Shaw 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

Indemnities

Many agreements related to acquisitions and dispositions of business assets include

indemnification provisions where the Company may be required to make payment to a vendor or

purchaser for breach of contractual terms of the agreement with respect to matters such as

litigation, income taxes payable or refundable or other ongoing disputes. The indemnification

period usually covers a period of two to four years. Also, in the normal course of business, the

Company has provided indemnifications in various commercial agreements, customary for the

telecommunications industry, which may require payment by the Company for breach of

contractual terms of the agreement. Counterparties to these agreements provide the Company

with comparable indemnifications. The indemnification period generally covers, at maximum,

the period of the applicable agreement plus the applicable limitations period under law.

The maximum potential amount of future payments that the Company would be required to

make under these indemnification agreements is not reasonably quantifiable as certain

indemnifications are not subject to limitation. However, the Company enters into

indemnification agreements only when an assessment of the business circumstances would

indicate that the risk of loss is remote. At August 31, 2014, management believes it is remote

that the indemnification provisions would require any material cash payment.

The Company indemnifies its directors and officers against any and all claims or losses

reasonably incurred in the performance of their service to the Company to the extent permitted

by law.

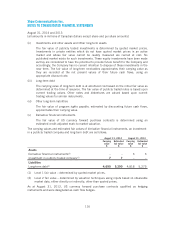

Irrevocable standby letters of credit and commercial surety bonds

The Company and certain of its subsidiaries have granted irrevocable standby letters of credit

and commercial surety bonds, issued by high rated financial institutions, to third parties to

indemnify them in the event the Company does not perform its contractual obligations. As of

August 31, 2014, the guarantee instruments amounted to $4. The Company has not recorded

any additional liability with respect to these guarantees, as the Company does not expect to

make any payments in excess of what is recorded on the Company’s consolidated financial

statements. The guarantee instruments mature at various dates during fiscal 2015.

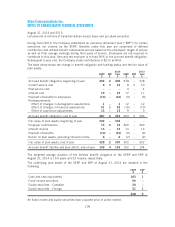

26. EMPLOYEE BENEFIT PLANS

Defined contribution pension plans

The Company has defined contribution pension plans for its non-union employees and, for the

majority of these employees, contributes 5% of eligible earnings to the maximum amount

deductible under the Income Tax Act. For union employees, the Company contributes amounts

up to 9.8% of earnings to the individuals’ registered retirement savings plans. Total pension

costs in respect of these plans were $37 (2013 – $35) of which $24 (2013 – $23) was

expensed and the remainder capitalized.

107