Shaw 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

ŠIFRS 15 Revenue from Contracts with Customers, was issued in May 2014 and replaces

IAS 11 Construction Contracts, IAS 18 Revenue, IFRIC 13 Customer Loyalty Programs,

IFRIC 15 Agreements for the Construction of Real Estate, IFRIC 18 Transfers of Assets

from Customers and SIC-31 Revenue – Barter Transactions Involving Advertising Services.

The new standard requires revenue to be recognized to depict the transfer of promised

goods or services to customers in an amount that reflects the consideration expected to

be received in exchange for those goods or services. The principles are to be applied in

the following five steps: (1) identify the contract(s) with a customer, (2) identify the

performance obligations in the contract, (3) determine the transaction price, (4) allocate

the transaction price to the performance obligations in the contract, and (5) recognize

revenue when (or as) the entity satisfies a performance obligation. The new standard is to

be applied either retrospectively or on a modified retrospective basis and is effective for

the annual period commencing September 1, 2017.

ŠIFRS 9 Financial Instruments: Classification and Measurement replaces IAS 39 Financial

Instruments and applies a principal-based approach to the classification and

measurement of financial assets and financial liabilities, including an expected credit

loss model for calculating impairment, and includes new requirements for hedge

accounting. The standard is required to be applied retrospectively for the annual period

commencing September 1, 2018.

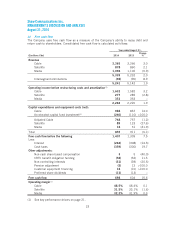

Change in accounting estimates

During the current year, the Company reviewed the useful lives of its property, plant and

equipment as well as the amortization period for amounts deferred under multiple element

arrangements, including equipment revenue and associated equipment costs and connection

fees. The review resulted in changes in the amortization period for amounts deferred under

multiple element arrangements and estimated useful lives of certain assets effective

September 1, 2013. As a result, cable and telecommunication distribution system assets are

amortized on a straight-line basis over 5 to 20 years, and digital cable terminals and modems

on a straight-line basis over 2 to 5 years. The amortization period for amounts deferred and

amortized on a straight-line basis under multiple element arrangements is 3 years. The impact

of the changes has been accounted for prospectively. The changes in estimates in respect of

unamortized balances at August 31, 2013 resulted in decreases to revenue and amortization as

summarized below.

($millions Cdn)

Year ended

August 31, 2014

Revenue 3

Amortization

Deferred equipment revenue 29

Deferred equipment costs 66

Property, plant and equipment, intangibles and other 63

I. Known events, trends, risks and uncertainties

The Company is subject to a number of risks and uncertainties which could have a material

adverse effect on its future profitability. Included herein is a “Caution Concerning

Forward-Looking Statements” section which should be read in conjunction with this report.

33