Shaw 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

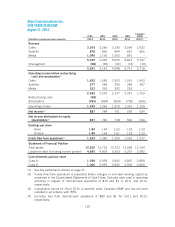

The Company manages its capital structure and makes adjustments to it in light of changes in

economic conditions and the risk characteristics of underlying assets. The Company may also

from time to time change or adjust its objectives when managing capital in light of the

Company’s business circumstances, strategic opportunities, or the relative importance of

competing objectives as determined by the Company. There is no assurance that the Company

will be able to meet or maintain its currently stated objectives.

On December 5, 2013 Shaw received the approval of the TSX to renew its normal course issuer

bid to purchase its Class B Non-Voting Shares for a further one year period. The Company is

authorized to acquire up to 20,000,000 Class B Non-Voting Shares during the period

December 9, 2013 to December 8, 2014.

The Company’s banking facility is subject to covenants which include maintaining minimum or

maximum financial ratios, including total debt to operating cash flow and operating cash flow to

fixed charges. At August 31, 2014, the Company is in compliance with these covenants and

based on current business plans and economic conditions, the Company is not aware of any

condition or event that would give rise to non-compliance with the covenants.

The Company’s overall capital structure management strategy remains unchanged from the

prior year.

31. SUBSEQUENT EVENT

On September 2, 2014, the Company closed the acquisition of 100% of the shares of ViaWest,

Inc, (“ViaWest”) for an enterprise value of US $1.2 billion which was funded through a

combination of cash on hand, assumption of ViaWest debt and a drawdown of US $330 on the

Company’s credit facility. The ViaWest acquisition provides the Company with a growth platform

in the North American data centre sector and is another step in expanding technology offerings

for mid-market enterprises in Western Canada. The Company is currently in the process of

completing the purchase price allocation which it expects to include in its interim financial

statements for the first quarter of fiscal 2015. The operating results of ViaWest will be included

in the Company’s consolidated financial statements from the date of acquisition. In connection

with the transaction, the Company incurred $4 of acquisition related costs in fiscal 2014 for

professional fees paid to lawyers, consultants and advisors and had a contingent liability of $6

at August 31, 2014 in respect of such fees.

121