Spirit Airlines 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

82

13. Defined Contribution 401(k) Plan

The Company sponsors three defined contribution 401(k) plans, Spirit Airlines, Inc. Employee Retirement Savings Plan

(first plan), Spirit Airlines, Inc. Pilots’ Retirement Savings Plan (second plan) and Spirit Airlines, Inc. Puerto Rico Retirement

Savings Plan (third plan). The first plan was adopted on February 1, 1994. Essentially, all employees that are not covered by

the pilots’ collective bargaining agreement, who have at least 1 year of service, have worked at least 1,000 hours during the

year and have attained the age of 21 may participate in this plan. The Company may make a Qualified Discretionary

Contribution, as defined in the plan, or provide matching contributions to this plan. Effective July 1, 2007, the Company

amended this plan to change the service requirement to 60 days and provided for matching contribution to the plan at 50% of

the employee’s contribution up to a maximum employer contribution of 3% of the employee’s annual compensation.

The second plan is for the Company’s pilots, and contained the same service requirements as the first plan and was

amended effective July 1, 2007, to change the service requirements to 60 days and having attained the age of 21. Throughout

the majority of 2014, the Company matched 100% of the pilot’s contribution, up to 8% of the individual pilot’s annual

compensation. Effective August 1, 2014, the Company matches 100% of the pilot's contribution, up to 9% of the individual

pilot's annual compensation. Both the first and the second plans are subject to the annual IRS elective deferral limit, which was

$17,500 for 2014.

The third plan is for all Company employees residing in Puerto Rico and was adopted on April 16, 2012. It contains the

same amended service requirements as the first and second plans. For pilots participating in the Puerto Rico plan, the Company

matches 100% of their contribution, up to 9% of the individual pilot's annual compensation, but subject to the annual Puerto

Rico pre-tax elective deferral limit, which was $17,500 for 2014. Prior to August 1, 2014, the Company matched 100% of the

pilot's contribution, up to 8% of the individual pilot's annual compensation. For all other employees participating in the Puerto

Rico plan, the Company provides for matching contribution to the plan at 50% of the employee's contribution up to a maximum

employer contribution of 3% of the employee's annual compensation.

Matching contributions made to all plans were $9.7 million, $7.7 million and $6.6 million in 2014, 2013 and 2012,

respectively, and were included within salaries, wages and benefits in the accompanying statements of operations.

14. Income Taxes

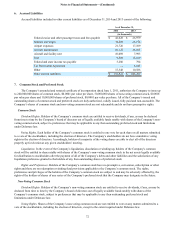

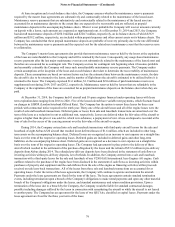

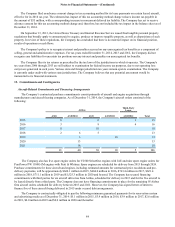

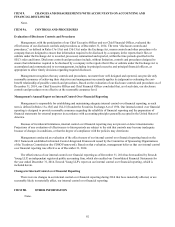

Significant components of the provision for income taxes from continuing operations are as follows:

Year Ended December 31,

2014 2013 2012

(in thousands)

Current:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 85,966 $ 86,437 $ 32,656

State and local. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,389 6,595 3,250

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,057 413 963

Total current expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93,412 93,445 36,869

Deferred:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,240 11,658 27,870

State and local. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (122) 389 1,385

Total deferred expense (benefit). . . . . . . . . . . . . . . . . . . . 34,118 12,047 29,255

Total income tax expense (benefit) . . . . . . . . . . . . . . . . . $ 127,530 $ 105,492 $ 66,124

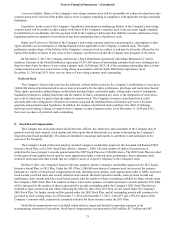

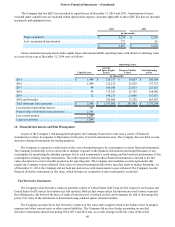

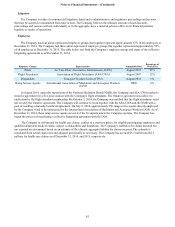

The income tax provision differs from that computed at the federal statutory corporate tax rate as follows:

Year Ended December 31,

2014 2013 2012

Expected provision at federal statutory tax rate. . . . . . . . . . . . . . . . 35.0 % 35.0% 35.0 %

State tax expense, net of federal benefit. . . . . . . . . . . . . . . . . . . . . . 1.0 % 1.7% 2.1 %

Income tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.4)% —% (0.1)%

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.5 % 0.7% 0.9 %

Total income tax expense (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . 36.1 % 37.4% 37.9 %