Spirit Airlines 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

Competition

The airline industry is highly competitive. The principal competitive factors in the airline industry are fare pricing, total

price, flight schedules, aircraft type, passenger amenities, number of routes served from a city, customer service, safety record

and reputation, code-sharing relationships and frequent flier programs and redemption opportunities. Our competitors and

potential competitors include traditional network airlines, low-cost carriers, and regional airlines. We typically compete in

markets served by traditional network airlines and other low-cost carriers, and, to a lesser extent, regional airlines.

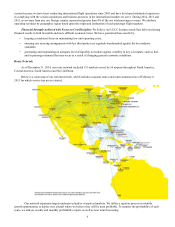

Our single largest overlap, at approximately 51% of our markets as of January 12, 2015, is with American Airlines. Our

principal competitors on domestic routes are American Airlines, Southwest Airlines, United Airlines and Delta Air Lines. Our

principal competitors for service from South Florida to our markets in the Caribbean and Latin America are American Airlines

through its hub in Miami and JetBlue Airways through its operations in Fort Lauderdale. Our principal competitive advantages

are our low base fares and our focus on the price-sensitive traveler who pays his or her own travel costs. These low base fares

are facilitated by our low unit operating costs, which in 2014 were among the lowest in the airline industry. We believe our low

costs coupled with our non-ticket revenues allow us to price our fares at levels where we can be profitable while our primary

competitors cannot.

The airline industry is particularly susceptible to price discounting because, once a flight is scheduled, airlines incur only

nominal incremental costs to provide service to passengers occupying otherwise unsold seats. The expenses of a scheduled

aircraft flight do not vary significantly with the number of passengers carried and, as a result, a relatively small change in the

number of passengers or in pricing could have a disproportionate effect on an airline’s operating and financial results. Price

competition occurs on a market-by-market basis through price discounts, changes in pricing structures, fare matching, target

promotions and frequent flier initiatives. Airlines typically use discount fares and other promotions to stimulate traffic during

normally slower travel periods to generate cash flow and to maximize RASM. The prevalence of discount fares can be

particularly acute when a competitor has excess capacity that it is unable to fill at higher rates. A key element to our

competitive strategy is to maintain very low unit costs in order to permit us to compete successfully in price-sensitive markets.

Seasonality

Our business is subject to significant seasonal fluctuations. We generally expect demand to be greater in the second and

third quarters compared to the rest of the year. The air transportation business is also volatile and highly affected by economic

cycles and trends.

Distribution

The majority of our tickets are sold through direct channels including online via www.spirit.com, our call center and the

ticket counter, with spirit.com being the primary channel. We also partner with a number of third parties to distribute our

tickets, including online and traditional travel agents and electronic global distribution systems.

Customers

We believe our customers are primarily leisure travelers who make their purchase decision based on price. By focusing on

lowering our cost structure, we can successfully sell tickets at low fares while maintaining a strong profit margin.

Customer Service

We are committed to taking care of our customers. We believe focusing on customer service in every aspect of our

operations including personnel, flight equipment, in-flight and ancillary amenities, on-time performance, flight completion

ratios, and baggage handling will strengthen customer loyalty and attract new customers. We proactively aim to improve our

operations to ensure further improvement in customer service.

In response to customer and other demands, we modified our online booking process to allow our customers to see all

available options and their prices prior to purchasing a ticket, and have initiated a campaign that illustrates our total prices are

lower, on average, than our competitors, even when options are included.

Fleet

We fly only Airbus A320 family aircraft, which provides us significant operational and cost advantages compared to

airlines that operate multiple aircraft types. By operating a single aircraft type, we avoid the incremental costs of training crews

across multiple types. Flight crews are entirely interchangeable across all of our aircraft, and maintenance, spare parts

inventories and other operational support remains highly simplified compared to those airlines with more complex fleets. Due