Shaw 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

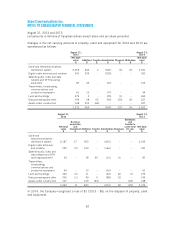

11. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

2014 2013

$$

Trade 44 71

Program rights 74 70

CRTC benefit obligations 30 50

Accrued liabilities 335 324

Accrued network fees 107 102

Interest and dividends 215 219

Related parties [note 27] 23 23

828 859

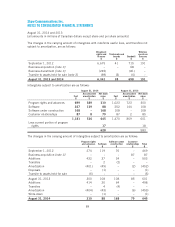

12. PROVISIONS

Asset

retirement

obligations Restructuring(1) Other Total

$$$$

September 1, 2012 8 – 19 27

Additions 1 – 9 10

Reversal – – (1) (1)

Payments – – (1) (1)

August 31, 2013 9 – 26 35

Additions – 58 12 70

Reversal – – (4) (4)

Payments – (45) (3) (48)

August 31, 2014 9133153

Current – – 26 26

Long-term 9 – – 9

August 31, 2013 9 – 26 35

Current – 13 31 44

Long-term 9 – – 9

August 31, 2014 9 13 31 53

(1) During the current year, the Company announced changes to the structure of its operating

units to improve overall efficiency while enhancing its ability to grow as the leading

network and content experience company. In connection with the restructuring of its

operations, the Company recorded $58 primarily in respect of the approximate

400 management and non-customer facing roles which were affected by the

organizational changes. The majority of the $13 of remaining costs are expected to be

paid within the next six months.

91