Spirit Airlines 2014 Annual Report Download - page 70

Download and view the complete annual report

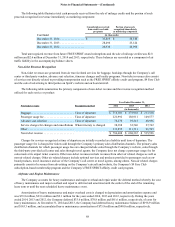

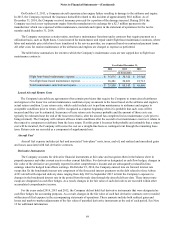

Please find page 70 of the 2014 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Financial Statements—(Continued)

70

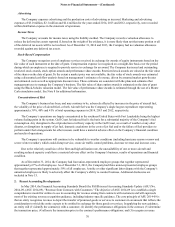

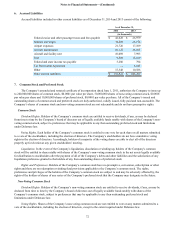

Advertising

The Company expenses advertising and the production costs of advertising as incurred. Marketing and advertising

expenses of $3.0 million, $2.1 million and $2.4 million for the years ended 2014, 2013 and 2012, respectively, were recorded

within distribution expense in the statement of operations.

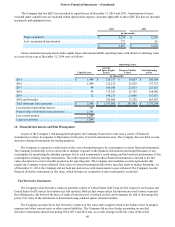

Income Taxes

The Company accounts for income taxes using the liability method. The Company records a valuation allowance to

reduce the deferred tax assets reported if, based on the weight of the evidence, it is more likely than not that some portion or all

of the deferred tax assets will be not realized. As of December 31, 2014 and 2013, the Company had no valuation allowance

recorded against any deferred tax assets.

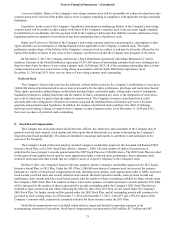

Stock-Based Compensation

The Company recognizes cost of employee services received in exchange for awards of equity instruments based on the

fair value of each instrument at the date of grant. Compensation expense is recognized on a straight-line basis over the period

during which an employee is required to provide service in exchange for an award. The Company has issued and outstanding

restricted stock awards, stock option awards and performance share awards. Restricted stock awards are valued at the fair value

of the shares on the date of grant. To the extent a market price was not available, the fair value of stock awards was estimated

using a discounted cash flow analysis based on management’s estimates of revenue, driven by assumed market growth rates

and estimated costs as well as appropriate discount rates. These estimates are consistent with the plans and estimates that

management uses to manage the Company’s business. The fair value of share option awards is estimated on the date of grant

using the Black-Scholes valuation model. The fair value of performance share awards is estimated through the use of a Monte

Carlo simulation model. See Note 8 for additional information.

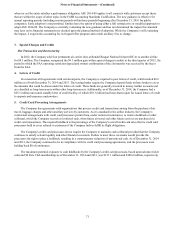

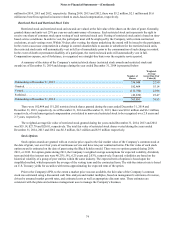

Concentrations of Risk

The Company’s business has been, and may continue to be, adversely affected by increases in the price of aircraft fuel,

the volatility of the price of aircraft fuel, or both. Aircraft fuel was the Company’s single largest expenditure representing

approximately 39%, 40% and 41% of total operating expenses in 2014, 2013 and 2012, respectively.

The Company’s operations are largely concentrated in the southeast United States with Fort Lauderdale being the highest

volume fueling point in the system. Gulf Coast Jet indexed fuel is the basis for a substantial majority of the Company’s fuel

consumption. Any disruption to the oil production or refinery capacity in the Gulf Coast, as a result of weather or any other

disaster, or disruptions in supply of jet fuel, dramatic escalations in the costs of jet fuel and/or the failure of fuel providers to

perform under fuel arrangements for other reasons could have a material adverse effect on the Company’s financial condition

and results of operations.

The Company’s operations will continue to be vulnerable to weather conditions (including hurricane season or snow and

severe winter weather), which could disrupt service, create air traffic control problems, decrease revenue and increase costs.

Due to the relatively small size of the fleet and high utilization rate, the unavailability of one or more aircraft and

resulting reduced capacity could have a material adverse effect on the Company’s business, results of operations and financial

condition.

As of December 31, 2014, the Company had four union-represented employee groups that together represented

approximately 67% of all employees. As of December 31, 2013, the Company had three union-represented employee groups

that together represented approximately 59% of all employees. A strike or other significant labor dispute with the Company’s

unionized employees is likely to adversely affect the Company’s ability to conduct business. Additional disclosures are

included in Note 15.

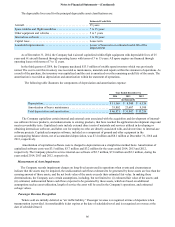

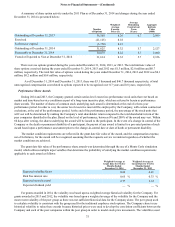

2. Recent Accounting Developments

In May 2014, the Financial Accounting Standards Board (the FASB) issued Accounting Standards Update (ASU) No.

2014-09, (ASU 2014-09), "Revenue from Contracts with Customers." The objective of ASU 2014-09 is to establish a single

comprehensive model for entities to use in accounting for revenue arising from contracts with customers and will supersede

most of the existing revenue recognition guidance, including industry-specific guidance. The core principle of ASU 2014-09 is

that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the

consideration to which the entity expects to be entitled in exchange for those goods or services. In applying the new guidance,

an entity will (1) identify the contract(s) with a customer; (2) identify the performance obligations in the contract; (3) determine

the transaction price; (4) allocate the transaction price to the contract's performance obligations; and (5) recognize revenue