Spirit Airlines 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

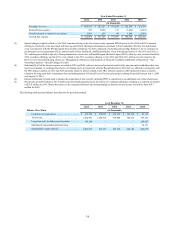

During the second quarter of 2012, we paid $27.2 million, or 90% of the 2011 tax savings realized from the utilization of

NOLs, including $0.3 million of applicable interest, to the Pre-IPO Stockholders.

During 2013, we filed an amended 2009 income tax return which resulted in a reduction to the estimated TRA liability

from $8.0 million to $5.6 million. On September 13, 2013, we filed our 2012 federal income tax return, and on October 14,

2013, we submitted a Tax Benefit Schedule to the Stockholder Representatives. On November 27, 2013, pursuant to the TRA,

we received an objection notice to the Tax Benefit Schedule from the Stockholder Representatives. On April 7, 2014, we

received a demand for arbitration from the Stockholder Representatives. Prior to commencing arbitration proceedings, on June

17, 2014, we and Stockholder Representatives agreed on a settlement amount of $7.0 million in addition to interest of $0.3

million. The agreed upon settlement was in excess of the outstanding liability of $5.6 million at the time of settlement. The

excess payment of $1.4 million was recorded within other expense in the statement of operations and recorded as cash from

operations in the statement of cash flows. As of December 31, 2014, we had made all payments in accordance with the agreed

upon settlement terms and had no outstanding obligations related to the TRA.

Trends and Uncertainties Affecting Our Business

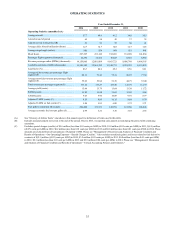

We believe our operating and business performance is driven by various factors that affect airlines and their markets,

trends affecting the broader travel industry and trends affecting the specific markets and customer base that we target. The

following key factors may affect our future performance.

Competition. The airline industry is highly competitive. The principal competitive factors in the airline industry are fare

pricing, total price, flight schedules, aircraft type, passenger amenities, number of routes served from a city, customer service,

safety record and reputation, code-sharing relationships and frequent flier programs and redemption opportunities. Price

competition occurs on a market-by-market basis through price discounts, changes in pricing structures, fare matching, target

promotions and frequent flier initiatives. Airlines typically use discount fares and other promotions to stimulate traffic during

normally slower travel periods to generate cash flow and to maximize unit revenue. The prevalence of discount fares can be

particularly acute when a competitor has excess capacity that it is under financial pressure to sell.

Seasonality and Volatility. Our results of operations for any interim period are not necessarily indicative of those for the

entire year because the air transportation business is subject to significant seasonal fluctuations. We generally expect demand to

be greater in the second and third quarters compared to the rest of the year. The air transportation business is also volatile and

highly affected by economic cycles and trends. Consumer confidence and discretionary spending, fear of terrorism or war,

weakening economic conditions, fare initiatives, fluctuations in fuel prices, labor actions, changes in governmental regulations

on taxes and fees, weather and other factors have resulted in significant fluctuations in revenues and results of operations in the

past. We believe demand for business travel historically has been more sensitive to economic pressures than demand for low-

price travel. Finally, a significant portion of our operations are concentrated in markets such as South Florida, the Caribbean,

Latin America and the Northeast and northern Midwest regions of the United States, which are particularly vulnerable to

weather, airport traffic constraints and other delays.

Aircraft Fuel. Fuel costs represent the single largest operating expense for most airlines, including ours. Fuel costs have

been subject to wide price fluctuations in recent years. Fuel availability and pricing are also subject to refining capacity, periods

of market surplus and shortage and demand for heating oil, gasoline and other petroleum products, as well as meteorological,

economic and political factors and events occurring throughout the world, which we can neither control nor accurately predict.

We source a significant portion of our fuel from refining resources located in the southeast United States, particularly facilities

adjacent to the Gulf of Mexico. Gulf Coast fuel is subject to volatility and supply disruptions, particularly in hurricane season

when refinery shutdowns have occurred in recent years, or when the threat of weather-related disruptions has caused Gulf

Coast fuel prices to spike above other regional sources. Our derivatives generally consist of United States Gulf Coast jet fuel

swaps (jet fuel swaps) and United States Gulf Coast jet fuel options (jet fuel options). Both jet fuel swaps and jet fuel options

are used at times to protect the refining price risk between the price of crude oil and the price of refined jet fuel, and to manage

the risk of increasing fuel prices. Our fuel hedging practices are dependent upon many factors, including our assessment of

market conditions for fuel, our access to the capital necessary to support margin requirements, the pricing of hedges and other

derivative products in the market, our overall appetite for risk and applicable regulatory policies. As of December 31, 2014, we

had jet fuel option agreements in place to protect 88.7 million gallons, or approximately 35% of our 2015 anticipated fuel

consumption, at a weighted-average ceiling price of $2.07 per gallon, which allows us to participate in falling oil prices. As of

December 31, 2014, we purchased all of our aircraft fuel under a single fuel service contract. The cost and future availability of

jet fuel cannot be predicted with any degree of certainty.

Labor. The airline industry is heavily unionized. The wages, benefits and work rules of unionized airline industry

employees are determined by collective bargaining agreements, or CBAs. Relations between air carriers and labor unions in the