Shaw 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

16. SHARE CAPITAL

Authorized

The Company is authorized to issue a limited number of Class A voting participating shares

(“Class A Shares”) of no par value, as described below, and an unlimited number of Class B

non-voting participating shares (“Class B Non-Voting Shares”) of no par value, Class 1 preferred

shares, Class 2 preferred shares, Class A preferred shares and Class B preferred shares.

The authorized number of Class A Shares is limited, subject to certain exceptions, to the lesser

of that number of shares (i) currently issued and outstanding and (ii) that may be outstanding

after any conversion of Class A Shares into Class B Non-Voting Shares.

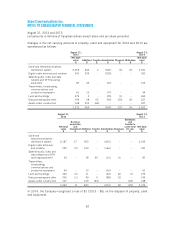

2014 2013 2014 2013

Number of securities $ $

22,420,064 22,520,064 Class A Shares 22

439,606,326 430,306,542 Class B Non-Voting Shares 2,887 2,660

12,000,000 12,000,000 Series A Preferred Shares 293 293

474,026,390 464,826,606 3,182 2,955

Class A Shares and Class B Non-Voting Shares

Class A Shares are convertible at any time into an equivalent number of Class B Non-Voting

Shares. In the event that a take-over bid is made for Class A Shares, in certain circumstances,

the Class B Non-Voting Shares are convertible into an equivalent number of Class A Shares.

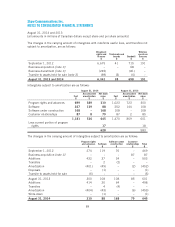

Changes in Class A Share capital and Class B Non-Voting Share capital in 2014 and 2013 are

as follows:

Class A Shares Class B Non-Voting Shares

Number $ Number $

September 1, 2012 22,520,064 2 421,188,697 2,455

Stock option exercises – – 3,564,856 79

Dividend reinvestment plan – – 5,552,989 126

August 31, 2013 22,520,064 2 430,306,542 2,660

Class A Share conversions (100,000) – 100,000 –

Stock option exercises – – 3,431,548 81

Dividend reinvestment plan – – 5,768,236 146

August 31, 2014 22,420,064 2 439,606,326 2,887

Series A Preferred Shares

The Cumulative Redeemable Rate Reset Preferred Shares, Series A (“Series A Preferred

Shares”) represent a series of class 2 preferred shares and are classified as equity since

redemption, at $25.00 per Series A Preferred Share, is at the Company’s option and payment

of dividends is at the Company’s discretion.

95