Shaw 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

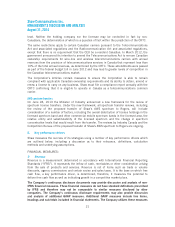

The following table sets forth all of the Specialty services in which the Company holds an

interest:

Specialty Services Operated % Equity Interest

Showcase 100%

Slice 100%

History 100%

H2 100%

HGTV Canada(1) 67%

Food Network Canada(1) 71%

Action 100%

Lifetime 100%

National Geographic Canada(2) 50%

National Geographic Canada Wild(2) 50%

BBC Canada(2) 50%

FYI 100%

IFC Canada 100%

DIY(1) 67%

DTOUR 100%

MovieTime 100%

DejaView 100%

Crime + Investigation 100%

Global News: BC1 100%

(1) Voting interest is 80.2%

(2) Voting interest is 80%

To meet the changing needs of its Conventional and Specialty viewing audiences, Media also

commenced the roll out of its TV Everywhere strategy in 2014 with the launch of Global Go and

HISTORY Go apps. These apps allow viewers to watch live TV, full episodes of select shows,

clips and video exclusives on popular mobile devices, including WiFi enabled tablets and

smartphones.

Late in fiscal 2014, Shaw Media partnered with Rogers to form shomi, a new SVOD/OTT service

having the latest most exclusive programming and selections personalized for viewers. The

service launched in beta in early November 2014.

C. Seasonality and other additional information concerning the business

(a) Seasonality and customer dependency

Although financial results of the Cable and Satellite business segments are generally not

subject to significant seasonal fluctuations, subscriber activity may fluctuate from one quarter

to another. Subscriber activity may also be affected by competition and varying levels of

promotional activity undertaken by the Company. Shaw’s Cable and Satellite businesses

generally are not dependent upon any single customer or upon a few customers.

The Media business segment financial results are subject to fluctuations throughout the year

due to, among other things, seasonal advertising and viewing patterns. In general, advertising

revenues are higher during the fall, the first quarter, and lower during the summer months, the

14