Shaw 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

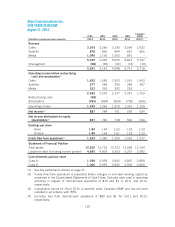

Other benefit plans

The Company has post employment benefits plans that provide post retirement health and life

insurance coverage to certain retirees in the media business and are funded on a pay-as-you-go

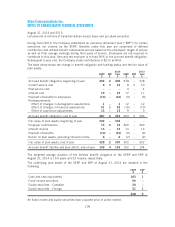

basis. The table below shows the change in the accrued post-retirement obligation which is

recognized in the statement of financial position.

2014

$

2013

$

Accrued benefit obligation and plan deficit, beginning of year 15 19

Current service cost 1–

Interest cost 11

Payment of benefits to employees (1) (1)

Remeasurements:

Effect of changes in demographic assumptions –(4)

Effect of changes in financial assumptions 2–

Accrued benefit obligation and plan deficit, end of year 18 15

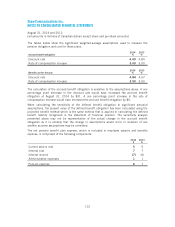

The weighted average duration of the benefit obligation at August 31, 2014 is 18.0 years.

The post-retirement benefit plan expense, which is included in employee salaries and benefits

expense, is $2 (2013 – $1) and is comprised of current service and interest cost.

The discount rates used to measure the post-retirement benefit cost for the year and the

accrued benefit obligation as at August 31, 2014 were 4.75% and 4.00%, respectively (2013

– 4.50% and 4.75%, respectively). A one percentage point decrease in the discount rate would

have increased the accrued benefit obligation at August 31, 2014 by $4.

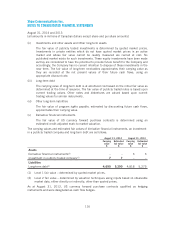

Employer contributions

The Company’s estimated contributions to the defined benefit plans in fiscal 2015 are $38.

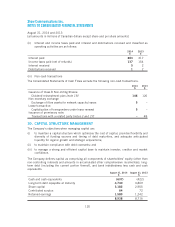

27. RELATED PARTY TRANSACTIONS

Controlling shareholder

The majority of the Class A Shares are held by JR Shaw, members of his family and the

companies owned and/or controlled by them (the “Shaw Family Group”). All of the Class A

Shares held by the Shaw Family Group are subject to a voting trust agreement entered into by

such persons. The Shaw Family Group is represented as Directors, Senior Executive and

Corporate Officers of the Company.

During the prior year, the Company and the Shaw Family Group formed a partnership to make

equity investments in companies with new and emerging technologies that have the potential to

provide future benefit to the Company. The Shaw Family Group contributed $1 for its 20%

interest in the partnership.

113