Spirit Airlines 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

84

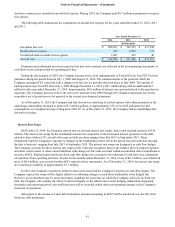

The Company filed an advance consent change in tax accounting method for its lease payments on certain leased aircraft,

effective for its 2014 tax year. The estimated tax impact of this tax accounting method change reduces income tax payable in

the amount of $35 million, with a corresponding increase in noncurrent deferred tax liability. The Company has yet to receive

advance consent for this tax accounting method change and, therefore, has not included the tax impact in the balance sheet as of

December 31, 2014.

On September 13, 2013, the United States Treasury and Internal Revenue Service issued final tangible personal property

regulations that broadly apply to amounts paid to acquire, produce or improve tangible property, as well as dispositions of such

property. In review of these regulations, the Company has concluded that there is no material impact on its financial position,

results of operations or cash flows.

The Company's policy is to recognize interest and penalties accrued on any unrecognized tax benefits as a component of

selling, general and administrative expenses. For tax years ended December 31, 2014, 2013 and 2012, the Company did not

recognize any liabilities for uncertain tax positions nor any interest and penalties on unrecognized tax benefits.

The Company files its tax returns as prescribed by the tax laws of the jurisdictions in which it operates. The Company's

tax years from 2006 through 2013 are still subject to examination for federal income tax purposes, due to net operating loss

carryovers generated in such years. Various state and foreign jurisdiction tax years remain open to examination. The Company

is currently under audit with various state jurisdictions. The Company believes that any potential assessment would be

immaterial to its financial statements.

15. Commitments and Contingencies

Aircraft-Related Commitments and Financing Arrangements

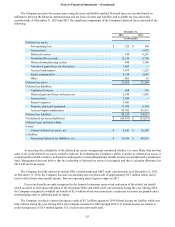

The Company’s contractual purchase commitments consist primarily of aircraft and engine acquisitions through

manufacturers and aircraft leasing companies. As of December 31, 2014, the Company's aircraft orders consisted of the

following:

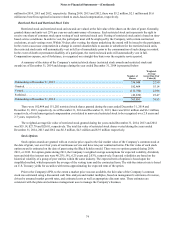

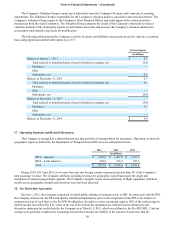

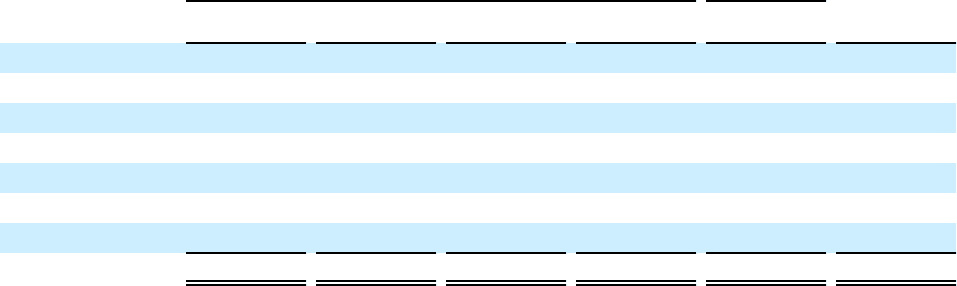

Airbus Third-Party

Lessor

A320 A320NEO A321 A321NEO A320NEO Total

2015 8 6 1 15

2016 3 9 4 16

2017 8 10 18

2018 2 6 5 13

2019 3 10 13

2020 13 13

2021 18 18

21 40 30 10 5 106

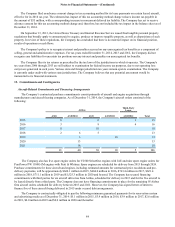

The Company also has five spare engine orders for V2500 SelectOne engines with IAE and nine spare engine orders for

PurePower PW 1100G-JM engines with Pratt & Whitney. Spare engines are scheduled for delivery from 2015 through 2024.

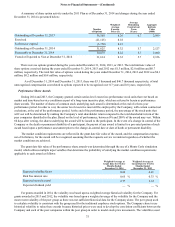

Purchase commitments for these aircraft and engines, including estimated amounts for contractual price escalations and pre-

delivery payments, will be approximately $660.1 million in 2015, $604.0 million in 2016, $763.4 million in 2017, $621.4

million in 2018, $711.1 million in 2019 and $1,525.3 million in 2020 and beyond. The Company has secured financing

commitments with third parties for six aircraft deliveries from Airbus, scheduled for delivery in 2015 and for the five aircraft to

be leased directly from a third party. The Company does not have financing commitments in place for the remaining 95 Airbus

firm aircraft orders scheduled for delivery between 2015 and 2021. However, the Company has signed letters of intent to

finance five of these aircraft being delivered in 2015 under secured debt arrangements.

The Company is contractually obligated to pay the following minimum guaranteed payments for its reservation system

and advertising media as of December 31, 2014: $5.1 million in 2015, $3.9 million in 2016, $3.9 million in 2017, $2.6 million

in 2018, $0.0 million in 2019 and $0.0 million in 2020 and thereafter.