Spirit Airlines 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

statements. For a detailed discussion of our significant accounting policies, please see “Notes to Financial Statements—1.

Summary of Significant Accounting Policies.”

Critical accounting policies are defined as those policies that reflect significant judgments or estimates about matters that

are both inherently uncertain and material to our financial condition or results of operations.

Revenue Recognition. Revenues from tickets sold are initially deferred as ATL. Passenger revenues are recognized when

transportation is provided. An unused non-refundable ticket expires at the date of scheduled travel and is recognized as

revenue for the expired ticket value at the date of scheduled travel.

Our most significant non-ticket revenues include revenues generated from air travel-related services paid for baggage,

bookings through our call center or third-party vendors, advance seat selection, itinerary changes and loyalty programs, and are

recognized at the time products are purchased or ancillary services are provided. These revenues also include commissions

from the sales of hotel rooms, trip insurance and rental cars recognized at the time the service is rendered. Non-ticket revenues

also include revenues from our subscription-based $9 Fare Club, recognized on a straight-line basis over 12 months.

Customers may elect to change their itinerary prior to the date of departure. A service charge is assessed and recognized

on the date the change is initiated and is deducted from the face value of the original purchase price of the ticket, and the

original ticket becomes invalid. The amount remaining after deducting the service charge is called a credit shell which expires

60 days from the date the credit shell is created and can be used towards the purchase of a new ticket and our other service

offerings. The amount of credits expected to expire is recognized as revenue upon issuance of the credit and is estimated based

on historical experience. Estimating the amount of credits that will go unused involves some level of subjectivity and judgment.

Accounting for property and equipment. Property and equipment is stated at cost, less accumulated depreciation and

amortization. Depreciation of operating property and equipment is computed using the straight-line method applied to each unit

of property. Property under capital leases and related obligations are initially recorded at an amount equal to the present value

of future minimum lease payments computed using the Company's incremental borrowing rate or, when known, the interest

rate implicit in the lease. Amortization of property under capital leases is on a straight-line basis over the lease term and is

included in depreciation and amortization expense. In accounting for property and equipment, we must make estimates about

the expected useful lives of the assets, the expected residual values of the assets, and the potential for impairment based on the

fair value of the assets and their future expected cash flows.

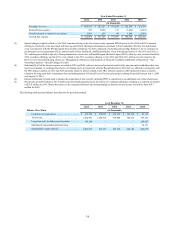

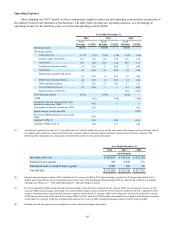

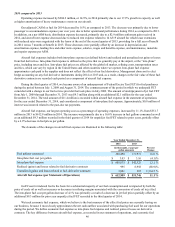

The depreciable lives used for the principal depreciable asset classifications are:

Estimated Useful Life

Aircraft . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 years

Spare rotables and flight assemblies . . . . . . . . . . . . . . . . . . . . . . 7 to 15 years

Other equipment and vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 to 7 years

Internal use software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 to 10 years

Capital lease. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lease term

Leasehold improvements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lesser of lease term or estimated useful life of the

improvement

As of December 31, 2014, we had 4 aircraft capitalized within flight equipment with depreciable lives of 25 years and 61

aircraft financed through operating leases with terms of 3 to 15 years. All spare engines are financed through operating leases

with terms of 7 to 12 years. Residual values for aircraft, major spare rotable parts, avionics and assemblies are estimated to be

10%.

We record impairment charges on long-lived assets used in operations when events and circumstances indicate that the

assets may be impaired, the undiscounted cash flows estimated to be generated by those assets are less than the carrying

amount of those assets, and the net book value of the assets exceeds their estimated fair value. In making these determinations,

we use certain assumptions, including, but not limited to: (i) estimated fair value of the assets; and (ii) estimated, undiscounted

future cash flows expected to be generated by these assets, which are based on additional assumptions such as asset utilization,

length of service the asset will be used in our operations, and estimated salvage values.

Frequent Flier Program. We accrue for mileage credits earned through travel, including mileage credits for members

with an insufficient number of mileage credits to earn an award, under our FREE SPIRIT program based on the estimated

incremental cost of providing free travel for credits that are expected to be redeemed. Incremental costs include fuel, insurance,