Spirit Airlines 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

Substantially all of our revenues are denominated in U.S. dollars. Passenger revenues are recognized once the related

flight departs. Accordingly, the value of tickets sold in advance of travel is included under our current liabilities as “air traffic

liability,” or ATL, until the related air travel is provided. Non-ticket revenues are generally recognized at the time the ancillary

products are purchased or ancillary services are provided. Non-ticket revenues also include revenues from our subscription-

based $9 Fare Club, which we recognize on a straight-line basis over 12 months. Revenue generated from the FREE SPIRIT

credit card affinity program are recognized in accordance with the criteria as set forth in Accounting Standards Update ASU

No. 2009-13. Please see “—Critical Accounting Policies and Estimates—Frequent Flier Program.”

We recognize revenues net of certain taxes and airport passenger fees, which are collected by us on behalf of airports and

governmental agencies and remitted to the applicable governmental entity or airport on a periodic basis. These taxes and fees

include U.S. federal transportation taxes, federal security charges, airport passenger facility charges and foreign arrival and

departure taxes. These items are collected from customers at the time they purchase their tickets, but are not included in our

revenues. We record a liability upon collection from the customer and relieve the liability when payments are remitted to the

applicable governmental agency or airport.

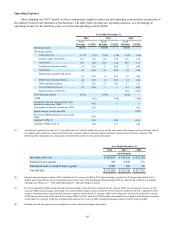

Operating Expenses

Our operating expenses consist of the following line items.

Aircraft Fuel. Aircraft fuel expense is our single largest operating expense. It includes the cost of jet fuel, related federal

taxes, fueling into-plane fees and transportation fees. It also includes realized and unrealized gains and losses arising from any

activity on our fuel derivatives. Our fuel derivatives generally consist of United States Gulf Coast jet fuel swaps (jet fuel

swaps) and United States Gulf Coast jet fuel options (jet fuel options).

Salaries, Wages and Benefits. Salaries, wages and benefits expense includes the salaries, hourly wages, bonuses and

equity compensation paid to employees for their services, as well as the related expenses associated with employee benefit

plans and employer payroll taxes.

Aircraft Rent. Aircraft rent expense consists of monthly lease rents for aircraft and spare engines under the terms of the

related operating leases and is recognized on a straight-line basis. Aircraft rent expense also includes supplemental rent.

Supplemental rent is made up of maintenance reserves paid or to be paid to aircraft lessors in advance of the performance of

major maintenance activities that are not probable of being reimbursed and lease return condition obligations which we begin

to accrue when they are probable. Aircraft rent expense is net of the amortization of gains and losses on sale and leaseback

transactions on our flight equipment. As of December 31, 2014, 61 of our 65 aircraft and all our spare engines are financed

under operating leases.

Landing Fees and Other Rents. Landing fees and other rents include both fixed and variable facilities expenses, such as

the fees charged by airports for the use or lease of airport facilities, overfly fees paid to other countries and the monthly rent

paid for our headquarters facility.

Distribution. Distribution expense includes all of our direct costs including the cost of web support, our third-party call

center, travel agent commissions and related GDS fees and credit card transaction fees, associated with the sale of our tickets

and other products and services.

Maintenance, Materials and Repairs. Maintenance, materials and repairs expense includes all parts, materials, repairs and

fees for repairs performed by third-party vendors directly required to maintain our fleet. It excludes direct labor cost related to

our own mechanics, which is included under salaries, wages and benefits. It also excludes the amortization of heavy

maintenance expenses, which we defer under the deferral method of accounting and amortize as a component of depreciation

and amortization expense.

Depreciation and Amortization. Depreciation and amortization expense includes the depreciation of fixed assets we own

and leasehold improvements. It also includes the amortization of heavy maintenance expenses we defer under the deferral

method of accounting for heavy maintenance events and recognize into expense on a straight-line or usage basis until the

earlier of the next estimated heavy maintenance event or the aircraft's return at the end of the lease term.

Loss on Disposal of Assets. Loss on disposal of assets includes the net losses on the disposal of our fixed assets.

Other Operating Expenses. Other operating expenses include airport operations expense and fees charged by third-party

vendors for ground handling services and food and liquor supply service expenses, passenger re-accommodation expense, the

cost of passenger liability and aircraft hull insurance, all other insurance policies except for employee related insurance, travel

and training expenses for crews and ground personnel, professional fees, personal property taxes and all other administrative