Spirit Airlines 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Financial Statements—(Continued)

79

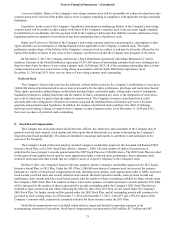

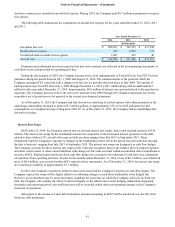

At lease inception and at each balance sheet date, the Company assesses whether the maintenance reserve payments

required by the master lease agreements are substantively and contractually related to the maintenance of the leased asset.

Maintenance reserve payments that are substantively and contractually related to the maintenance of the leased asset are

accounted for as maintenance deposits to the extent they are expected to be recoverable and are reflected as prepaid

maintenance deposits in the accompanying balance sheets. When it is not probable the Company will recover amounts currently

on deposit with a lessor, such amounts are expensed as supplemental rent. As of December 31, 2014 and 2013, the Company

had aircraft maintenance deposits of $250.0 million and $220.7 million, respectively, on its balance sheets of which $36.9

million and $59.2 million, respectively, are included within prepaid expenses and other current assets on its balance sheets. The

Company has concluded that these prepaid maintenance deposits are probable of recovery primarily due to the rate differential

between the maintenance reserve payments and the expected cost for the related next maintenance event that the reserves serve

to collateralize.

The Company’s master lease agreements also provide that most maintenance reserves held by the lessor at the expiration

of the lease are nonrefundable to the Company and will be retained by the lessor. Consequently, any usage-based maintenance

reserve payments after the last major maintenance event are not substantively related to the maintenance of the leased asset and

therefore are accounted for as contingent rent. The Company accrues for contingent rent beginning when it becomes probable

and reasonably estimable the Company will incur such nonrefundable maintenance reserve payments. The Company makes

certain assumptions at the inception of the lease and at each balance sheet date to determine the recoverability of maintenance

deposits. These assumptions are based on various factors such as the estimated time between the maintenance events, the date

the aircraft is due to be returned to the lessor, and the number of flight hours the aircraft is estimated to be utilized before it is

returned to the lessor. The Company expensed $1.6 million, $1.9 million and $2.0 million of paid maintenance reserves as

supplemental rent during 2014, 2013 and 2012, respectively. Maintenance reserves held by lessors that are refundable to the

Company at the expiration of the lease are accounted for as prepaid maintenance deposits on the balance sheet when they are

paid.

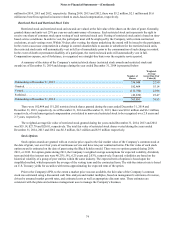

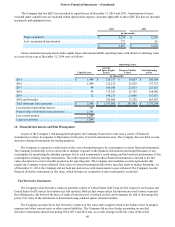

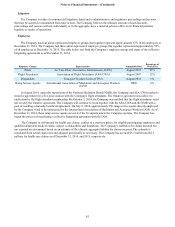

At December 31, 2014, the Company had 61 aircraft and 10 spare engines financed under operating leases with lease

term expiration dates ranging from 2016 to 2026. Five of the leased aircraft have variable rent payments, which fluctuate based

on changes in LIBOR (London Interbank Offered Rate). The Company has the option to renew three leases for three-year

periods with contractual notice required in the tenth year. Thirty-one of the aircraft leases and all of the engine leases were the

result of sale and leaseback transactions. Deferred gains or losses from sale and leaseback transactions are amortized over the

term of the lease as a reduction in rent or additional rent, respectively. Losses are deferred when the fair value of the aircraft or

engine is higher than the price it was sold for, which is in substance, a prepayment of rent. A loss on disposal is recorded at the

time of sale for the excess of the carrying amount over the fair value of the aircraft or engine.

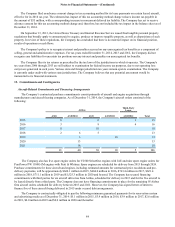

During 2014, the Company entered into sale and leaseback transactions with third-party aircraft lessors for the sale and

leaseback of eight Airbus A320 aircraft that resulted in net deferred losses of $1.6 million, which are included in other long-

term assets on the accompanying balance sheet. Deferred losses are recognized as an increase to rent expense on a straight-line

basis over the term of the respective operating leases. Deferred gains are included in deferred gains and other long-term

liabilities on the accompanying balance sheet. Deferred gains are recognized as a decrease to rent expense on a straight-line

basis over the term of the respective operating leases. The Company had agreements in place prior to the delivery of these

aircraft which resulted in the settlement of the purchase obligation by the lessor and the refund of $53.2 million in pre-delivery

deposits from Airbus during 2014. The refunded pre-delivery deposits have been disclosed in the statement of cash flows as

investing activities within pre-delivery deposits, net of refunds. In addition, the Company entered into a sale and leaseback

transaction with a third-party lessor for the sale and leaseback of one V2500 IAE International Aero Engines AG engine. Cash

outflows related to the purchase of the engine have been disclosed in the statement of cash flows as investing activities within

purchases of property and equipment and the cash inflows from the sale of the engine as financing activities within proceeds

received on sale lease back transactions. All of the leases from these sale and leaseback transactions are accounted for as

operating leases. Under the terms of the lease agreements, the Company will continue to operate and maintain the aircraft.

Payments under the lease agreements are fixed for the term of the lease. The lease agreements contain standard termination

events, including termination upon a breach of the Company's obligations to make rental payments and upon any other material

breach of the Company's obligations under the leases, and standard maintenance and return condition provisions. Upon a

termination of the lease due to a breach by the Company, the Company would be liable for standard contractual damages,

possibly including damages suffered by the lessor in connection with remarketing the aircraft or while the aircraft is not leased

to another party. The Company has an agreement for the lease of two QEC kits, classified as capital leases. Payments under the

lease agreement are fixed for the three year term of the lease.