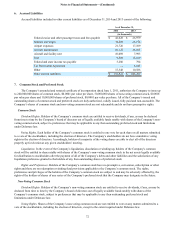

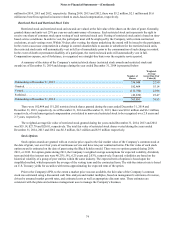

The depreciable lives used for the principal depreciable asset classifications are:

Estimated Useful Life

Aircraft . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 years

Spare rotables and flight assemblies . . . . . . . . . . . . . . . . . . . . . . 7 to 15 years

Other equipment and vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 to 7 years

Internal use software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 to 10 years

Capital lease . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lease term

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lesser of lease term or estimated useful life of the

improvement

As of December 31, 2014, the Company had 4 aircraft capitalized within flight equipment with depreciable lives of 25

years and 61 aircraft financed through operating leases with terms of 3 to 15 years. All spare engines are financed through

operating leases with terms of 7 to 12 years.

In the third quarter of 2014, the Company purchased $13.5 million of rotable spare inventory which was previously

rented. The cost to rent this inventory was recorded as maintenance, materials and repairs within the statement of operations. As

a result of the purchase, the inventory was capitalized and the cost is amortized over the remaining useful life of the assets. The

amortization is recorded as depreciation and amortization within the statement of operations.

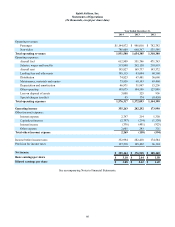

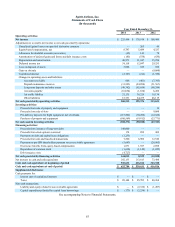

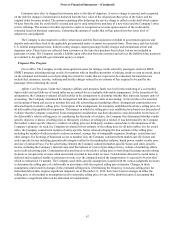

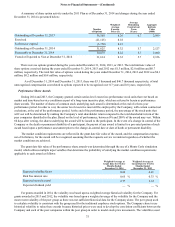

The following table illustrates the components of depreciation and amortization expense:

Year Ended December 31,

2014 2013 2012

(in thousands)

Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11,169 $ 8,340 $ 6,156

Amortization of heavy maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . 35,802 23,607 9,100

Total depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 46,971 $ 31,947 $ 15,256

The Company capitalizes certain internal and external costs associated with the acquisition and development of internal-

use software for new products, and enhancements to existing products, that have reached the application development stage and

meet recoverability tests. Capitalized costs include external direct costs of materials and services utilized in developing or

obtaining internal-use software, and labor cost for employees who are directly associated with, and devote time, to internal-use

software projects. Capitalized computer software, included as a component of ground and other equipment in the

accompanying balance sheets, net of accumulated depreciation, was $7.4 million and $8.1 million at December 31, 2014 and

2013, respectively.

Amortization of capitalized software costs is charged to depreciation on a straight-line method basis. Amortization of

capitalized software costs was $3.5 million, $3.7 million and $3.2 million for the years ended 2014, 2013 and 2012,

respectively. The Company placed in service internal-use software of $2.7 million, $7.0 million and $2.3 million, during the

years ended 2014, 2013 and 2012, respectively.

Measurement of Asset Impairments

The Company records impairment charges on long-lived assets used in operations when events and circumstances

indicate that the assets may be impaired, the undiscounted cash flows estimated to be generated by those assets are less than the

carrying amount of those assets, and the net book value of the assets exceeds their estimated fair value. In making these

determinations, the Company uses certain assumptions, including, but not limited to: (i) estimated fair value of the assets; and

(ii) estimated, undiscounted future cash flows expected to be generated by these assets, which are based on additional

assumptions such as asset utilization, length of service the asset will be used in the Company’s operations, and estimated

salvage values.

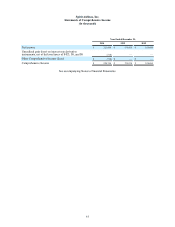

Passenger Revenue Recognition

Tickets sold are initially deferred as “air traffic liability.” Passenger revenue is recognized at time of departure when

transportation is provided. A nonrefundable ticket expires at the date of scheduled travel and is recognized as revenue at the

date of scheduled travel.