Spirit Airlines 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

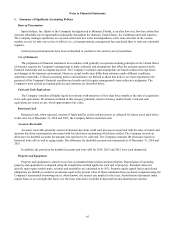

We also have five spare engine orders for V2500 SelectOne engines with IAE and nine spare engine orders for

PurePower PW 1100G-JM engines with Pratt & Whitney. Spare engines are scheduled for delivery from 2015 through 2024.

As of December 31, 2014, we had lines of credit related to corporate credit cards of $18.6 million from which we had

drawn $4.5 million.

As of December 31, 2014, we had lines of credit with counterparties for both physical fuel delivery and jet fuel

derivatives in the amount of $38.0 million. As of December 31, 2014, we had drawn $9.3 million on these lines of credit. We

are required to post collateral for any excess above the lines of credit if the derivatives are in a net liability position and make

periodic payments in order to maintain an adequate undrawn portion for physical fuel delivery. As of December 31, 2014, the

Company did not hold any derivatives with requirements to post collateral.

As of December 31, 2014, we have $6.8 million in uncollateralized surety bonds and a $25.1 million unsecured standby

letter of credit facility, representing an off balance-sheet commitment, of which $10.3 million had been drawn upon for issued

letters of credit.