Spirit Airlines 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

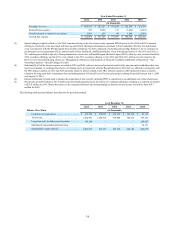

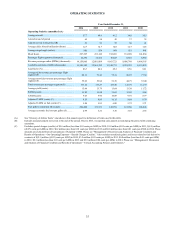

Year Ended December 31,

2014 2013 2012 2011 2010

(in thousands)

Into-plane fuel cost. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 608,033 $ 542,523 $ 471,542 $ 392,278 $ 251,754

Realized losses (gains) . . . . . . . . . . . . . . . . . . . . . . . . . . 995 8,958 175 (7,436) (1,483)

Unrealized mark-to-market losses (gains) . . . . . . . . . . . 3,881 265 46 3,204 (2,065)

Aircraft fuel expense . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 612,909 $ 551,746 $ 471,763 $ 388,046 $ 248,206

(3) Special charges (credits) include: (i) for 2010, amounts relating to the sale of previously expensed MD-80 parts; (ii) for 2010 and 2011 amounts

relating to exit facility costs associated with moving our Detroit, Michigan maintenance operations to Fort Lauderdale, Florida; (iii) termination

costs in connection with the IPO during the three months ended June 30, 2011 comprised of amounts paid to Indigo Partners, LLC to terminate its

professional services agreement with us and fees paid to three individual, unaffiliated holders of our subordinated notes; (iv) for 2011 and 2012, a

$9.1 million gain related to the sale of four permanent air carrier slots at Ronald Reagan National Airport (DCA) offset by costs connected with the

2012 secondary offerings; and for 2013, costs related to the 2013 secondary offering; (v) for 2013 and 2014, $0.1 million in costs related to the

DCA exit. For more information, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our

Operating Expenses—Special Charges (Credits).”

(4) Substantially all of the interest expense recorded in 2010 and 2011 relates to notes and preferred stock held by our principal stockholders that were

repaid or redeemed, or exchanged for shares of common stock, in connection with the Recapitalization in 2011 that was effected in connection with

the IPO. Interest expense in 2012 and 2013 primarily relates to interest related to the TRA. Interest expense in 2014 primarily relates to interest

related to the long-term debt, commitment fees and underpayment of Federal Excise Tax for fuel purchases during the period between July 1, 2009

and August 31, 2014.

(5) Interest attributable to funds used to finance the acquisition of new aircraft, including PDPs is capitalized as an additional cost of the related asset.

(6) Net income for 2010 includes a $52.3 million net tax benefit primarily due to the release of a valuation allowance resulting in a deferred tax benefit

of $52.8 million in 2010. Absent the release of the valuation allowance and corresponding tax benefit, our net income would have been $19.7

million for 2010.

The following table presents balance sheet data for the periods presented:

As of December 31,

2014 2013 2012 2011 2010

Balance Sheet Data: (in thousands)

Cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . $ 632,784 $ 530,631 $ 416,816 $ 343,328 $ 82,714

Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,602,981 1,180,765 919,884 745,813 475,757

Long-term debt, including current portion . . . . . . . . 146,248 — — — 260,827

Mandatorily redeemable preferred stock. . . . . . . . . . — — — — 79,717

Stockholders' equity (deficit). . . . . . . . . . . . . . . . . . . 1,003,075 769,117 582,535 466,706 (105,077)